Let me tell you my comic book origin story, the executive summary version:

I began managing money for retail clients one year before the dot com bubble burst, so my first three years were spent helping people through a 50% decline in the stock market. I was in my early twenties talking to clients in their fifties and sixties as the Dow and S&P 500 weathered a recession, the twin bankruptcies of Enron and Worldcom followed by 9/11 and the Nasdaq dropping 90% from its high. People’s entire retirements were on the line and I did my best. I only knew what the “senior brokers” told me, which was mostly useless. But watching them proved to be invaluable.

Five years after the recovery of that particular crash, the next crash was already underway. But this one was worse. 57% peak-to-trough for the S&P in the span of 18 months. It was fucking sick. Lehman, Bear, AIG, Countrywide, Fannie, Freddie, Wachovia, WaMu, Madoff (MADOFF!) and on and on. I got people through that one too, the best I could. I was a little wiser than my first go-round, thanks to what I learned reading The Big Picture blog and my rabbi Barry Ritholtz.

Anyway, the first ten years of my career were bookended by two of the worst stock market crashes and grueling bears of all time, in the recorded history of the stock market. I didn’t appreciate it at the time. I wasn’t exactly enjoying myself during. But I smile about it now. Whole stock market would have to go to fucking zero to impress me at this point. Anything short of that ain’t gonna stop me from doing my job. Nassim Taleb, in his book about systems, people and institutions that were built to endure crisis and hardship, refers to this as “anti-fragility”. Okay, alright, I like it.

***

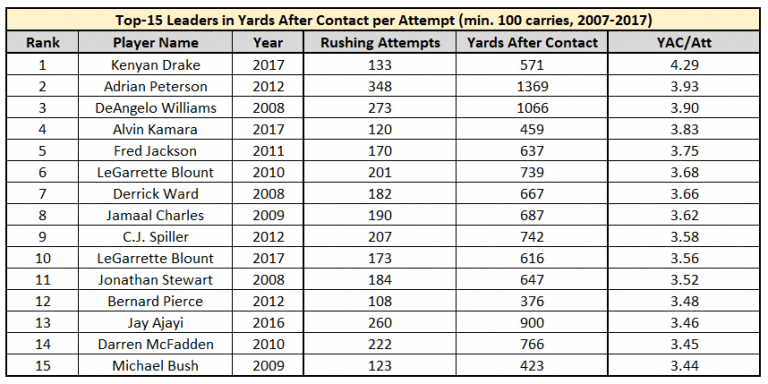

Running backs in the NFL are judged by all sorts of stats. Total rushing yards per game or season, total touchdowns, 3rd down conversions, yards per carry, etc. My favorite statistic, which is not widely followed but ought to be, is Yards After Contact, or YAC (not to be confused with Yards After Catch). Yards after contact is a measure of how much further the running back can go once the first guy hits him. Does he get another yard? Two more? Or does he go down on the first tackle he encounters?

Ezekiel Elliott, on the Cowboys (whom I despise) is racking up big career numbers in the Yards After Contact category. So are Jay Ajayi and LeVeon Bell (if he ever makes it back). They get hit and they keep going. Sure they’re fast, but all NFL running backs are fast. Sure, they’re all nimble on their feet and they’re all smart enough to find the holes in the defensive line. But the YAC leaders are also something else. They’re different. Tougher.

Last season, Kenyan Drake put on a YAC clinic for the ages. Just an absolute beastworthy performance in getting the next yard and then the next no matter what. An extra 4.29 yards after contact per rushing attempt. There have been players with higher season totals (Adrian Peterson in 2012, good lord!), but not on average per attempt throughout an entire season. Drake was busting through tackles every weekend.

I respect this stat more than all the rest. I appreciate what it means. What it says about a player and his determination. I appreciate what it says about the people in life who exhibit similar determination. In the investment realm, there are seasons where it’s nothing but green fields ahead, not a cornerback or a rush defender in sight. 2017 was a year like that. So was 1999 and the second half of 2016 and most of 2003 and if I sit here I can probably think of a few others I’ve personally lived through.

But most years aren’t 2017 or 1999. Most require us to break some tackles and keep going.

***

Here’s the headline of today’s Wall Street Journal cover:

Uh oh. The gains are gone. We are flat to down on the year. And so late in the year! Well, that’s certainly a big change of pace. We haven’t been down on the year going into Thanksgiving in quite a long time. Not everyone will survive this situation. Promises have been made, impressions have been conveyed, implications have been implied…

“Hello? Is this Vanguard Customer Service? Well, yes, it seems that these index funds I’ve purchased are defective, they seem to have been losing value throughout the course of the year…yes, I’ll hold…”

Trillions of dollars have come into ETFs, index funds, passively-oriented financial advisors, robo services, etc, all of them pitching some form of “I promise not to do anything for you and the cost to you is practically free.” That’s a great pitch when the markets are higher every year than they were the previous year. Especially when they’re higher every sequential month as they were last year.

2018 is a different ball game. I’m not so sure the prevailing popularity of “Here, this is basically free” will hold up. Investors may start thinking more about what, “Well, what am I getting?” In the modern service economy, how much you pay is only one side of every transaction. The other side is how much value you are receiving in return. Investors who have been taught to only consider the first side now have some new things to think about.

***

I wrote an article for Fortune Magazine about portfolio loans four years ago and one of the attorneys for a major wirehouse wrote a letter to my editor complaining about it.

I read the letter and that’s when I knew I had these sonofabitches dead to rights. Because his only criticisms were semantic. For example, when I described wirehouse brokers attaching loans to the retirement assets of their boomer-age clients and exposing them to unnecessary risk, the little asshole said I was wrong because portfolio loans aren’t made against retirement accounts like IRAs. Semantics. Because your non-tax deferred brokerage accounts are still going to be used to fund retirement. A client with a million dollars in an IRA and then a million in a regular brokerage account has TWO MILLION SAVED FOR RETIREMENT. It’s not different money, liar. It’s going to be used to pay future expenses in old age, and, as such, pushing people to take out loans using it as collateral is bad fucking advice and would be considered malpractice if brokers were doctors.

Anyway, the mainstream media is starting to take notice of the gargantuan growth in these portfolio loans over the last few years. Money was cheap and stocks were going straight up. Convincing clients to take on more debt against their stocks and bonds was a great business line for the bank brokerages. They could attach a second revenue stream to the same assets under management and even make their clients’ money stickier – “I can’t leave and take my portfolio elsewhere, there’s a loan attached. I’d have to arrange an offsetting loan somewhere else. Fuck it, we’ll leave it with Jeff. What time’s the Spurs game?”

Well, soon enough it’ll be time to pay the piper…

Here’s the Wall Street Journal yesterday:

Some brokers at Merrill Lynch are pushing back against a compensation plan they claim rewards them for increasing debt their clients take on and in some cases can punish them for reducing it.

Some of the 15,000 financial advisers at Merrill have complained internally to management about a compensation structure they say urges more customer debt at a time when interest rates are rising, according to brokers and managers. Others have written over the past year to Andy Sieg, head of Merrill Lynch Wealth Management, saying the policy potentially pits them against their clients’ interests.

We’re talking somewhere close to $200 billion in securities based loans at brokerage firms right now, that we know about. God knows how much that we don’t know about. Boomers have been told, by their (non-fiduciary) financial advisors at brokerage firms that they could have their cake and eat it too. That they could “unlock the true potential of their balance sheets” by keeping their investments and spending the money anyway, just as though they had sold down their portfolios.

But the world doesn’t work that way. As markets fall in value, some of these loans will be called. You’re not able to sell the boat so quickly to cover. Brokerages have taken no risk in making these non-underwritten loans to you. They got you the money in less than a week, no problem. You know how? Because they can liquidate your shit at the drop of a hat. The assets you’ve pledged are sitting in the brokerage account. It’s like a margin call. They can pay themselves back instantly by liquidating your positions. Enjoy the boat. The brokerage’s executives are definitely enjoying theirs.

If your investments are encumbered by loans and debt, you’re not going to be able to withstand many tackles. Your YAC gonna be wanting. First hint of contact from a market downturn and you’ve got a problem.

***

And now this freakshow…

…the latest in a long line of illustrative examples of people who aren’t ready for contact.

When I first watched the video, I actually felt sorry for the guy. He’s on the verge of tears and I think they’re genuine. If you haven’t seen it, he’s basically issuing a public apology to the investors he’s wiped out with an options strategy and hedge fund he took to zero in the course of a month when oil and gas volatility shot up. Worse than zero. Supposedly not only were the accounts wiped out, they actually owe money in margin calls after the fact!

But then some people made me aware of how he was marketing this fund. He called it a retirement strategy. It’s not a retirement strategy, it’s speculation. By the way, to an options trader, every problem calls for an options solution. Just like insurance brokers see insurance as the answer to everything – estate planning, long term investing, asset protection, health care, sex fetishes, etc. To the man with a hammer, everything looks like a nail.

Anyway, I don’t feel bad for James Cordier, or his “clients.” Taking in premiums from selling calls – picking up nickels – and having no idea of the potential for a blow-up is the most childish thing I’ve ever heard. No, the laws of risk and reward are not repealed just because someone sounds sophisticated when discussing derivatives. Risk cannot be eliminated, only transformed. This man sold investors a lie. And now he compounds it with a new lie – “a rogue wave came along and capsized us!” GMAFB.

Google this guy’s sales pitch when you get a chance.

If your strategy bets on the movement of commodities and it isn’t durable enough to survive the movement of commodities, perhaps you have no business managing money in the first place. So no, no sympathy. Fuck you and your cufflinks too.

***

All around me I see examples of people, portfolios, strategies, messaging and business models that weren’t built to withstand corrections that persist for more than a month or so, as this one now has. Free asset management isn’t built for it. The phone banks won’t withstand the onslaught as millions of people learn that index funds aren’t any “safer” than the active funds they’ve exchanged them for.

Advisors who don’t charge any money for portfolio management aren’t built for it either. Imagine telling a client “Oh, I don’t add any value on the portfolio, I’m just here to be friends with you.” Lots of people who HAVE NEVER taken a phone call from a client who’s seen a fifth of their retirement money disappear have opinions on how advisors ought to charge for their services. Lots of retired advisors turned consultants, who are no longer in the trenches, have strident points of view – now that it no longer pertains to them. Which is fine. I have a strident point of view of my own…

Advisors charge clients a fee on the money they manage because they are actually managing it. That means, in real life, that they are answering for it. They are forced, at a moment’s notice, to defend the portfolios and strategies they have recommended. Sometimes in tearful conversations over the phone and, yes, unfortunately, sometimes in a court of law.

If you’re responsible for a thing, you should get paid for building and managing that thing. And if you’re not responsible, and don’t have to answer for it or worry about it or address it, then, no, you should not be paid based on it.

So if you say “I only get paid for advice, the asset markets take care of themselves and the portfolio is not my problem,” I’m not sure you’re going to enjoy yourself should the current correction turn into something much worse. You’re definitely not going to keep those clients who had different expectations.

***

Yards After Contact is the game right now.

Are you built for it?

popular gay dating apps for android https://gaysugardaddydatingsites.com

chat cam gay random https://bjsgaychatroom.info/

gay dating websites https://gaypridee.com/

free gay sex chat fcn https://gaytgpost.com/

gay chat porn https://gay-buddies.com/

comprar cialis

WALCOME

senior gay hiv dating sites https://speedgaydate.com/

what is cialis

Yards After Contact – The Reformed Broker

compra cialis online

Yards After Contact – The Reformed Broker

viagra warnings

Yards After Contact – The Reformed Broker

viagra covered by insurance

Yards After Contact – The Reformed Broker

viagra canadian pharmacy ezzz

Yards After Contact – The Reformed Broker

fortnite weapon slots https://2-free-slots.com/

tiki torch slots free https://freeonlneslotmachine.com/

slots blaze casino https://candylandslotmachine.com/