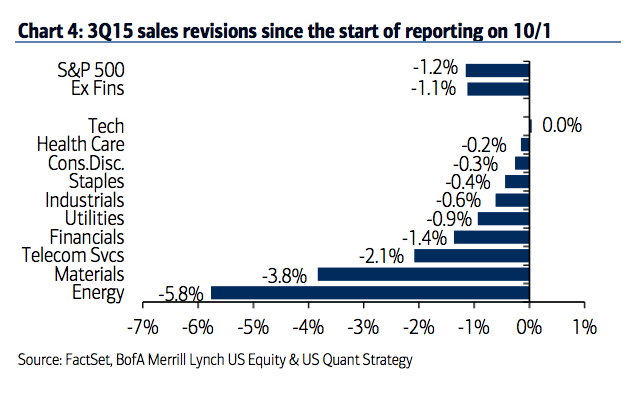

Savita Subramanian (BAML) catches us up on Q3 earnings season now that approximately half of the S&P 500 have reported. One of the big trends this time around is revenue disappointment. Weak global demand and the stronger dollar have made sales gains hard to come by. Subramanian notes that every sector has seen revenue revisions downward except for technology, since the start of the reporting season.

Sales for the quarter have come in worse than expected across all sectors except Technology, as revenue growth was pressured by the strong dollar (DXY +17% YoY on avg.), falling commodity prices (WTI -52% YoY on avg.) and weak global growth. Similar to earnings, the biggest drags on revenue in the quarter were the weaker than expected results from the commodity-exposed sectors of Energy and Materials, which screened as having the most earnings risk in our 3Q Preview. Overall for the S&P 500, consensus expects 3Q earnings growth of -4% YoY, or +3% ex. Energy. Sales growth is expected to be -3% YoY, or +2% ex. Energy. Sales growth is expected to exceed earnings growth for six of the ten sectors, suggesting the beginnings of widespread margin compression.

Here’s a breakdown of revenue revisions by sector. Tech is flat, everything else is a negative revision:

Source:

Earnings Season Update, Week 3: So far tracking a 1% beat

Bank of America Merrill Lynch – October 26th 2015

[…] Revenue disappointments are rife. (thereformedbroker) […]

[…] Q3 sales revisions in the US have only gone one way… http://thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Here you can find 41249 additional Info to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Here you can find 60244 more Information to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] There you will find 78835 more Info on that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2015/10/26/revenue-disappointment-for-every-sector-except-tech/ […]