Very few of history’s most well known collapsed Ponzi schemes began deliberately. This is also true of many famous securities-related frauds. Men are drawn into this by degrees.

What typically happens is that a fund or a deal begins in good faith but there are setbacks. These setbacks threaten the money-raising efforts of the people behind the venture and they say to themselves “Someday I will make this right, but for now I have to find a way to paper over this and keep going.” So they lie, obfuscate the details, fudge some numbers, change the story, find new people to raise money from to preserve the investments of the original backers so that no one gets wind of the problems.

And thusly the problems grow. And step by step, the perpetrator of the Ponzi gets further and further away from that initial line they’d once stepped over so innocently. The point of no return is too far back to turn around. The knot too all encompassing to be unknotted without substantial financial damage, legal ramifications and life-shattering consequences. So the Ponzi must be continued until discovered. Bernie Madoff once said that confessing, after having lived the lie for decades, was almost a relief – despite the fact that it cost him everything in a single instant.

This week in crypto, a major decentralization project unraveled over concerns that one of the project’s insiders was, himself, accused of a Ponzi scheme when his Canada-based crypto exchange blew up a few years ago. He had changed his name and was acting pseudonymously while working on the Wonderland DeFi project and its widely followed TIME token. It’s a wild story which I will link to below. Suffice it to say the community involved with building Wonderland became suddenly aware of who this person really was, which led to accusations that the whole project was a giant Ponzi scheme. I would argue that this is what every decentralized crypto startup has the potential to be if its community ceases to grow and there are no new people to sell the tokens to, but that’s more of a philosophical alleyway I don’t feel like wandering down right now…

Anyway, the founder and central figure of the project announced this week that, because of the distrust of his colleague among the Wonderland community, it made no sense to continue. The TIME token, already falling in sympathy with the broader crypto market, proceeded to collapse. A rug-pull in plain sight.

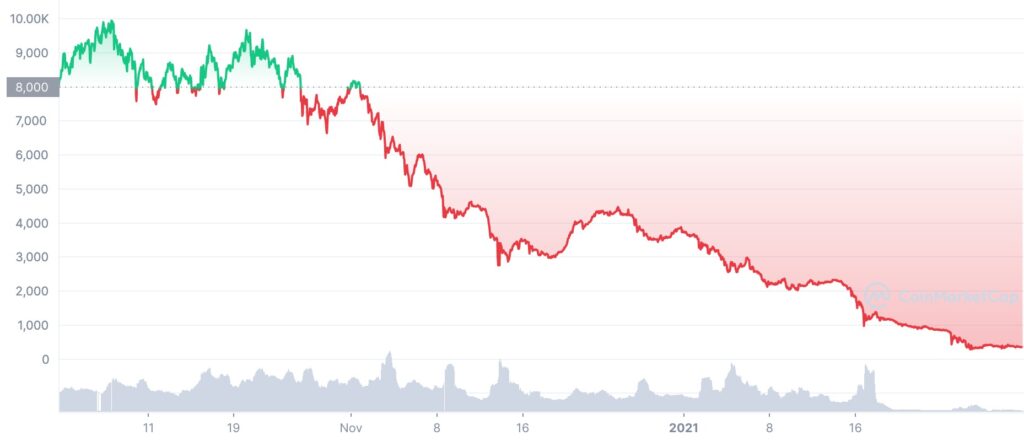

Here’s TIME’s price in USD over the last three months – currently trading below $350 from recent highs above $10,000:

Ironically, by ending the projecting the founder basically validated all of the Ponzi accusations that had been leveled in the last few weeks. But, as described above, the project didn’t set out to cause harm. It’s just the way things ended up going.

Orginally, TIME was a spin-off from a popular decentralized community known as OlympusDAO. A DAO is a sort of organization (disorganziation?) wherein people who are otherwise strangers affiliate with one another for a shared purpose, like to purchase a copy of the US Constitution or evade taxes or some such purpose. The DAO is meant to be democratic with voting power based on token ownership rather than a traditional hierarchy of CEOs and janitors like at a regular corporation. One day, one of these DAOs is going to utilize the power of a crowd to do something very important, like elect the next US President or vote in a new American Idol.

Anyway, that’s where this token’s community originally came from. It’s meant to be a stablecoin (lol) that is unpegged to traditional currencies and is based instead on the value of its treasury. High interest rates from staking activities were meant to attract capital and developers to the tokens. But then, well…

And now the community of token holders is voting on what to do next. Of course, the vast majority of people who were involved in developing the blockchain and protocol would like to salvage this investment of their time and capital. Reputation is important here too – Mark Twain said that it’s easier to fool people than to convince them they’ve been fooled. I’m not sure there is a path to a happy ending here but, of course, that’s what I would wish for these folks.

The takeaways from this story, for me, are the following:

There are a lot of well-intentioned folks working on decentralized and crypto-related stuff whose projects will go down in flames. This is no different than what goes in any other field but the risks are perhaps elevated due to the lack of regulatory oversight, the cross-border (and cross-jurisdictional) nature of these communities and the prolific use of hidden identities that is an inherent trait of Web3.

The prices people are paying for tokens and inclusion to these projects are based on absolutely nothing. There is no math. There is no science. Passionate developers almost don’t care. Reckless speculators don’t either. This is how something could veer between being worth thousands of dollars to worth hundreds of dollars within days. Because there’s no logic or reason underpinning any of it.

There’s way too much trust among DeFi participants and way too much belief that they are surrounded by people who are trying to “build the future” or “disrupt Wall Street” or whatever. Decentralized communities can do a lot of disruption, for sure, but powerful centralized interests will not just lie back and take it. You will not be surprised to learn that the Reddit retail trader community that captured the imagination of millions on year ago is no longer as influential. It was too decentralized to spark another uprising like they did with shares of GameStop or AMC. Too much dilution of opinion and dispersion of action, too many potential candidates for the community to coalesce around. Herding millions of otherwise non-connected individuals into a coordinated activity is hard without tanks and planes. Tokens may incentivize more cooperation than could otherwise be expected, but there are natural limits to this sort of thing. Meanwhile, Gabe Plotkin has plans to launch his next hedge fund, having raised plenty of capital to shore up his first hedge fund.

Plotkin’s fund, you will recall, was at the center of the GameStop firestorm a year ago but still very much still exists, thank you very much. He only had to make two phone calls to survive last year, one to Steve Cohen in Stamford and another to Ken Griffin in Chicago. Reddit had to rely on millions of people staying interested in order to keep their favorite stock on the moon. Centralization beat decentralization once again.

Every movement will eventually be co-opted by moneyed interests and plain old human nature. And if you think Wall Street isn’t going to eventually feed on all of this activity and bring it under their sphere of influence, you might want to read some history. Nothing escapes the grasp of The Street in the end. Not whaling and canals, not the railroads and the telegraph, not the production of steel and oil, not the building of the electrical grid and the interstate highway system, not the space race or the information technology revolution. If there’s substantial money to be made, it is the banks that will ultimately take over the making of it. They’ve written the rulebooks this way. The banks can be controlled and the people who do the controlling prefer it this way. You almost have to have the mind of a child to believe for one second that this time will be any different from the last time.

For every great idea for why something should be decentralized, there are dozens of more pragmatic ideas for why it should be re-centralized as soon as possible. This is the reason why Coinbase is hiring as many lawyers as engineers. It’s why the new class of crypto billionaires are rapidly converting their wealth into physical real estate and other “off chain” interests. It’s the reason you’re about to see Mastercard become a preferred method for NFT payment and mainstream e-commerce sites start to list pictures of pregnant kangaroos.

And why shouldn’t it trend in this direction if this is the way for token prices to increase in value and projects to increase in real-world utility? If we’re investing in these things (and many of us are), isn’t this the necessary compromise that entrepreneurs have been striking with the mainstream since the beginning? Give a little to get a little. Go along to get along. Nobody gets 100% of what they want. Not Jobs, not Musk, so definitely not those titans of industry who founded crypto.com.

The revolution will end with IPOs on the Nasdaq, interviews at Davos, cabanas at the Wynn Las Vegas, booths at the Morningstar Conference, video appearances on Yahoo Finance, testimony on Capitol Hill once enough money has been lost, TV commercials during the US Open, board of directors laden with former Fed officials and Citibank VPs. We’re just a few years away from all of that. Just picturing how conventional it’s all going to become is sort of depressing. It’s won’t be all sex and leather jackets and cigarettes up on the roof for much longer. It never is.

Read further:

Wonderland co-founder throws in the towel on beleaguered DeFi project (Coin Telegraph)

[…] Decentralization (“For every great idea for why something should be decentralized, there are dozens of more pragmatic ideas for why it should be re-centralized as soon as possible”) – The Reformed Broker […]