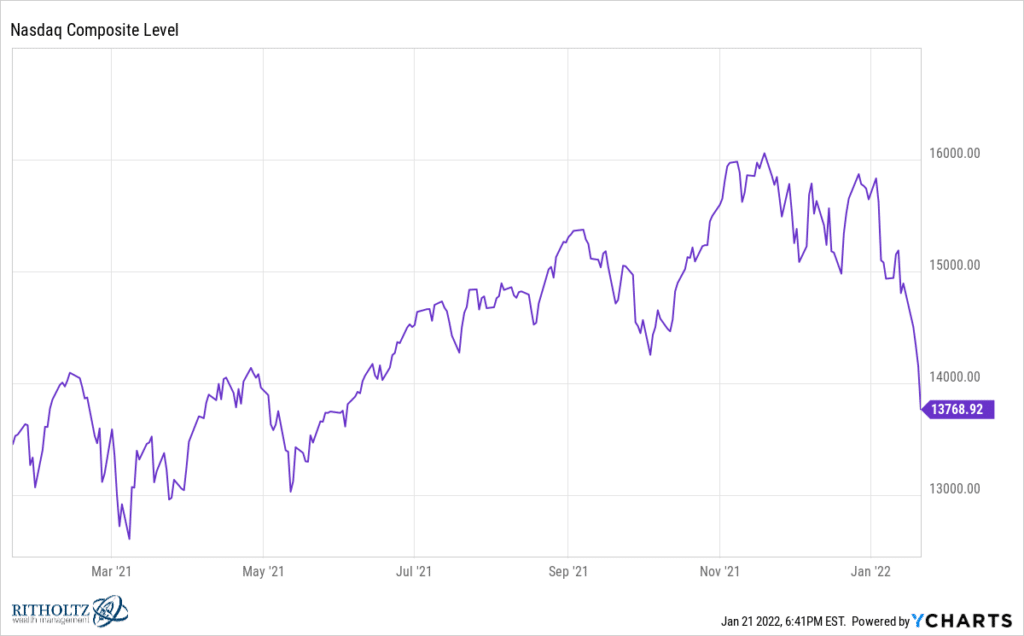

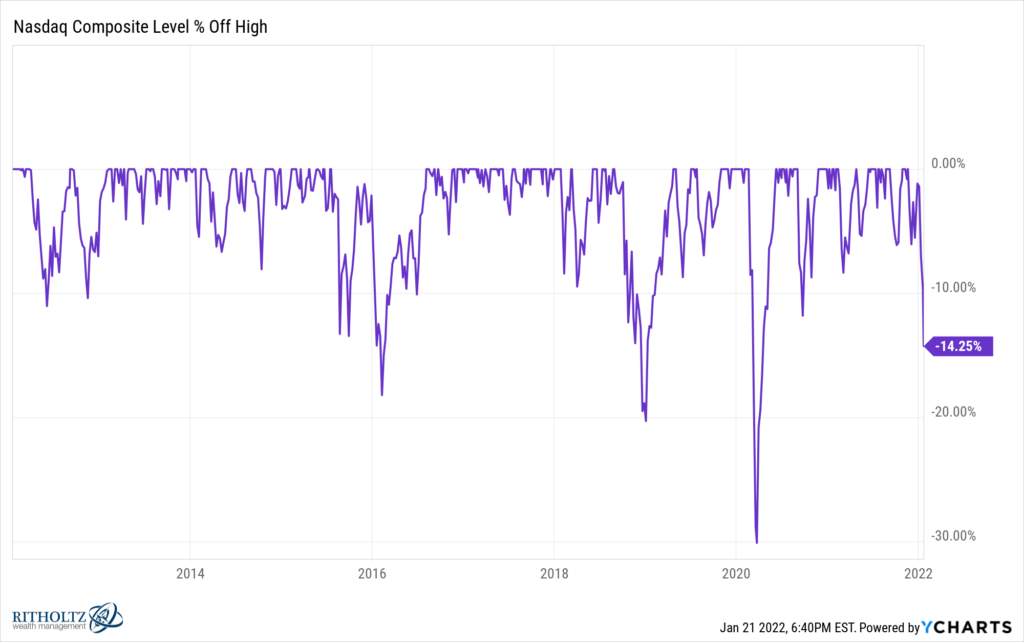

The Nasdaq Composite is now undergoing its 66th correction since its inception in the year 1971. A correction is a drawdown of greater than 10 percent from a high. In this case, the Nasdaq peaked the week before Thanksgiving and is now almost 15 percent lower.

The question on everyone’s mind after today’s disgusting close is whether or not the correction will turn into a full-blown bear market – meaning a drawdown of 20 percent or worse. Mark DeCambre wrote about the historical probabilities of this happening at MarketWatch this week. According to Dow Jones data, during 24 of the previous 65 times the Nasdaq has corrected, a bear market has followed. That’s 37 percent of the time. But in 41 instances, or two thirds of the time, the Nasdaq Composite’s correction did not turn into a full blown bear market and the correction represented a swiftly rewarded buying opportunity.

My best guess is that, yes, we will go past the 20 percent threshold into a bear market for the Nasdaq Composite. But in a 14 and change percent drawdown already, that extra 6 percent or so won’t make much of a difference at this point.

And you should know that we’ve been here before. Below, some of the biggest Nasdaq drawdowns of the last decade:

So this one’s bad, not the worst. At least not yet.

I would also add that an enormous percentage of Nasdaq Composite stocks have already been in bear markets of their own for quite some time.

There’s also a big list of Nasdaq Composite stocks that have already been cut in half from their highs over the last year. This list includes meme stocks, recent IPOs, SPACs, biotechs, electric vehicles, alternative energy and on and on. As JC pointed out this past August, the stock market – as in “the market of stocks” – actually peaked in February of 2021 during the mania phase. Large caps kept making new highs which pushed the indices up, but a thousand smaller stocks have spent most of the last 11 months selling off beneath the surface. The Russell 2000 in total is worth close to $3 trillion, or roughly one Apple (two Amazons). It didn’t matter.

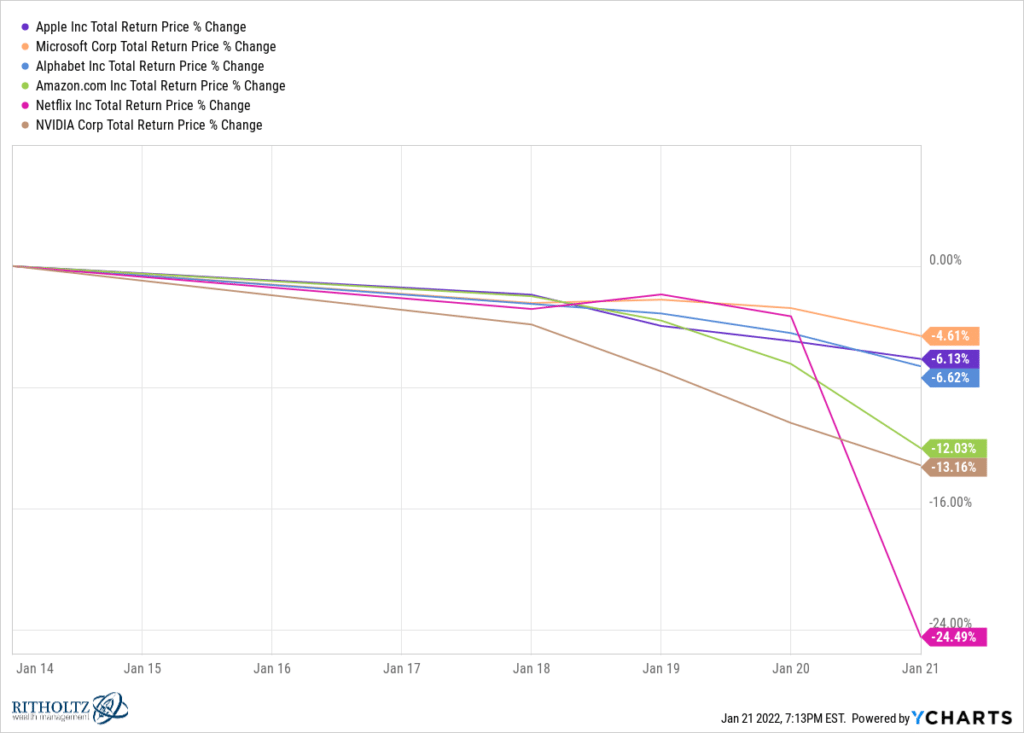

What’s different now is that the largest names in the Nasdaq are starting to get sold. Netflix, Amazon, Alphabet, Facebook, Apple, Nvidia. They’re “catching down” with the rest of the stocks in the market now. It’s not pretty. Virtually every investor in America has exposure to these gigantic stocks because of how large they are in the indices. Apple is in the Dow Jones, Nasdaq 100 and S&P 500. It’s an important weighting in all three. It’s also in dividend ETFs, tech ETFs, thematic ETFs, growth ETFs, value ETFs, quality ETFs, momentum ETFs, you get the idea. Microsoft too.

And now they’re hitting these stocks at last. Here’s what this past week looked like for these six formerly untouchable companies:

Again, my best guess is that we’re not done yet. It would be great to be wrong.

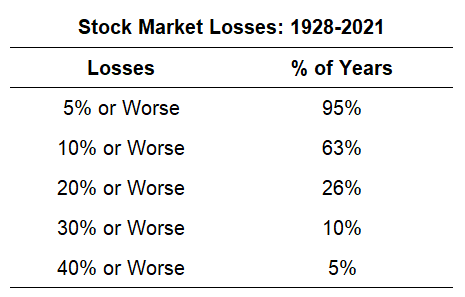

Here’s something from my colleague Ben Carlson, using S&P 500 data from the last century, on the likelihood that this gets much worse. He calculates the frequency of market drops of various magnitudes, just to give you an idea of what’s “normal.” As you can see, 10 percent corrections for the S&P 500 have happened in SIXTY THREE PERCENT OF ALL YEARS:

These averages are skewed a little higher because of all of the crashes throughout the 1930s, but even in more modern times, stock market losses are a regular occurrence.

Since 1950, the S&P 500 has had an average drawdown of 13.6% over the course of a calendar year.

Over this 72 year period, based on my calculations, there have been 36 double-digit corrections, 10 bear markets and 6 crashes.

This means, on average, the S&P 500 has experienced:

- a correction once every 2 years (10%+)

- a bear market once every 7 years (20%+)1

- a crash once every 12 years (30%+)

These things don’t occur on a set schedule but you get the idea.

Okay, so far, the S&P isn’t even there yet, even if the Nasdaq is. And this is totally par for the course. Even though, of course, it absolutely sucks as you’re living during it.

So what do you do now? How do you get through this thing? There are rules. I have written them. Here. On multiple occasions. Here’s a new version, on account of the hundreds of thousands of new investors who are now subscribed to our stuff and maybe reading our blogs and listening to our podcasts for the first time. If you’ve been around awhile, a lot of this material will be familiar to you. You may even find yourself nodding along because these philosophies have become your philosophies. That’s cool. I didn’t invent any of this stuff, I just know it works.

1. Shut the f*** up. No one wants to hear you complain about having stocks that are down. They also have stocks that are down. Commiserating with humor is allowed. Memes about losses are great, everyone can relate. Here’s the deal: Everyone has stocks that are down, at all times. And at a time like this, everyone has stocks that are down big. If they don’t, they’re not really investors, they’re just playing make-believe on social media. People are especially irritable when stocks are falling and brokerage account values are declining. Try not to get on everyone’s nerves. Don’t beat your chest for having taken money off the table. Don’t “told you so” your friends. Just grit your teeth and get through it. Say less.

2. Comportment. This is one of the all-time great words in the English language. I think the British use it but Americans generally don’t. Maybe at boarding schools in the Northeast they do. It’s a shame. This is a lost art. The art of comporting oneself in the face of adversity. Act like an adult. Go about your business. You have no control of what the markets will do, only your own reactions. Don’t whine and cry to influencers on TikTok or Instagram or Twitter or Reddit. Don’t blame Jim Cramer for your own decisions. Comport yourself! This is going to become a very valuable ability as you get older and the assets (and dependents) you’re responsible for grow. A lot is going to be riding on your comportment during some of the worst of times. Your sons and daughters will be watching how you act. Comport accordingly.

3. My psychological trick. Put in some absolutely absurd good-til-canceled buy limit orders on the stocks you had always wished that you owned – at prices so far below their highs, it would be miraculous to ever buy them down there again. Make sure there is enough cash in your account to cover these orders should you get hit on a few of them. This is my very best trick for surviving corrections, I have written about it many times. Here’s the version I published during the Chinese yuan panic of August 2015 (remember that? Of course you don’t). And here it is again, republished during the Brexit / Trump panic of summer 2016. This always works for me. I start subconsciously rooting for sell-offs to get hit on my buy limits for the best stocks in the market. And sometimes I actually get them! I bought Starbucks in the 60’s in the spring of 2020. It subsequently ran to 120. I didn’t know it would ever get down to the 60’s. I just knew that if it did I wanted to own it there. And then one morning I got filled. Boom! I am currently setting up bids at ridiculously low prices for a handful of names – all limit orders, all GTC. We’ll see what happens.

4. It’s not about you. And your regrets. And the fact that the last three stocks you bought went straight down. Don’t be in people’s mentions asking about individual names, “So…you still like this Cisco?” Come on. Every stock is down, it’s not about that. In a market-wide correction with the Vix headed to 30 it doesn’t matter what people liked before or why they liked it. Stocks temporarily become commodities as funds and traders sell what they can, when they can, to meet redemptions or reorganize themselves for the eventual rebound or make margin calls. Indiscriminate selling is a good thing. It means we could be getting close to the end. So try to remember that this isn’t about you and your problems. It’s bigger than that. The market isn’t watching you. Your actions and emotions are not a signal of anything.

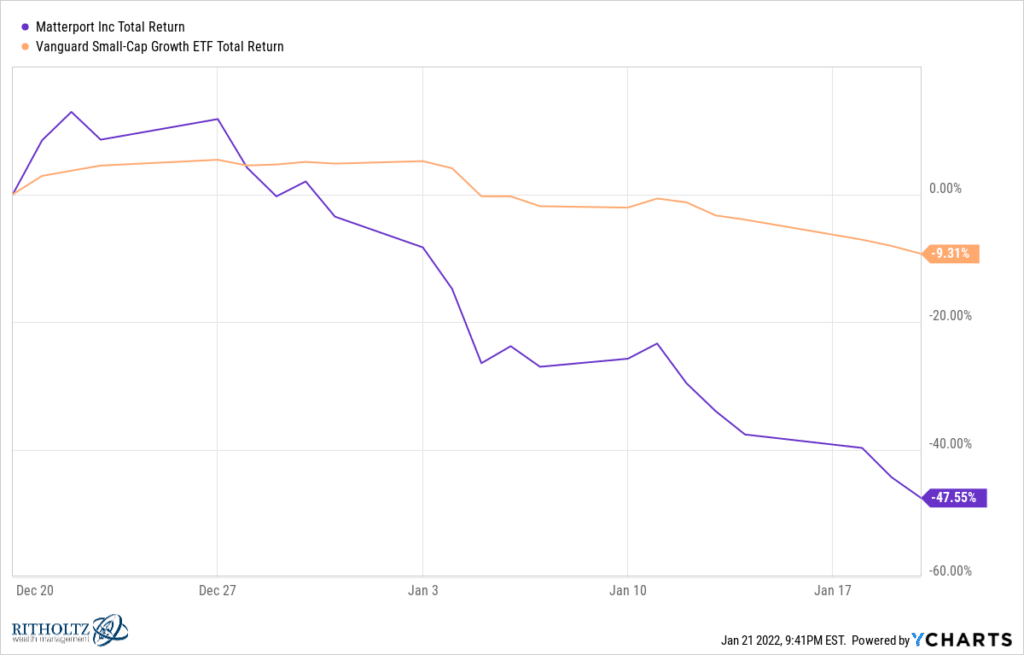

5. Newer companies have less long-term institutional support and, as such, they will be absolutely thrashed. This isn’t true in every single case under the sun (I am sure you can find examples to refute me) but it’s mostly true. I would bet if someone ran the numbers, they’d find what I already have learned with my own eyes. I just know this intuitively. The most recently public stocks are going to get sold off the hardest, all things being equal. They just don’t have the shareholder support; the muscle memory that lets a fund manager say “this always comes back, I’m keeping it.” And if it’s a smaller recently public company, lights out. This is just an unavoidable risk you’re assuming when you’re playing in these names. Take a look at my beloved Matterport, a stock which has had zero news come out over the last 30 days and has still managed to get cut in half, quite inexplicably:

I’m showing it versus the small cap growth index ETF from Vanguard which is made up of stocks in the same peer group, but stocks that have been around long enough to have been included in the index. Matterport is months old as a public company and isn’t in any index ETFs worth mentioning. I’m in this stock and it sucks because prior to this correction it was doing incredibly well. I have now given up all my gains and I have unrealized losses. It happened virtually overnight. This sort of thing does not happen with more established, longer tenured stocks, for all of the reasons we discussed above. It’s been orphaned. I’m sticking with it as an investment – it was never a trade – but I am not happy. Outside of this post, however, you won’t hear me pissing and moaning about it. Won’t be the first bag I ever held. Won’t be the last.

6. Remind yourself that, unless you are in your seventies, chances are you are still a forced buyer of stocks for the time being. Retirement investing requires you to accumulate assets that have the potential to out-earn the longer term inflation situation and, at today’s yields, bonds and cash just can’t. Only stocks and real estate have been proven over the last one hundred years as viable long-term inflation hedges. The volatility you get from stocks and the illiquidity you get from real estate are the prices you pay for the high returns they offer. It’s not free. The Nasdaq Composite has been compounding at 18 percent a year for the last five years. I’d like to see Treasury bills do that. They cannot. So as you continue to earn and put money away, you will be buying equities with some of your savings. The younger you are, the more this is an absolute. No choice. Your 401(k) demands this of you.

So the question is, do you want to pay all-time high prices for these purchases or are you better off buying lower? I know you know the answer is buying lower. But you forget. I am here to remind you. If you’re a buyer, not a Boomer, corrections work in your favor. In February 2018, I took this concept to the Los Angeles Times and they put me on the cover of the business section. Stocks had just begun the year with a violent correction – so I decided to correct some people’s misperceptions.

7. Find something else to focus on. So, if you’ve committed to riding this out rather than panicking, good for you. You’ve made the right choice. Now what? Try to make this decision easier to live with. Shut off the “news alerts” that are only designed to earn money for someone else’s advertisers. Close your laptop. Stop checking prices. Log out of that f***ing brokerage app. You’re not doing yourself any good watching tick by tick if you’re not a full time professional trader (and you’re not). If the TV is on, remember everyone you see on there is doing their best but making guesses. No one can know what’s going to happen next for certain. I’m pretty certain of that. I’ve met everyone you could possibly meet at the highest levels of the money management profession. I can assure you it’s not a science. So why fixate? Read books, comb your horses, work on that old Corvette out in the garage, maybe have an affair with your neighbor’s wife, anything but this. I’m trapped in the middle of all this shit, 24/7. You aren’t. Remember that.

8. Don’t cap your upside at the bottom. There are going to be people out there selling hedging solutions against losses now that everyone has just experienced losses. This works every time. If only you had listened to them before! Christmas would have been saved! I’m not anti-hedging, I just know that the more you try to suppress risk, the more you are sacrificing in potential return. So do you want to do that now? I prefer to calculate the correct amount of equity risk to take in the first place rather than taking too much and then trying to hedge some of it away. But hey, that’s just me.

In 2002 we were selling a UIT (basically a fund you lock yourself up in for like five years in exchange for downside protection) to clients who had just been shell-shocked by the dot com bubble bursting. Here was the pitch: “We’re buying you the biggest names on the Nasdaq – Microsoft, Cisco, Oracle, EMC, Intel, Dell, etc. They’re sure to recover! You hold the trust for seven years. You are guaranteed against any losses on the downside. You get the upside.” In the fine print, it says “actually, you get the upside of the portfolio but capped at one percent per month.” I’m paraphrasing. But basically they took almost all of the upside as those blue chip tech stocks recovered. If this portfolio of stocks ran up 5 percent during the course of one month, my clients only got 1 percent of that. Terrible deal but they all wanted it. Because that feature – guaranteed return of principle – was all they could think about. Those stocks did recover. Holders of the UIT didn’t get the benefit the way they would have had they owned them outright, accepting the potential downside risk.

9. Swinging to cash is crazy. Even if it works once, it’s not going to work twice. You can’t do this reliably. No one has ever demonstrated the ability to be all-out and then all-in and then all-out again without churning themselves into a massive loss. It’s simply not possible. If that’s what you think you’re going to do, then think about the implications of this mindset: You’re basically saying you have a magical ability to predict what 100 million other investors are going to do, when they’re going to start selling and when they’ll stop. Around the world. It’s beyond farce. You have to stop believing in magic. I wrote about the stupidity of the All-In, All-Out mentality back in 2011. I really haven’t changed my mind about any of it since. Warren Buffett said the most important trait to have as an investor is not intelligence. Everyone’s smart. No, it’s temperament. “Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.” Warren is right. I know people with high IQs who literally cannot deal. I know many regular folks who do just fine through all sorts of volatility. You cannot allow yourself to get too bullish at record highs and then fall into utter despair or abject fear in a correction. You will definitely lose permanently if this is your temperament.

10. The basics still work. Diversification. A year ago you might have been tempted to go all growth, lose the value, and load up on the momentum names that everybody loved – DraftKings, Tesla, Moderna, you know the rest. The stuff that wasn’t hot then – energy, utilities, REITs, banks – that’s what’s saving your ass right now. Bonds too. You know what else was a good decision? When your “wealth manager” at the wirehouse called you to pitch a million dollar portfolio loan for “general purposes” against your brokerage account, you said “No thanks, I don’t need the cash right now.” Then he said, “Well, we should just set it up in case you ever want to use it. You gotta unlock both sides of your balance sheet!” And you were like “Seriously, Ethan, I’m good, call the next schmuck on the ‘opportunity list’ they handed you.” If you did that, you’re fine now. Keeping leverage low is working. You can sit tight. Nobody is making you do anything now. There’s going to be a big opportunity to rebalance out of fixed income, into stocks, the longer this keeps up. Rebalancing opportunistically into a correction is great. We did it in early 2020. Would love to do it again. Tax loss harvesting – this is what every financial advisory firm ought to be doing for its clients right now. We’re doing a lot of ours algorithmically via direct indexing tools. It’s meaningful. It’s a productive activity in a storm. Remember: Saving someone a dollar on taxes gets you the same positive reaction as you get from making them ten dollars with an investment. It’s weird but it’s true, ask any advisor. The Basics!

OK, so these are ten of my rules. I could probably do twenty but I imagine you probably want to check on your family at this point, maybe get up and stretch your legs a bit. I am passionate about helping investors become better versions of themselves and my writing on these topics is a true labor of love. if you get something out of them and they help you get through a tough time in the market, that brings a smile to my face. So thanks for reading and sharing.

Last thing – you don’t have to do this by yourself. I have over twenty certified financial planners standing by, all across the country, ready to talk with investors at every level. These professionals are full-time financial advisors, handpicked to join our firm and steeped in the culture we’ve built since 2013.

We’ve got four service tiers at Ritholtz Wealth:

Liftoff (automated asset allocation and goals-based investing, no minimum, for investment portfolios up to $250,0000)

Inflight ($250,000 to $1 million, Liftoff plus one-on-one consultations with CFPs, ongoing planning help)

Wealth Management ($1 million to $7 million, full-service dedicated Certified Financial Planner relationship, custom portfolio design and management)

The Preserve ($7 million plus, full wealth management plus access to additional strategies, asset classes and opportunities)

You can tell us about yourself and we’ll take it from there.

And if you’re out there on your own, that’s fine too. Stay cool. This too shall pass. It always has.