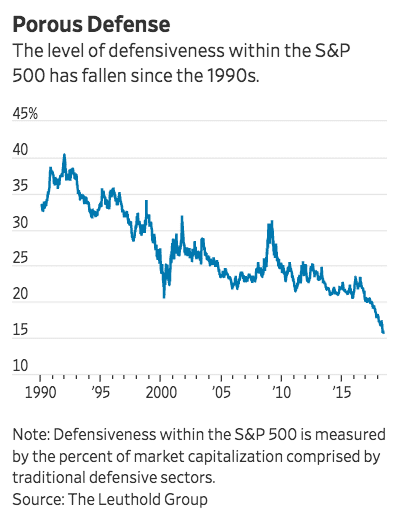

I wanted to call your attention to an interesting chart posted by the Wall Street Journal looking at how much “defensive” sectors have shrank (shrunken?) in relation to the overall stock market over the last 30 years.

The degree of defensiveness within the S&P 500, which Leuthold Group calculated by using the percentage of the index’s market capitalization comprised of defensive sectors, has fallen nearly 60% from 1991 through early June, according to the group’s data. That has increased the weighting of highflying growth stocks within the S&P 500, reducing its overall effectiveness as a diversified portfolio for investors who opt to passively track the broad index, Mr. Paulsen said.

Josh here – this is a long-term, secular trend that’s been in force through multiple up- and down-cycles, but it seems to have gotten even more exaggerated of late. It’s been the bane of value investors throughout the entire post-crisis period beginning in 2009 – a decade during which growth has massively outperformed through almost every rolling 90-day period, let alone the annual periods.

Growth at a Reasonable Price (GARP) managers and momentum players are feasting on this disparity. More adventurous managers – who refer to themselves as value investors in their marketing literature – have invented reasons for tilting more toward growth. It’s been the right move for their end investors so far, even if smacks of career preservation.

And lots of people are doing one thing but saying another, because they kinda have to…

From the same piece:

The five largest publicly traded companies in the world by market capitalization are now all tech-related, a stark change from 2009, when firms such as General Electric Co. and Exxon Mobil Corp.dominated the list. Nearly half of global fund managers now say betting on the FAANG names—Facebook, Amazon, Apple Inc.,AAPL 0.73% Netflix and Alphabet Inc. —and their Chinese equivalents ranks as the most crowded trade in the market, according to a June survey from Bank of America Merrill Lynch. That marked the highest share of investors since 2015 to agree that one trade was becoming too popular.

It’s nice that we all agree it’s a crowded trade, but someone’s buying them (everyone’s buying them?).

Crowded trades can stay crowded for a long time. There’ve been prominent hedge fund managers referring to these names as being part of a “bubble basket” for much of the last five years and even going so far as to not only underweight the stocks but to actually short them. Those prominent hedge fund managers have become a lot less prominent as a result.

As for the mutual fund managers who’ve underweighted the big winners of this decade or avoided them outright, the flows have only been going in one direction.

Source:

Investors Double Down on FAANG in Rocky Quarter for Stocks (WSJ)

[…] I wanted to call your attention to an interesting chart posted by the Wall Street Journal looking at how much “defensive” sectors have shrank (shrunken?) in relation to the overall stock market over the last 30 years. The degree of defensiveness within the S&P 500, which Leuthold Group calculated by using the percentage of the index’s market capitalization comprised of defensive sectors, has fallen nearl… Source: http://thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bou… […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Here you will find 47184 more Information on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] There you can find 8388 more Information to that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Here you will find 91336 more Info to that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] There you can find 97575 more Info on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2018/06/29/the-sp-500-is-not-the-same-index-it-was-when-your-father-bought-it/ […]