Since everyone loves a growth story, I thought I’d chime in with this lovely statistic on personal bankruptcy filings: According to the American Bankruptcy Institute, total bankruptcies will exceed 1.4 million for 2009, this is the highest number since 2005, and represents a 30% jump from last year’s total of 1,074,225. Now before you get excited and say, “well then I guess things…

What the Burlington Northern and Black & Decker Deals Have in Common

The Deal Professor, having expressed his dismay at the lack of M&A a day too early, weighs in on the similarities between Buffett’s purchase of BNI and the Stanley Works buyout of Black & Decker… From Steven M. Davidoff (NYT): While both deals may or may not be the sign of a new trend, and two…

Hot Links: Old Guitar Heroes

Stuff I’m Reading this Morning… No bubble: Jim Rogers disagrees with Roubini on gold and emerging markets. (Bloomberg) Morgan Stanley’s after the bell downgrade of Intel, Semis. (YahooFinance) Jim Chanos: We’ve learned nothing from the credit crunch. (Clusterstock) BetOnSports.com founder sentenced to 51 months in prison. (Reuters) The possible effects of Brazil’s new foreign investor tax. …

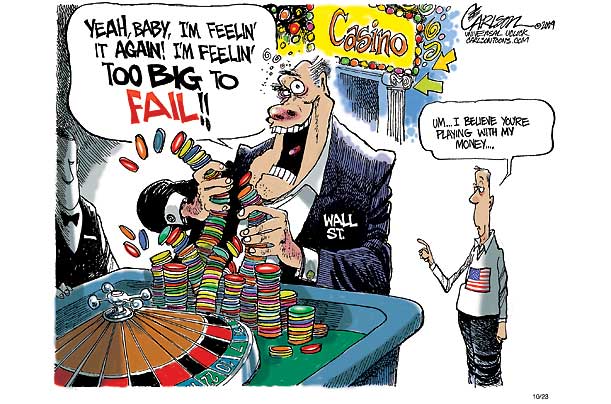

Too Big To Fail, Too Flush Not To Gamble

7 Terms That Should Never Be Used To Describe A Finance Pro

A successful career on Wall Street is as much about the failures as it is about the wins. Anyone who tells you differently is either hiding their past mistakes or is about to experience their own epic collapse, made even worse by the fact that it will be wholly unexpected to them. This is good…

Breaking: Buffett to Acquire the Rest of Burlington Northern Railroad

It’s not for me to tell you what Warren Buffett must see ahead for transportation, energy and economic activity, you must draw your own inferences. What I will say is that this is Berkshire Hathaway‘s largest-ever purchase so you may want to come up with some kind of thesis to encompass it. From MarketWatch: NEW…

Hot Links: Insolvency, Google Facts & the TradeBot3000

Stuff I’m Reading this Morning… The Fly notes how cranky the Goldman TradeBot3000 must have been yesterday. (iBankCoin) Bank of America is now searching for CEOs in New York, could it be you they’re looking at? (DealBook) India’s central bank buys $6.7 billion worth of gold from the IMF. (Bloomberg) 10 things you probably didn’t…

Quick Question re: the Stock Market

Quick question for those following the stock market today… Does any of this activity even remotely resemble rational buyers and sellers pursuing their own interests in a logical fashion? Or am I simply looking at computers trading against other computers ad infinitum? Nice way to start the week: Ford surprise profit vs CIT not-surprise bankruptcy…

The Periodic Table of Finance Bloggers

Click Image to Embiggen! I’ve been asked several times to update my finance blogger list, so I figured on the week of The Reformed Broker’s first anniversary, I’d oblige. Everyone listed on The Periodic Table of Finance Bloggers has either inspired, educated or entertained me in some way, so I figured I’d return the favor. …

Doug Kass: 20 Signs Of How Bad The Economy Is

If you’re not reading Doug Kass on a regular basis, here’s one more reason why you should… This morning he posted his Letterman-style list 20 Signs Of How Bad The Economy Is over on RealMoney Silver. You need a subscription to read it, so I’ll only share two or three of these: The economy is…