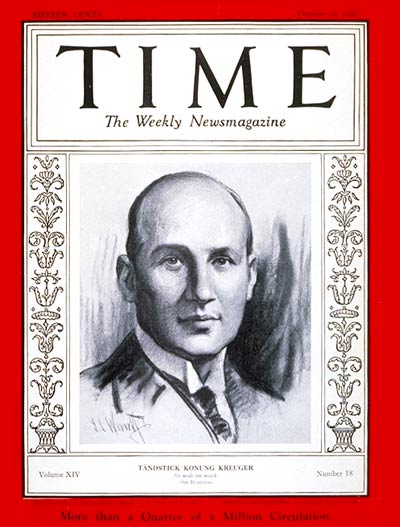

On October 28th, the day before Black Tuesday, the crescendo moment of the Crash of 1929, Time Magazine had a financier on its cover. At that time, virtually everyone in the international community had known his name all too well, although investors today probably wouldn’t recognize it. He was a confidant of kings and princes, dictators and captains of industry, a noted companion to the international movie star Greta Garbo and the close personal friend of President Herbert Hoover.

Little did anyone suspect that he was also destined to be be revealed as the biggest fraud in the history of Wall Street.

The more you read about financial history (and the more of it you live through), the more you start picking up on repeating patterns. This is not because the markets never change. They absolutely do. But people…people don’t change.

The dueling twin instincts of fear and greed are as old as the species itself and perhaps even older. We possess these instincts because they’re the reason we’ve made it as far as we have from an evolutionary standpoint. The woman who didn’t run from a sabretooth tiger with the rest of her clan did not pass on her genes. The man who never attempted to rise above the circumstances into which he was born through the pursuit of more resources probably wasn’t the most popular mate in the available gene pool.

So we’ve got these two inalienable parts of our personalities and biochemical makeup. They make us do things. We have some self-control, but not fully. As William aka the Man in Black from Westworld asks rhetorically this season, “What is a person but a collection of choices? Where do those choices come from? Do I have a choice? Were any of these choices ever truly mine to begin with?”

The greed side of this equation is worth discussing today because we’re in what could be the tenth straight year of positive gains for the US stock market and a lot of what’s happening now will look horrendously foolish when the cycle turns. There will be all sorts of revelations to come when the proverbial tide goes out (and, as Warren Buffett says, we find out who has been swimming naked).

Not all of the investment losses to come will be a result of fraud or cheating; good assets decline in value too. But undoubtedly, the most memorable debacles will involve fraud and cheating, to go along with the customary lack of attention being paid to details and the general sense of risk-free delusion. Almost everyone saw losses during the post-tech bubble period of the early 2000’s, but Worldcom and Enron are the touchstone moments we recall with the most ease. There were plenty of losses to go around in the wake of the financial crisis, but the reckless confidence games being played by Lehman Brothers and Bernie Madoff stand head and shoulders above the rest of the disaster in our collective consciousness.

When it comes to the massive frauds – the kind that wipe out tens of billions of dollars and result in career-ending, corporation-killing infernos, there are some necessary conditions that seem to appear with great regularity accompanying them. These are the conditions that allow the seed of a fraud to take root and germinate, they provide the fertile ground and atmosphere letting the sprout become something larger, thornier and more interconnected with the flora around it.

Ivar Krueger aka The Match King was one of the most notorious purveyors of investment fraud who ever lived. His story is relatively unknown in modern times despite the fact that the global scale of what he did was ten times more intricate and ultimately destructive than anything Madoff attempted. When you read about the details of the Krueger saga, you realize that everything that’s happened since (and will happen hence) is merely an echo of an old story.

Using his tale as a backdrop, we can look at the conditions that allowed him to thrive and rope in almost the entirety of the investing public.

One: It begins with an enigmatic figure with an aura of success and brilliance

Ivar Kreuger is obsessed with the cultivation of his image from the very beginning. Almost everything he does in the public eye from his first arrival in America is calculated and carried out deliberately. He projects a supernatural air of confidence about himself and many of the affectations he adopts in both business meetings as well as in social settings end up making the newspapers. He finesses a conversation with one group so as to ensure a future meeting with a second group, and so on. The manipulation of people’s feelings about the person eventually allow for even greater manipulation down the road.

Two: The markets are booming

When people are making a lot of money and haven’t recently taken significant losses, lots of details are overlooked and difficult questions go unasked and unanswered. Oversight is seen as a trifling interference and people lose patience with long, drawn out due diligence. The money burns a hole in their pockets – every delay in putting it to work feels like a costly waste of time, a mere formality at best and an intolerable impediment to opportunity at worst. Besides, if you don’t buy in, someone else will take your spot.

Frank Partnoy, the author of The Match King, describes the environment into which Ivar hatches his scheme…

The hottest two emerging industries were cars and radio. Annual car sales had doubled from two years earlier, and there were now more than 15 million cars on the road. Manufacturers introduced faster, safer, cheaper models every year, and the only asset people wanted more than cars were securities issued by car companies. Anyone who bought shares of General Motors or Fisher Body or Yellow Cab expected to double or triple their money after just a few years.

Shareholders of Radio Corporation of America, known as RCA, did even better…

As recently as 1920, only 5,000 families had owned in-home radio sets, and RCA’s share price was around a dollar then. Then, WBAY, a pioneering New York radio station, sold the first-ever radio spot, a pitch for apartments in Jackson Heights – and the world changed overnight. Radio stations popped up in every major city, and radio sales soared, to $60 million in 1922. RCA’s share price flew even higher than its sales. Anyone who held RCA shares during the 1920’s earned an average annual return of 60 percent. All of that gain was from share price appreciation, not any periodic payments from the company. RCA did not even pay a dividend.

If this sounds familiar, it’s because the market is currently engaged in exactly this debate over the Netflixes, the Amazons and the Teslas of the world as we speak. It’s almost identical…

A few naysayers argued that shares of General Motors and RCA were overvalued, because actual profits were slim. Shares represented a claim to future dividend payments, so share prices should reflect the value of expected future dividends. The pessimists noted that RCA didn’t pay a dividend, and claimed it never would, because it didn’t make any money. Their point was simple: no profits, no dividend, no value…

Here’s the kill shot (bold is mine):

But these shares were a bet on tomorrow, not today. If people thought the share price of General Motors would rise in the future, no one could prove them wrong now. And even though RCA didn’t pay a dividend or earn much actual profit, the people who bet on the company were winners, year after year. RCA’s share price rose because investors believed RCA eventually would make money and pay dividends. The skeptics who bet against RCA were stepping in front of a speeding train.

This is how hundreds of internet and telecom startups with large cash-burns were taken public in the late 1990’s. It’s how billions of dollars for housing projects and lending scams were financed in the mid-2000’s.

You can sell anything to investors in this environment, and it’s exactly the sort of condition necessary for a massive fraud to flourish.

Three: Many massive frauds start out as legitimate businesses

Once upon a time, before the world was completely electrified, matches were among the most important consumer staples in the world, second only to perhaps food, clothing and shelter. You couldn’t do anything without a box of matches. The trouble was that matches were highly combustible, making their storage and transport a major challenge. This was the case until the Swedes invented something called the safety match, which could only be ignited by a deliberate strike against the side of the box. An industry of global necessity was born.

In the early 1920’s, European countries were starving for cash as they rebuilt themselves. They were already massively indebted and had strained the resources of their own central banks and private lenders. Ivar Kreuger emerges into this environment with an answer to their troubles, in the form of a simple business proposition. Kreuger’s match manufacturing capabilities are real. His business interests are legitimate. This legitimacy is what gets him in the door to make his pitch.

Enron was once a legitimate business – an electric utility. Worldcom was a telephone company. Madoff Securities began as a broker-dealer. When things begin to go wrong, the principals cannot admit it to the shareholders and the community that sees them as geniuses. So they hide losses, which leads to an escalating series of more and more illegitimate business behind the scenes.

Four: Massive frauds frequently involve an innovative approach to an old industry

Ivar’s got a brand new way to help sovereign nations fund themselves, retire old debts and raise new capital away from traditional bank loans or new taxes. It’s a loan for monopoly scheme involving his company, Swedish Match. In many countries around the world, the match making industry is either nationalized and run by the government or fragmented and run by various mom & pop enterprises. Ivar convinces the governments of Europe, Latin America and the Middle East to allow him to make enormous loans to them at competitive interest rates in exchange for Swedish Match being granted a monopoly in the manufacture and sale of matches within their borders. This means that all domestic means of production are turned over to his company and all foreign imports of matches are punished with tariffs and levies until they stop coming.

Germany, among the more desperate countries given the terms imposed upon it by the Versailles Treaty after the war, is among the first to say yes. France follows, as do Turkey and Poland. Ivar has reinvented sovereign lending, treading upon the territory previously controlled almost exclusively by investment banks like J.P. Morgan. At first, the incumbent competitors are shocked by Ivar Kreuger’s ability to lend tens of millions of dollars at rates as low as five and six percent to these governments.

In the 1700’s, the South Sea bubble was financed through a similar conceit – England converted her debts from fighting endless wars throughout Europe into an equity. That equity, the South Seas joint-stock company, was granted a monopoly on trade with the colonies of the Western Hemisphere. The Dutch East India Company had become the world’s first publicly traded “corporation” a century earlier with an almost identical pitch. Trade monopolies gave way to industrial monopolies in the 20th century and Ivar Kreuger was building the ultimate version of one.

Five: Fraud is enabled by the greed of people who desperately want to believe

Kreuger’s match factory, of course, does not have tens of millions of dollars to secure these monopolies, which requires the use of outside capital in huge amounts. Specifically, it requires the sort of daring and adventurous capital from investors that only really exists in one place: America. Ivar begins his charm offensive with a dashing display of sophistication and worldliness, first on a transatlantic voyage and then in front of an audience of willing suckers at the nation’s second most prosperous investment bank, Lee Higginson & Co. Lee Higg, based in Boston but with a growing presence in New York City, is perennially playing second fiddle to J.P. Morgan but is far ahead of it’s competitors at Lehman or Goldman Sachs. The New York office is desperate to make a splash at the outset of the roaring 20’s and Ivar’s scheme presents them with the perfect opportunity at the perfectly opportune moment.

Madoff’s hard-to-get act made allocators to his fund feel fortunate just to have the chance to invest and that to even question his consistent returns would possibly cut off their access to his genius. Elizabeth Holmes had the unabashed support of Silicon Valley and most of the media as so many wanted to believe that the heir to Steve Jobs was a confident young lady who was on her way to changing the world.

Six: The financing of these schemes requires innovation as well

The investment bank agrees to create a series of different securities to fund the loans being made by Swedish Match (now International Match) and its expansion plans. The format of these securities – ranging from a gold-backed debenture to a mixture of tracking stocks and preferred equity instruments – are all innovations in and of themselves. Ivar Krueger and his partners at Lee Higg continue to create brand new instruments as investor demand for the combination of large dividends and unheard of growth opportunities skyrockets. The louder the ducks are quacking, the larger the quantities of securities the brokers can sell them. The more the earlier investors earn in yields, the more outrageous the terms that future investors will agree to. Eventually clients of almost every major brokerage house will start flooding International Match with capital. The press plays its role, anointing Ivar as an unparalleled genius. The Wall Street Journal and New York Times breathlessly report on his every move and on rumors of the various international deals he is said to be working on. Time Magazine would eventually put him on the cover.

The funding of real estate and mortgage loans in the aught’s decade was highly dependent on new and increasingly obtuse methods of packaging and repackaging debt in the form of wilder and less understandable securities. Anytime the terms “innovative” and “lending” are used in the same breath, something bad is usually about to happen.

Seven: Fraud always has unwitting accomplices and useful idiots

Now that Ivar Kreuger has an investor base and listings for his various securities on legitimate exchanges like the NYSE and the Curb (Amex), his businesses must report numbers to them. His Swedish auditors issue reports and Ivar massages the numbers before passing them along to his US auditors. Kreuger makes frequent use of the time delays in getting information from around the world in order to cook his books. He uses discrepancies between terminology and the vagaries of international accounting rules to his advantage. He takes “lost in translation” to a whole new level in his dealings with the firm’s US auditors. He turns his business relationships into friendships so as to ensure that even the most basic questions are never asked or can be dismissed casually during weddings and cocktail parties.

As Kreuger creates an endless series of subsidiaries and subsidiaries of hit companies, the truth becomes impossible to determine. No stakeholder is possession of all the information to understand the entity so they content themselves with understanding the pieces that have been explained to them. Enron had so many off-balance sheet subsidiaries and debts that even the CFO who’d created them lost track. Madoff had a floor in the building that most employees had not even known about where fake account statements were coming off the printing press night and day.

Eight: The point of no return

Not all hucksters go about their hucksterism deliberately. In many cases, the crossing of the line takes place incrementally, in stages. The point of no return is reached toward the end, frequently without the person carrying it out even being aware of the exact moment it occurs. Ivar’s promises of up to 24% income distributions to shareholders and the constant shuffling around of assets from one jurisdiction to another represents one of the most audacious “spinning plates” routines the world has ever seen. Every time a deal falls through or a payment is missed, he announces an even bolder and more lucrative potential deal to take its place. Ivar begins to publicly mention a gold mine in Sweden with supposedly massive deposits of precious metals in response to bankers and investors questioning his ability to make good on International Match’s commitments. By constantly hinting at new securities to be offered or new loan agreements to be signed in new locales, Kreuger keeps the plates spinning for years and years before anyone loses confidence in him.

But in the wake of the crash, investor appetites for new and exotic deals vanish virtually overnight. People start demanding their money or, at least, some actual answers to their questions. Rather than admitting to having bit off more than he could chew, the entrepreneur crosses the line from fudging numbers to outright forgery of documents and theft of investor assets. He begins pledging the same assets twice to obtain loans from multiple banks, ordering the printing of fake Italian sovereign bonds and copying the signatures of various finance ministers.

Nine: The unraveling is always the same

The perpetrator of the fraud, as the curtain begins to come down, grows increasingly desperate. The tactics become increasingly erratic and inexplicable. Deals that appear to have no economic purpose are announced. Hail Mary style passes are thrown. Investors are asked to believe in more outlandish projections and are made even bigger promises just as the old promises fail to play out.

And then the con artist goes on the offensive, against both the media as well as a supposed conspiracy of short-sellers who are unfairly targeting the company. This takes place near the very end. Think of Theranos employees creating a video game where they could shoot at the Wall Street Journal reporter who first unearthed the truth about their company. Think of threats of litigation, the incitement of loyal fans to rush to a company’s defense and other forms of intimidation used when it becomes clear that the time is almost up.

Here’s how Ivar Kreuger explained what was happening as his company’s securities began declining in value…

The decline weighed on Ivar. He complained to Durant that he and his companies “have been the subject of a deceitful press campaign from…some twenty black-mailing papers who continually attack our securities.” Ivar became increasingly paranoid about short-sellers, and he personally bought large volumes of his companies’ securities, in an effort to prop up the price. As the short selling of Ivar’s companies increased during late 1931, he became increasingly frustrated and ultimately published the following statement: “This situation has been utilized by an internationally organized short selling syndicate, which has not hesitated to spread unfounded rumours about the group.”

In reality, what was actually happening was that the once-buoyant economy and stock market euphoria had been replaced with a post-crash environment of skepticism. The priority had become preservation of capital rather than the pursuit of lavish dividends and grand schemes. Simultaneously, banks were losing faith in the Match King’s ability to finance and pay for all of the elaborate promises he’d made and the immense obligations he’d assumed in the boom times.

The Match King is an important book to read because of how amazingly similar the rise and fall of his fraudulent enterprise had been to all the frauds that have come after it – and the frauds still to be revealed. People don’t change and so the enterprises built by people to deceive and to be deceived by do not substantially change either. There is always the enigmatic leader, the battles with the press and invisible “short seller” cabals, the use of unsuspecting third parties who convey legitimacy, the convoluted corporate structure and accounting liberalism, the replacement of dashed promises with even greater promises of what’s to come in the future…

As speculator Jesse Livermore said, a hundred years ago, “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

***

The Match King is the second book on my summer reading list. The next book in the series is here.

[…] On October 28th, the day before Black Tuesday, the crescendo moment of the Crash of 1929, Time Magazine had a financier on its cover. At that time, virtually everyone in the international community had known his name all too well, although investors today probably wouldn’t recognize it. He was a confidant of kings and princes, dictators and captains of industry, a noted companion to the international movie star Gre… Source: http://thereformedbroker.com/2018/07/09/the-nine-essential-conditions-to-commit-massive-fraud/ […]

[…] The Nine Essential Conditions to Commit Massive Fraud (Brown) […]

[…] Joshua Brown: The Nine Essential Conditions to Commit Massive Fraud […]

[…] Joshua Brown: The Nine Essential Conditions to Commit Massive Fraud […]

[…] Joshua Brown: The Nine Essential Conditions to Commit Massive Fraud […]

[…] Nine essential conditions to commit massive fraud (Reformed Broker) […]

[…] The Nine Essential Conditions to Commit Massive Fraud – Reformed Broker […]

[…] The nine essential conditions to commit massive fraud – The Reformed Broker […]

[…] The Nine Essential Conditions to Commit Massive Fraud (The Reformed Broker) […]

[…] The nine essential conditions to commit massive fraud – The Reformed Broker […]

[…] The nine essential conditions to commit massive fraud – The Reformed Broker […]

[…] The Nine Essential Conditions to Commit Massive Fraud – Link here […]

[…] The Nine Essential Conditions to Commit Massive Fraud (The Reformed Broker) […]

[…] Downtown Josh Brown explains the nine essential conditions to commit massive fraud. […]

[…] This post originally appeared here on July 9th, 2018 […]