Underwriters have learned over the years to price IPO deals at such a level that a) the company raises a nice amount of money that greatly values the business but b) it leaves enough room on the table for an opening share price pop for appearance’s sake.

This is doubly true for venture-backed tech unicorns, because a lot of the narrative around a company’s prospects is tied up in its image. Engineers don’t flock to or stay at an early-stage growth company that looks like it has no momentum.

With yesterday’s initial public offering for Snap Inc, parent company of Snapchat, the underwriters did an impeccable job. The stock was priced above the discussed range at 17 and then ran up to 25, closing right there. It’s a 45% first-day pop on $200 million shares, or 15% of the company. Snap was able to raise $3.4 billion, IPO participants were able to see big appreciation in the secondary, and now the business is “worth” $30 billion, putting it up there with the big boys and in line to join the S&P 500 should it hold (the average S&P 500 component’s market capitalization is about $42 billion and the median is $20 billion).

This opening day performance is an exemplar of the art of the small deal. By limiting the size of the float, the underwriters create artificial scarcity that feeds into demand for the stock at almost any price and plays right into the mythos that the company needs to create in the early going. The deal was said to have been 10x oversubscribed yesterday and, frankly, 200 million shares is not a lot of stock to begin with these days. Orchestrating the jump was a cake walk.

Now what?

Snap Inc’s underwriters were able to use the strong demand for the stock offering to engineer another feature of the deal worth noting – a 12 month lockup expiration on 50 million shares. These shares, held by employees, early investors and other insiders, cannot be dumped on the open market until a year from yesterday. That should keep the publicly available float tight for quite some time, buying management breathing room to get on The Street’s good side and establish institutional support.

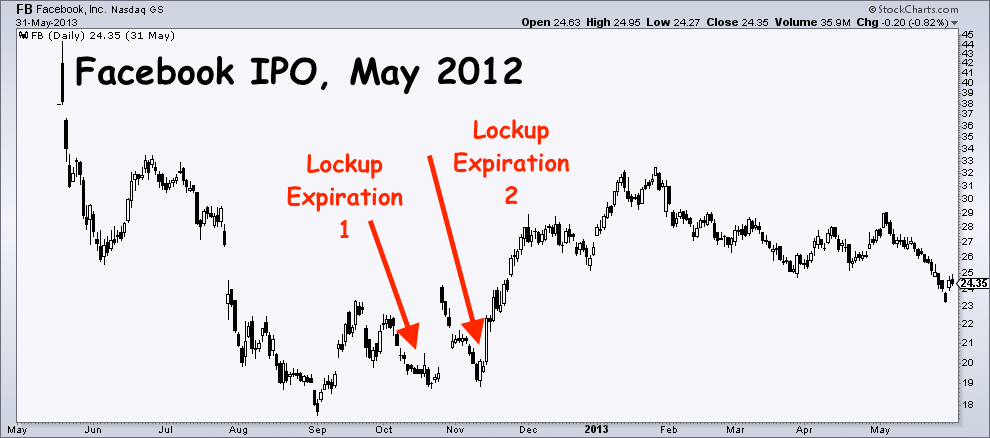

In contrast, Facebook’s lockup expiration for selling shareholders was only 120 days on 271 million shares. By the time these shares became unencumbered and free to be sold in October of 2012, FB stock had dropped 50%. Ironically, this plunge prevented a lot of selling on the next lockup expiration, when an additional 800 million or so shares became unlocked. Employees and early investors had probably said to themselves “it’s too low to sell here” and this, combined with monster short interest, helped form a bottom.

See the 2012-2013 period below for what this looked like:

Now there are a couple of important reasons for why the Facebook IPO is not a great analog for Snap. The first is the sheer size we’re talking about. Facebook raised $16 billion in its first day, making it the 3rd largest IPO of all time. By the close of business it was worth $100 billion.

Additionally, there was a clusterf*** amongst the syndicate firms where investors couldn’t get any information about their allocations until much later in the day. It turned out that there was more stock than there was demand, which led to confusion and disorderly activity. People were furious at the confusion and underwriters had to support the aftermarket that day, ensuring a close slightly above the offering price of $38 per share. Ironically, the Twitter and LinkedIn IPOs had much better opening sessions, up 72% and 109% respectively in their first day of trading.

A better analog for Snap might be to look at two highly popular IPOs with a similar amount of name recognition and investor / consumer interest that also had the small float dynamic.

First, we’ll take a look at GoPro, which is also “a camera company” but of a very different sort. The post-IPO period wasn’t pretty. GPRO’s relatively small amount of shares available (17.8 million at $24 each) combined with a great growth story led to a stratospheric run to almost $100 per share within just a few months. The fever broke that fall heading into the lockup expiration at the end of December.

If you bought on the IPO, you’re down 60% from the opening price, and more like 90% from the highs.

Let’s look at one other – Shake Shack (full disclosure, I own some and consume the product).

SHAK made its debut at the end of January 2015, offering 5 million shares at $21 per share. The lockup expiration was set for that July, 180 days later. The chart below doesn’t quite do it justice, but this was one more example of an artificial scarcity that drove it to more than a double on the opening day, with the stock closing at $45. Then it raced higher still, to just below $100 that May. This was followed by a crash from 100 back into the 50’s going into the expiration, and no recovery since, although the volatility has been much more tame:

The Snap deal has enough in common with the Shake Shack and GoPro offerings that it’s worth considering the impact of a small float and extremely high investor demand. There are other examples with similar outcomes – Box, Twilio, FitBit – all of them had outstanding first days and then ended up being creamed when the floats opened up. Reuters says:

Globally, shares of most of the 25 largest technology IPOs have languished in their first 12 months on the public market, with 16 of them notching a hefty decline from their debut day closing price, according to a Reuters analysis of market performance. Eight of the 10 biggest fell by between 25% and 71%.

While Snap has taken steps to lock in 50 million shares for a longer period of time than is typical, there is no guarantee that the company will have gotten its bearings on Wall Street by that time.

[…] SNAP and the art of a small deal: The Reformed Broker […]

[…] insiders and early investors to cash out. Joshua Brown, better known as The Reformed Broker, makes a really compelling case (save for the use of Comic Sans to annotate the chart) that the company intentionally kept the IPO […]

[…] insiders and early investors to cash out. Joshua Brown, better known as The Reformed Broker, makes a really compelling case (save for the use of Comic Sans to annotate the chart) that the company intentionally kept the IPO […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2017/03/03/the-art-of-the-small-deal/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2017/03/03/the-art-of-the-small-deal/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2017/03/03/the-art-of-the-small-deal/ […]

… [Trackback]

[…] Here you will find 60698 additional Information to that Topic: thereformedbroker.com/2017/03/03/the-art-of-the-small-deal/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2017/03/03/the-art-of-the-small-deal/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/03/03/the-art-of-the-small-deal/ […]

… [Trackback]

[…] There you can find 18299 more Information to that Topic: thereformedbroker.com/2017/03/03/the-art-of-the-small-deal/ […]