Risk assets around the world are having one of their worst stretches of the decade right now, as inflation fears and concerns over interest rates have shattered a record period of tranquility in the financial markets. The return of “uncertainty” has brought with it a return of high volatility.

There’s no reason to believe that things will get better or worse in the near term because the emotions of millions of people cannot be predicted in real-time – and emotions are what dictate short-term prices, regardless of economics or underlying fundamentals. Traders will place their bets, some will win and some will lose.

But what should investors, as opposed to traders, be thinking right now?

Too often, we think about “investors” as a monolithic group of people that should somehow all feel and act in the same way, but the reality is very different. Investors of different age groups have widely varying needs and risk tolerance situations. I attempt to break down how rational investors ought to be thinking right now, given what’s going on out there…

Investors in their 70’s

“I have a balanced portfolio in which fixed income and cash equivalents are somewhere between 50 and 60% of my allocation. I am drawing down only what I need to live on, leaving the remaining amounts of my capital in the investment markets for long-term growth. Why don’t the kids call?”

—

Investors in their 60’s

“I’m really glad I have a financial plan in place, and, according to the plan I will be fine. I need to tolerate the ups and downs of equities because there’s a decent probability that I may live another 30 years – and cash isn’t going to keep pace with my cost of living. Now leave me alone, NCIS is starting.”

—

Investors in their 50’s

“I have a financial advisor but he works at a brokerage firm and I only hear from him when he wants me to buy into a new fund or flip a muni bond to buy a different one. I have no idea what today’s volatility means for my long-term situation. All I know is it makes me feel like something is wrong. Maybe I should be talking to a financial planner so I can figure out if my spending needs are realistic.”

—

Investors in their 40’s

“This bites. But I’ve seen this all happen already. First I blew myself up with dot com stocks right out of college. Then the financial crisis blew me up, even though I was being conservative. I didn’t sell then and I’m not selling now. I wouldn’t know when to buy back in anyway.”

—

Investors in their 30’s

“I’m focusing on my career. I have no idea what’s going on other than I haven’t been promoted in 18 months. Regardless of what’s happening in the market, I have nowhere near enough money in my IRA or 401(k) built up. And this f***ing baby does not stop crying. You think I have even a second to worry about interest rates?”

—

Investors in their 20’s

“This is a beautiful opportunity. I have nothing but time and the more I put away now, the more those dollars multiply. I feel bad for mom and dad, but I get a chance to build up my portfolio of financial assets at a discount to where they were a week ago. Why on earth would I want to be doing my buying at record highs?”

___

Investors in their teens

“What’s a stock? Is that like…a coin?

***

Now, of course, this is the rational way for investors to be thinking about the correction (crash?). Most investors haven’t quite arrived at these realizations in time to coincide with where they are in life. It’s really hard to run into a burning building with your wallet open. It goes against our wiring as human beings and only the best are able to do it.

People in their 20’s are logging back into their robo accounts to dial down their risk setting when they should be dialing up their regular contribution amounts. I tell my younger clients that, during events like these, they should be thinking about getting as much money as they can into their investment accounts.

People in their 30’s are trying to keep up with what’s going on, even though they are utterly bewildered every time an app on their phone buzzes to inform them of the latest global sell-off.

People in their 40’s and 50’s don’t necessarily know whether or not they’ve got a plan in place, or they don’t adhere to what the plan dictates because there’s a weak advisor at the helm.

People in their 60’s and 70’s are blown away when they look at their statements because they’ve allowed someone to talk them into “fixed income alternatives” – which may or may not act very bond-like at all. In a correction, only the real thing will do.

It’s a mess out there. My crew is on the front lines in a market like this. We do our best to explain this stuff, just like advisors around the country are currently doing. Explaining it isn’t the hard part – it’s re-explaining it again and again until it sinks in that makes the real difference in a client’s life.

***

A version of this post ran at the market lows on February 11th 2016. Markets had been hammered from the first of the year and the six week sell-off had pummeled sentiment. Staying the course was a tough call.

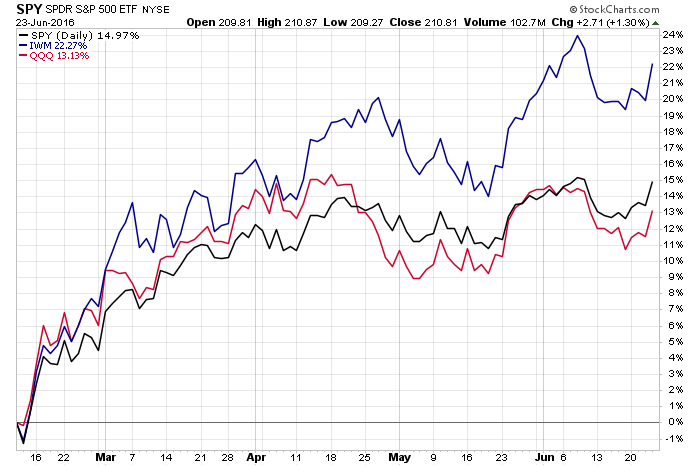

What happened next was a 15% rally in the S&P 500 and Nasdaq 100, along with a 22% rally in small caps.

We’re by no means assured a similar course from here, but it’s important to remember that things can go either way on day’s like today.

If you’re looking for portfolio guidance and investment counseling, talk to us now.

therapist website theme

[…]below you will find the link to some web-sites that we think it is best to visit[…]

mini swan wand vibrator review

[…]Here are several of the web-sites we suggest for our visitors[…]

سكس عربي

[…]just beneath, are many entirely not connected web pages to ours, having said that, they’re surely worth going over[…]

global 3d systems

[…]one of our visitors just lately encouraged the following website[…]

plastic surgery marketing strategies

[…]Wonderful story, reckoned we could combine some unrelated information, nonetheless genuinely really worth taking a search, whoa did one particular understand about Mid East has got a lot more problerms also […]

kalendar prazdnikov

[…]here are some hyperlinks to websites that we link to because we assume they are worth visiting[…]

beauty tips video in tamil

[…]here are some links to websites that we link to mainly because we assume they are really worth visiting[…]

clinical research associate training

[…]Here are some of the web-sites we suggest for our visitors[…]

mcat usa

[…]The information and facts talked about in the article are several of the most beneficial offered […]

Ass Sex Toy

[…]we came across a cool web-site that you may get pleasure from. Take a appear if you want[…]

bandar online

[…]Here are some of the web-sites we recommend for our visitors[…]

cheap plane tickets

[…]Here is a great Weblog You might Uncover Exciting that we Encourage You[…]

Alexander McQueen

[…]that could be the finish of this post. Right here you will obtain some web pages that we feel you will appreciate, just click the hyperlinks over[…]

Bottega Veneta

[…]very couple of web sites that happen to be comprehensive below, from our point of view are undoubtedly nicely really worth checking out[…]

Balenciaga

[…]the time to study or go to the content material or websites we’ve linked to beneath the[…]