Ari Wald is out with his firm’s technical roadmap for 2019. He lists the numbers he believes will be the most important or meaningful for traders to be aware of. I thought this look at the history of cyclical bear markets occurring during secular bull markets was very interesting.

If Ari is correct, then we are currently enduring a cyclical bear market but the secular bull market that began in 2013 with fresh S&P 500 record highs is still intact. Other secular bull markets throughout history had endured their share of these cyclical bear markets without being thrown off course for good. This would be the best-case scenario for investors at this point – that the recent bear is a short-lived episode of which we have already seen much of the worst.

Here’s Ari’s take and some historical context, my Chart o’ the Day…

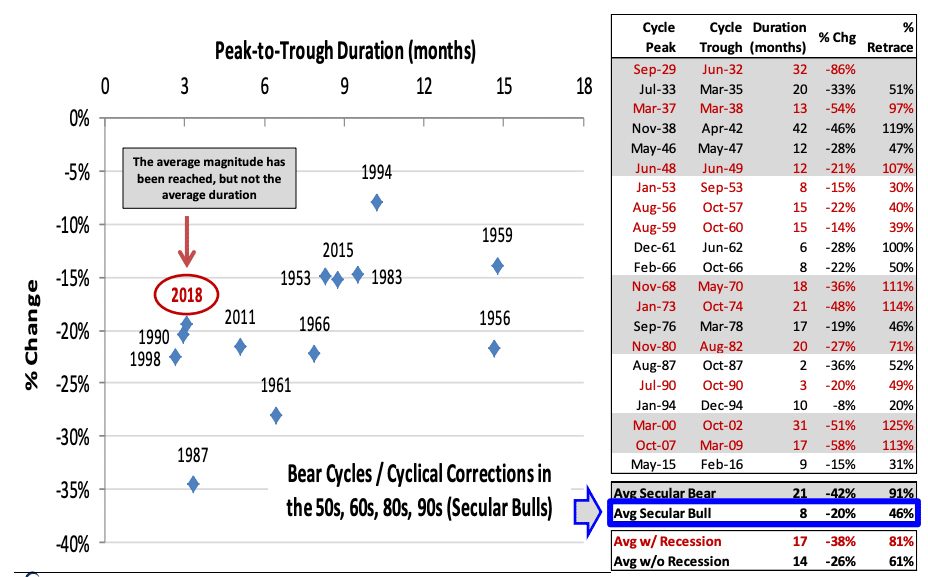

The table to the right lists the bear markets in the S&P 500 since 1929 (economic recessions are colored in red, secular bears are shaded in gray). We’ve found that cyclical bears in secular bulls (in white) are usually either long-and-shallow (1953, 1959, 1994, 2015) or short and sharp (1961, 1987, 1990), by our analysis. On average, the index drops 20% over an 8-month period and retraces 50% of the prior advance. This is why we believe the S&P 500 has endured the bulk of the magnitude and now requires time to base.

(click to embiggen!)

Josh here – we’ve already seen a 50% retracement of the 2016-2018 rally. The average cyclical bear in a secular bull has not required losses much deeper than that in order to make its point.

Source:

Big Numbers for 2019

Oppenheimer & Co – January 1st, 2019

[…] that has been prognosticated by several Wall Street analysts and bloggers in recent months like Josh Brown who recently […]

[…] that has been prognosticated by several Wall Street analysts and bloggers in recent months like Josh Brown who recently […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]

… [Trackback]

[…] Here you will find 79020 additional Information to that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2019/01/02/what-if-weve-just-seen-the-worst/ […]