I’m plowing through this really interesting report from Deutsche Bank on why European stocks are always cheaper than US stocks (on price/book value) and coming across all sorts of great insights. (Shout to Steve G for sending)

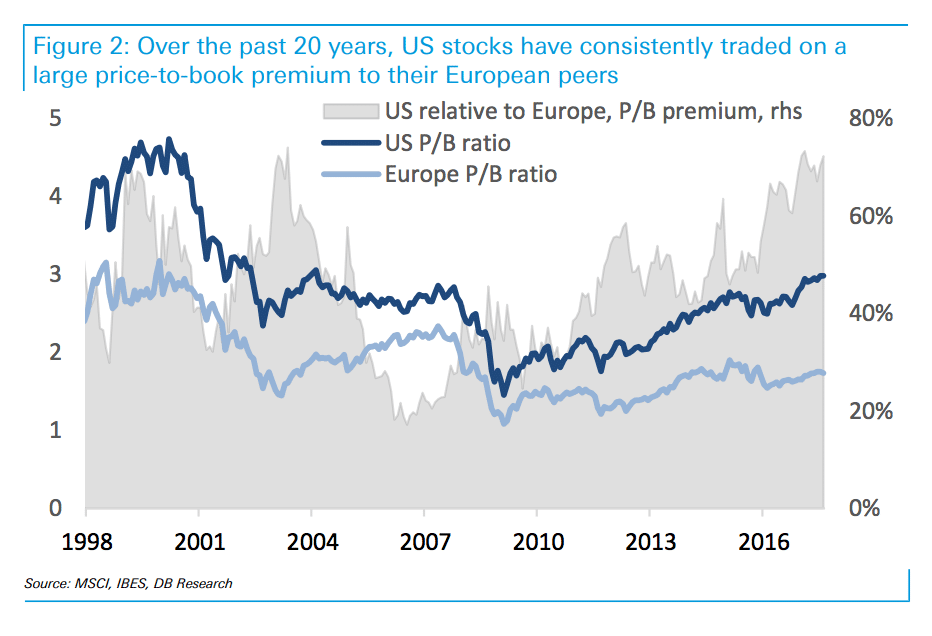

Right now, despite the rally in foreign stocks this year, US companies currently sell at an obscenely high 70% premium to their Euro counterparts. That’s a 20-year high. Here’s DB’s John Tierney, Sebastian Raedler and Andreas Bruckner on the phenomenon:

Everything is generally bigger in America: cars, homes, food portions and stock valuations. Investors currently deem American companies to be worth 3.1 times book value. European stocks, with a price to book multiple of 1.9 times, seem like a bargain by comparison.

This valuation premium of US relative to European stocks is a persistent feature rather than a fleeting anomaly. The price to book ratio for American companies has on average been almost 50 per cent above those for European ones over the past two decades, with the current 70 per cent price-to-book premium close to a 20-year high. However, even at its narrowest, the valuation gap was still 20 per cent in favour of the US during the two years leading up to the 2008 financial crisis (Figure 2).

One plausible-sounding explanation for the valuation gap, namely the very dissimilar sector composition of the major US and European stock indices, turns out not to be relevant in practice. Start by excluding the financials sector. Even on an ex-financials basis, the price-to-book ratio of the S&P 500 is 3.6, whereas it is 2.3 for the Stoxx 600. Thus, the valuation premium of the US index remains intact even after removing financial companies from the comparison.

Josh here – right about now is when someone (usually me) will blurt out “IT’S BECAUSE WE HAVE MORE TECHNOLOGY STOCKS” but Deutsche demonstrates that the premium is still there when you take out tech (Apple, Google) as well as consumer discretionary (AMZN).

So what is the reason? The strategists focus in on Return On Equity (ROE) as being the crucial driver of this discrepancy. Structurally, we have higher margins, cheaper equity capital and a better tax system (despite the spurious claim that taxes on US corps make us non-competitive – it’s actually not true). We also have more flexible labor markets here and are better at refinancing debt at lower rates.

The implications?

The most interesting question is whether or not this premium will exist forever. Or, if it is permanent, should it really be 70%? And what will be the drivers of this spread narrowing in the future – falling US price/book or Euro indices rising to meet ours at higher levels?

As a firm that believes in global asset allocation – and a firm that raised international exposure to overweight in our strategic models this past January (read about that here) – these questions may not be answerable today but they are certainly worthy of consideration.

Source:

What explains the valuation gap between US and European equities?

Deutsche Bank – September 27th, 2017

Read Also:

[…] Read the whole thing here – Why Are European Stocks Chronically Cheaper Than US Stocks? […]

[…] Josh Brown: Why Are European Stocks Chronically Cheaper Than US Stocks? […]

[…] Josh Brown: Why Are European Stocks Chronically Cheaper Than US Stocks? […]

[…] ‘Why Are European Stocks Chronically Cheaper Than US Stocks?’ – Josh Brown –… […]

[…] Why are European stocks chronically cheaper than US ones? – The Reformed Broker […]

[…] A lot has been written lately about the outperformance of US stocks over European stocks. Here is a good summary. […]

[…] Why Are European Stocks Chronically Cheaper Than US Stocks? (thereformedbroker) “Josh here – right about now is when someone (usually me) will blurt out “IT’S BECAUSE WE HAVE MORE TECHNOLOGY STOCKS” but Deutsche demonstrates that the premium is still there when you take out tech (Apple, Google) as well as consumer discretionary (AMZN).” […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]

… [Trackback]

[…] There you can find 4946 more Info on that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/10/05/why-are-european-stocks-chronically-cheaper-than-us-stocks/ […]