Savita Subramanian notes that, overall, Q4 2014 earnings reports are tracking better than average, despite the massive headwinds of FX volatility and energy-related investment stalling.

With the conclusion of Week 3—the biggest week of 4Q earnings season—226 companies representing 63% of S&P 500 earnings have reported. Bottom-up EPS jumped $0.51 to $30.06, now tracking above our forecast of $29.75 and representing a 1.5% beat vs. analysts’ expectations.

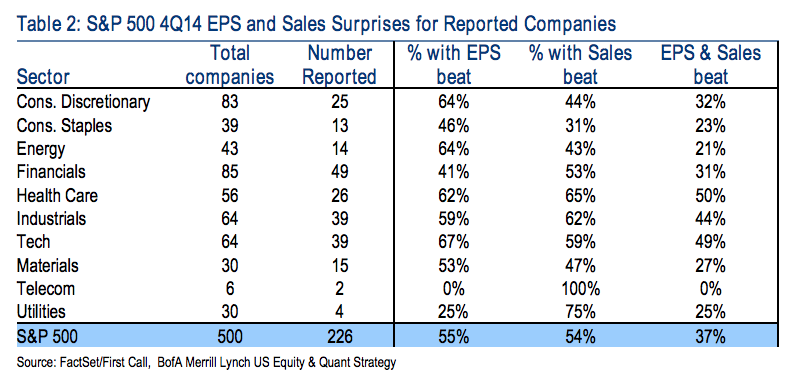

Overall, 55% of companies have beaten on EPS, 54% have beaten on sales and 37% have beaten on both. This was an improvement vs. the prior week, and is now tracking slightly above the long-term average of 35% for EPS and sales beats.

As she predicted, Health Care has been the belle of the ball this season, with the highest percentage of beats on both top and bottom line along with the most positive revisions. The Equity and Quant Strategy group also notes that Apple’s huge upside report is contributing almost half of the S&P 500’s total 4.2% year-over-year earnings growth rate. That’s a pretty astounding contribution from one company, n’est-ce pas?

Here’s the sector breakdown coming out of the massive third week that represents the season’s peak:

Source:

Q4 EPS now exceeding expectations

Bank of America Merrill Lynch – February 2nd 2015

RT @ReformedBroker: Q4 S&P 500 earnings growth now ahead of expectations – but half of it is coming from Apple.

http://t.co/eMqpJYtUrR

Q4 Earnings Season Tracks Above Average http://t.co/Z9SxI4IHTq #money #feedly

Q4 Earnings Season Tracks Above Average http://t.co/OVVlaeizQd

[…] fine narrative – except for the fact that crude has rebounded by 10% in the last few days and S&P 500 earnings are now tracking ahead of expectations, with 37% of companies beating on both the top and bottom line (better than the historic average of […]

RT @ReformedBroker: Q4 S&P 500 earnings growth now ahead of expectations – but half of it is coming from Apple.

http://t.co/eMqpJYtUrR

RT @ReformedBroker: Q4 S&P 500 earnings growth now ahead of expectations – but half of it is coming from Apple.

http://t.co/eMqpJYtUrR

Q4 Earnings Season Tracks Above Average via @ReformedBroker: http://t.co/FFth3y0V77

Q4 Earnings Season Tracks Above Average via @ReformedBroker: http://t.co/27ZzF9nnkb

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/02/02/q4-earnings-season-tracks-above-average/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/02/02/q4-earnings-season-tracks-above-average/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2015/02/02/q4-earnings-season-tracks-above-average/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2015/02/02/q4-earnings-season-tracks-above-average/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/02/02/q4-earnings-season-tracks-above-average/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2015/02/02/q4-earnings-season-tracks-above-average/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2015/02/02/q4-earnings-season-tracks-above-average/ […]