If a financial advisor could just accomplish one thing for clients – help them capture more of the returns that their own investments offer, then he or she has done something extremely worthy and valuable. This requires difficult work though: It’s easier to promise a client that they’ll be able to avoid drawdowns than it is to convince a client why they must learn to tolerate them. Every advisor’s client yearns to be able to say “My guy got me out” at the country club.

Steve Russolillo looks at the well-known phenomenon in which investors systematically underperform their own investments by acting emotionally, over-trading and making poor timing decisions.

via Wall Street Journal:

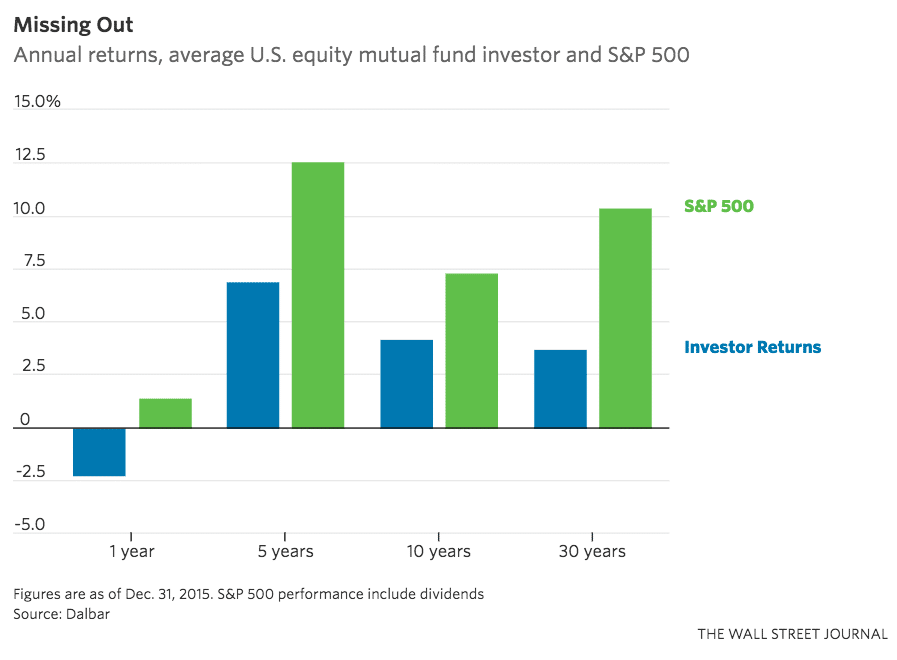

Consider a long-running study of investor returns by Dalbar, a financial-research firm in Boston. It found the average investor in U.S. stock mutual funds lost 2.3% in 2015, whereas the S&P 500 was slightly positive that year, including dividends. Dalbar, which has published this study each year since 1994, plans to release an updated version this week.

And 2015 wasn’t an anomaly. The gap between investors’ returns and the market’s performance is even wider over a longer time horizon. Equity-fund investors earned just 3.7% annually over the past 30 years through 2015 compared with a 10.4% annual return for the S&P 500.

The gaps between blue and green in the chart above are abominable. Critics will say that the Dalbar study has flaws and that the calculations overstate the problems. Anecdotally, I disagree. We see investor portfolios every week coming in over the transom at my shop and I am never not surprised by what goes on out there.

The brokerages don’t care if this happens – and, in fact, some of them actively encourage it given the fact that they get paid on the trading you do, and not the sitting. Volatility avoidance is what crushes long-term returns, which is very counterintuitive. Vol is not the enemy because it causes fluctuation – rather, it is the enemy because it drives bad decisions.

There might always be a gap between the performance available and the performance an individual receives, owing to things like taxes, fees, trading costs and unavoidable cash emergencies that arise from time to time. Minimizing these detractors from long-term returns is yeoman’s work and a mission that serious financial advisors are happy to undertake.

Source:

Why the ‘Trump Slump’ Still Stings for Mom-and-Pop Investors (Wall Street Journal)

***

[…] If a financial advisor could just accomplish one thing for clients – help them capture more of the returns that their own investments offer, then he or she has done something extremely worthy and valuable. This requires difficult work though: It’s easier to promise a client that they’ll be able to avoid drawdowns than it is to convince a client why they must learn to tolerate them. Every advisor’s … Source: http://thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

[…] Investors Underperforming Their Own Investments Source: ReformedBroker […]

… [Trackback]

[…] Here you will find 13258 more Information on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] There you will find 94337 additional Information to that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2017/12/28/investors-underperforming-their-own-investments-2/ […]