One concern is that investor pessimism, as expressed in lower stock prices and rising corporate bond yields, could exert pressure on consumer and business confidence and ultimately reduce spending in the real economy—a linkage that is potentially more potent when asset prices have been rising for almost a decade since the end of the financial crisis.

The economy is not the stock market, but it can be influenced heavily by the stock market. Chairman Powell’s “don’t worry” speech last Friday made it clear the extent to which the Federal Reserve is willing to respect this idea.

I think a lot of people assume that stock prices will be affected by what happens in the real economy, but it’s a little less intuitive to someone from Main Street that their careers or livelihoods or wages might be directly affected by what happens on Wall Street.

The Depression was directly caused by a crash on the stock market after almost a full decade of epic speculation. The 2000-2002 recession, a more recent event, was also directly caused by a stock market crash. However, the crash of 1987 did not cause an economic recession. It started as a stock market panic and ended there – no spillover.

With the brief dip into “bear market territory” experienced by the S&P 500 this month, I’ve been thinking about whether or not the next recession would cause a stock market sell-off – or if a collapse in stock prices (along with real estate, art, etc) might be the thing that sets off the next recession. It’s a bit of a chicken and egg question.

The Wall Street Journal’s piece on the topic is worth considering, as the economy has become more “equitized” than ever before. I made that word up just now. It’s my way of describing the inextricable link between stocks and the economy that, perhaps, has never been stronger, thanks to the prevalence of equity-linked exec / employee compensation, the rise of the 401(k), etc. We have a fully equitized economy.

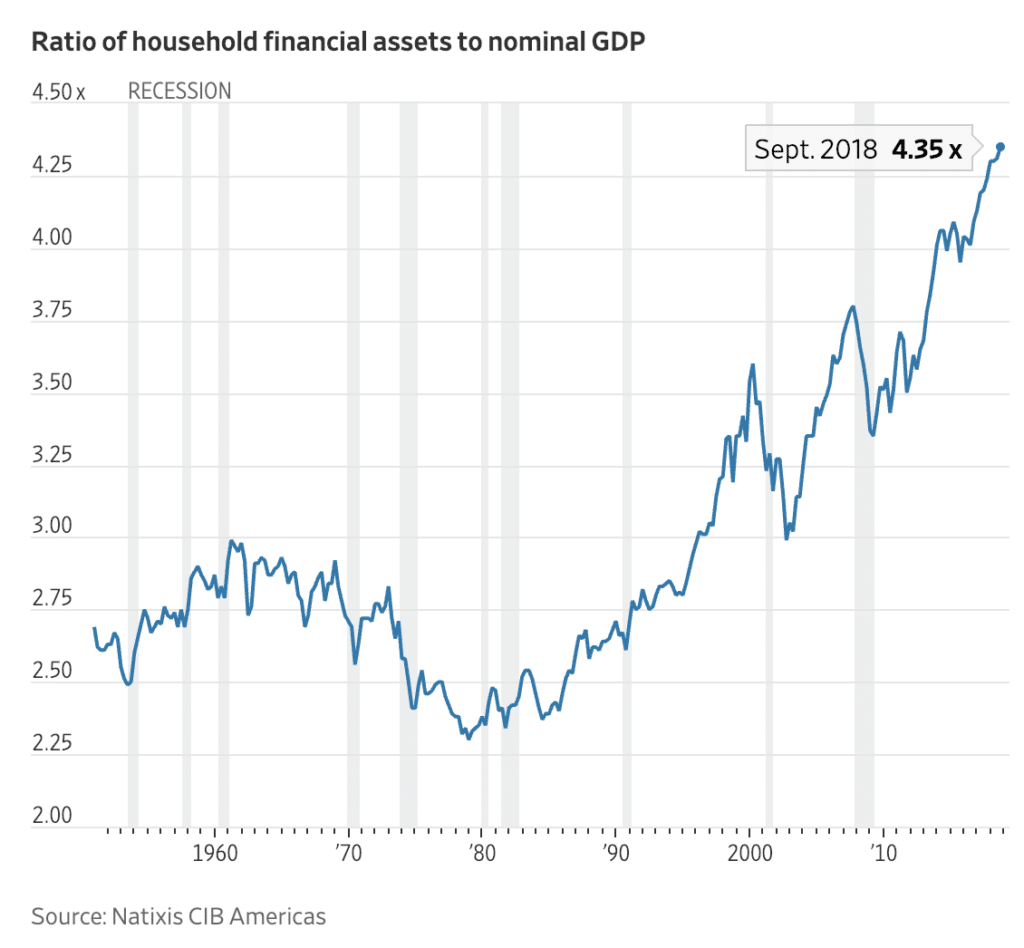

The value of Americans’ financial assets—such as stocks, bonds and savings accounts—is at a record relative to the size of the economy, research from investment bank Natixis shows. That could mean the fate of the U.S. economy has never been more tethered to that of Wall Street, said economist Joseph LaVorgna—adding to the drama of each swing in the stock market and putting more pressure on Fed officials to consider market conditions when setting interest-rate policy.

Joe’s chart is pretty illustrative of the degree to which stock prices matter to the real economy…

What do you think? Will the next recession be caused by falling asset prices on Wall Street? Tell me here.

Source:

Among the Growing Risks Investors Are Assessing: Their Own Fear (WSJ)

[…] One concern is that investor pessimism, as expressed in lower stock prices and rising corporate bond yields, could exert pressure on consumer and business confidence and ultimately reduce spending in the real economy—a linkage that is potentially more potent when asset prices have been rising for almost a decade since the end of the financial crisis. The economy is not the stock market, but it can be influenced heavily … Source: https://thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]

[…] Joshua Brown: Could A Falling Stock Market Create Its Own Recession? & Good Riddance […]

[…] Joshua Brown: Could A Falling Stock Market Create Its Own Recession? & Good Riddance […]

[…] Recessions involve a reduction in factory output, a surge in unemployment, and (as a result) a dip in GDP. Everybody you know asks “How are things at your work?” with a perverse fascination about the layoff body count, and I guarantee your Twitter feed will feature a sharp reduction in “I quit the job I hate today!” humble brags to be replaced with “Oh shit, I got fired, now what?”. The cherry on top of this shit sundae is usually a 40% haircut to stock market valuations. […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]

… [Trackback]

[…] Here you can find 62827 additional Info to that Topic: thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]

… [Trackback]

[…] There you can find 25581 additional Info on that Topic: thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]

… [Trackback]

[…] There you will find 1963 more Information on that Topic: thereformedbroker.com/2019/01/08/could-a-falling-stock-market-create-its-own-recession/ […]