The Kentucky Coal Museum just switched over to solar power to save money on energy costs.

An employee of the NRA just shot himself at NRA headquarters.

Morgan Stanley financial advisors in Massachusetts held a contest to see who could give their clients the worst financial advice.

The Secretary of Education hates public schools.

The head of the Environmental Protection Agency hates the environment.

The Secretary of Energy didn’t know what department even was until they named him to head it. And that’s after he wanted to shutter it.

The number one book in America right now is Bill O’Reilly talking about how men should treat women. Yes, that Bill O’Reilly.

The President of the United States, who spent two years campaigning on a platform of staying out of the Middle East, just fired 60 missiles at an airstrip in Syria and dropped “the mother of all bombs” on a cave in Afghanistan.

Also, he spent five years screaming about his predecessor’s vacationing costs to the tax payer and he’s on pace to outdo 8 years of them in his first year.

And his predecessor’s golf outings, which he may outdo 8 years of by the end of June.

Protectionist, Nationalist Trump was supposed to be bad for stocks. Except that they went up every day. Since he began his pivot to Globalist Trump, which is what Wall Street was said to have wanted, stocks have gone down every day.

92% of all actively managed stock mutual funds have failed to beat their benchmark over the last 15 years, according to S&P Dow Jones Indices. Stated another way, only 8% of thousands of fund products have been able to do what they were supposed to have been able to do.

Can you imagine if 92% of the cars sold by auto companies couldn’t drive? Or if 92% of the pills sold by the pharmaceutical industry were placebos, or worse? What if 92% of the pizzas sold by Domino’s were just Ritz Crackers. How is this a thing that exists?

Don’t worry, nobody knows.

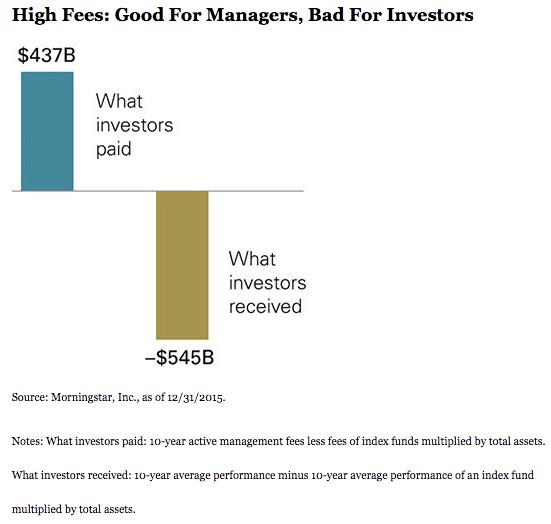

For the ten years ending 12/2015, mutual fund investors, collectively, have received returns that were $545 billion below what the indices would have given them. And for that, they’ve paid $437 billion in fees.

Here’s what that looks like, but don’t show it to anyone (their head might explode):

They say that stock prices follow earnings.

Maybe?

Except “S&P 500 earnings have not yet even returned to their previous peak from the third quarter of 2014, but the S&P 500 currently sits about 20% above the closing price on September 30 of that year!” via Andrew Adams (Raymond James).

Imagine formulating a forecasting model that uses earnings growth, which you cannot know in advance, to arrive at an S&P 500 target. And then you manage to get earnings growth right – flat – but the market goes up 20% anyway.

At that point, what do you even do for a living?

Pure comedy.

***

[…] The Kentucky Coal Museum just switched over to solar power to save money on energy costs. An employee of the NRA just shot himself at NRA headquarters. Morgan Stanley financial advisors in Massachusetts held a contest to see who could give their clients the worst financial advice. The Secretary of Education hates public schools. The head of the Environmental Protection Agency hates the environment. The Secretary of Energ… Source: http://thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Here you will find 87823 additional Information to that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] There you will find 66396 additional Info to that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] There you will find 49700 more Info on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Here you will find 30463 additional Information to that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2017/12/30/pure-comedy-2/ […]