I figured out a very big, very important thing. Nobody ever told me about this, I had to learn it from my own experience and then realize it on my own.

Last summer I wrote “Who are you talking to?” about the crossroads I found myself at in terms of content and audience. I had decided that the bigger, faster, louder, more era was over for me. I had resolved to only talk to my own audience from now on, and to give them a much better product.

The alternative was to continue talking to any audience that would listen and go lowest common denominator to fit other people’s formats. I’m fortunate that I don’t need to do that any longer. My own audience is the best audience for what I do, and they (you) are the only people I care about. And my own audience is getting bigger. I don’t need to please anyone else’s. So, I decided, I’m just going to do my stuff for the people who like it, and not worry about what some phantom audience that isn’t even paying attention might think. I decided to stop being everywhere, all over the place, in everyone’s faces all the time. I shrank the size of the footprint to grow the quality of the content and the engagement with my real audience. It’s hard to find my commentary these days unless you’re looking for it. I’m giving more to you and nothing to anyone else.

Great call.

It was one of the best decisions I’ve made in years. I’ve never been happier and more fulfilled.

Our message of “tune out the noise and keep investing” has been proven right year after year after year, through horrible crises and scary corrections. Our philosophy of less is more and our focus on staying rich, despite all the distractions, has been validated. Again and again and again. We’ve added tax planning advice and college planning advice and a way to get clients access to red hot pre-IPO startups and a custom indexing solution and all sorts of other stuff to our practice in recent years. People are happy and I am happy presiding over it all. I don’t have anything left to prove. There might be other approaches to wealth management that look better in any given year, but I would put my version up against any of them over the long haul. And the long haul is all that matters.

I can say that now as a 44 year old with a lot more conviction than I could when I started this blog at 31.

I don’t really want to spend any time or effort talking to people who want to fight about that approach. I don’t see the value in it, for me or for them. I’m not looking to impose my point of view on others. When people try to argue, I tell them they’re probably right and keep moving. No debate, you win. They can keep their opinions and I’ll hang onto my own real life experience.

So, who am I talking to now? You guys. The coolest, most rational, successful and open-minded audience in all of financial media. We are a group with a few loosely-defined characteristics and personality traits: Aggressively moderate in our views, emotionally temperate in our reaction to events, good sense of humor, good taste in music, TV, movies, restaurants and books. That’s my audience. Why would I want to talk to anyone else?

A year has gone by since that post and I’ve spent that year quietly building my own thing. It’s going great. No negativity, some reasonable disagreements, lots of support and encouragement, lots of helpful input from the crowd and new information from the commenters. So when I ask myself again “Who are you talking to?”, the answer is: Not political psychopaths, not twitter know-it-alls who spend all day and night trying to score points on others to mask their own insecurities, not conspiracy theorists or nihilists, not unemployed basement macro experts or options speed freaks or social justice nags or right wing trolls or whatabout-ist brain donors. There are plenty of others who want to talk with those people. I have no interest.

I realized that I really talk to two groups: The first group is made up of people who have already succeeded in life and want to get better at investing to build upon that success. And they’d like to be serious about their portfolios but lighthearted and intellectually curious about everything else. This group includes executives, business founders, company owners, professionals from every field, creators, celebrities from sports, music, Hollywood, the art world and pop culture, as well as retirees who, after decades, remain as fascinated by the markets and the economy as I am.

The second group is people who have only just begun in their careers or their investing lives. Young people, folks digging themselves out of a rut, out of debt, trying to make their lives better. They relate to me because of my own story; I was broke and basically unemployed eleven years ago with no idea what to do with my career. Many of the readers and listeners from this group have grown up with me here on this blog and watched me build everything I have built, step by step, from zero. I’m not Gary Vee screaming at people to CRUSH IT all day, but I like to think there’s a small part of my stuff that is inspirational in nature. This group of people may not have a lot of investable assets yet but they make up for their it with a surfeit of hunger, imagination and aspiration. And because I don’t truly feel as though I have “made it” yet, I guess I’m still relatable enough to keep this audience tuned in. I promise you won’t see me flying private any time soon.

So when you think about this audience in total, basically I talk to people who recognize that they can never learn enough, no matter what stage of the game they’re at, and who are willing to have their minds changed as new information presents itself. I don’t do well with pessimism, or “the system is broken” types. They don’t feel me or want to hear anything constructive or hopeful. And I don’t give a shit about changing their minds. If you have the Joker in your social media avatar (Ledger or Phoenix), we’re probably not going to vibe with each other. No worries.

Figuring that all out was like unlocking an ancient door carved into the side of a mountain. And inside the mountain were great halls of gold and jewels. I am enriched. Not with money. Spiritually enriched. Emotionally satisfied. Everyday I wake up excited to research and write and create for my audience, to hear the feedback and update my thinking. Everyday I get a chance to become a better investor. And I get to do it with you along for the ride. As Kurt Vonnegut said, “If this isn’t nice, what is?”

The hardest part is turning people down when they want me to comment for their articles or appear at their conferences or speak on their stages or debate people for sport on their websites or contribute columns or whatever else. I recognize that they’re just trying to do their jobs. I respect that to the fullest. And I did a decade of that. More. But I’m done with that now. Paid my dues. If you see me appear somewhere, it’s because there’s something special or unique about that opportunity that makes me happy. All of the rest of my time and energy are already spoken for – my family, my employees, my clients and my investments, usually in that order.

If you’re not sure where to find my stuff, below is a list:

Text message me at +1 (917) 540-6095 I try to respond to as many as I can and occasionally text you my hot take on stuff.

Watch our channel on YouTube, which is absolutely on fire – tens of thousands of subs, millions of minutes watched.

Our new podcast, The Compound and Friends, is definitely more fun than anything else in the category. Believe me, I listen to all the other pods.

I also make periodic contributions to our group podcast, The Goldmine, which is audio versions of our best blog posts. Tadas runs it while me and Blair and Barry and Michael and Ben and Tony contribute each month.

I’m on CNBC’s the Halftime Report on Tuesdays and Thursdays at noon, Closing Bell on Wednesday’s at 3:45pm. When I’m on, those audiences are mine too 🙂 Just kidding.

Facebook and LinkedIn are just links to these things and other stuff I am reading. I don’t spend any time there, it’s all automated.

I’m glad I came to this realization when I did last July. There were some big changes I needed to make in order to be happy. I hope you will use this post as a jumping off point for your own exploration of how you’re spending your time and what you’re not doing for yourself that you should be.

Enjoy the rest of your summer. I appreciate you and look forward to continuing our journey together this fall 🙂

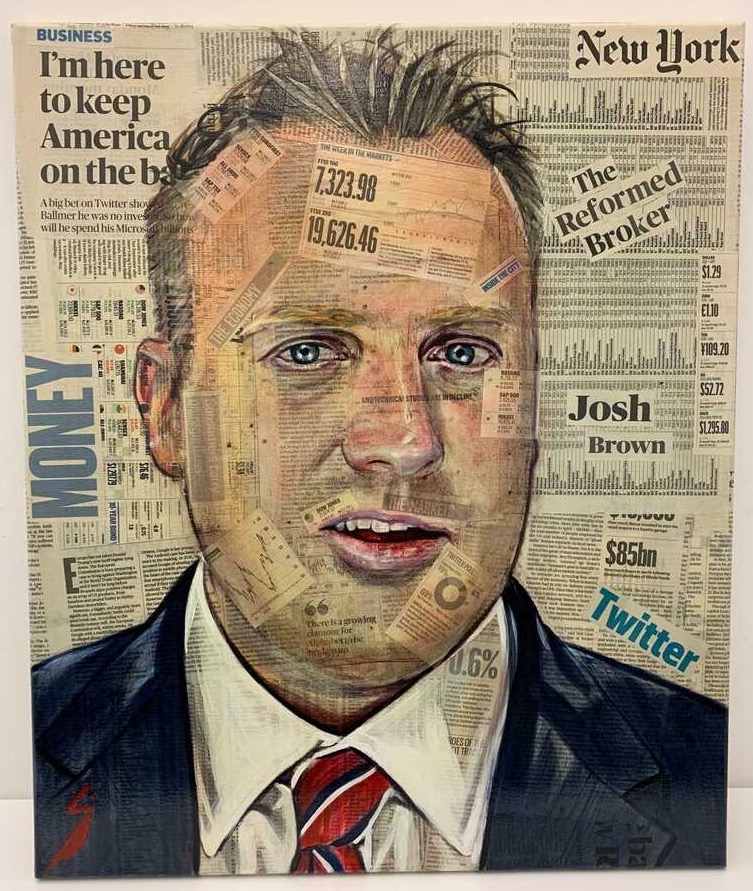

(When this painting arrived at my house, my wife was like “Oooh, that would look great in your office in Manhattan!” LOL, I agree.)