I’m just thinking out loud here and I’m not a CMT, so don’t jump all over me as I muse my way toward a demi-conclusion…

Island reversals are powerful patterns. They can signal the end of a strong trend and the beginning of a new one. Stockcharts.com defines the island reversal pattern like this:

An island reversal is a reversal pattern that forms with two gaps and price action in between the two gaps. These gaps tell us that the island reversal marks a sudden, and sharp, shift in direction. Even though they are relatively uncommon, island reversals are potent patterns that warrant our attention.

My favorite all-time example is the Facebook bottom that took place in September of 2012. It was about five months after the IPO that May and price action had been disgusting pretty much from the get-go.

By the time the company reported its first earnings quarter (a disappointment), the cascading sell-off became an outright dump. Then a gap down below 20 (50% below the IPO day close). And then the panickiest sellers exhausted themselves in the high teens. And then a gap higher, back over 20.

Facebook shares pretty much never looked back from that island reversal. The stock has since traded from 20 to 128, or 540%, one of the biggest winners I’ve ever seen.

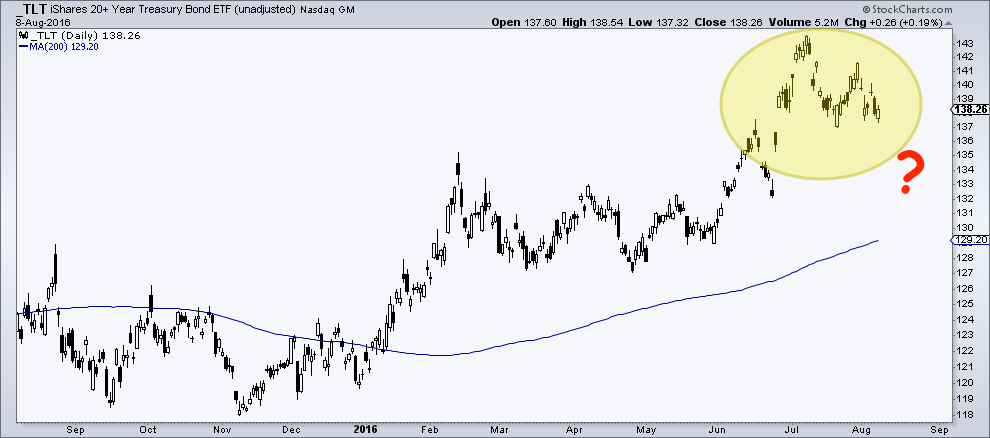

Which brings me to the biggest elephant in the room right now, the long bond. Let’s look at TLT, the 20+ year Treasury bond ETF and perhaps the most worthy signal in the modern marketplace. TLT is a proxy for the hunt for yield, the global deflationary scare and the go-to risk-off instrument of asset allocators everywhere. In the chart below, I show you the non-dividend adjusted version (pure price):

You see the gap up, and then the formation of an island. A gap down would complete the pattern and potentially carry all sorts of implications and potential meaning for global markets and risk appetites. It could even mean the bottom for yields is in. Or not, this is pure speculation until it happens, of course. I’m interested in pondering the What If’s prior to getting confirmation if only for the reason that everyone has pretty much given up on finding a bottom for yields.

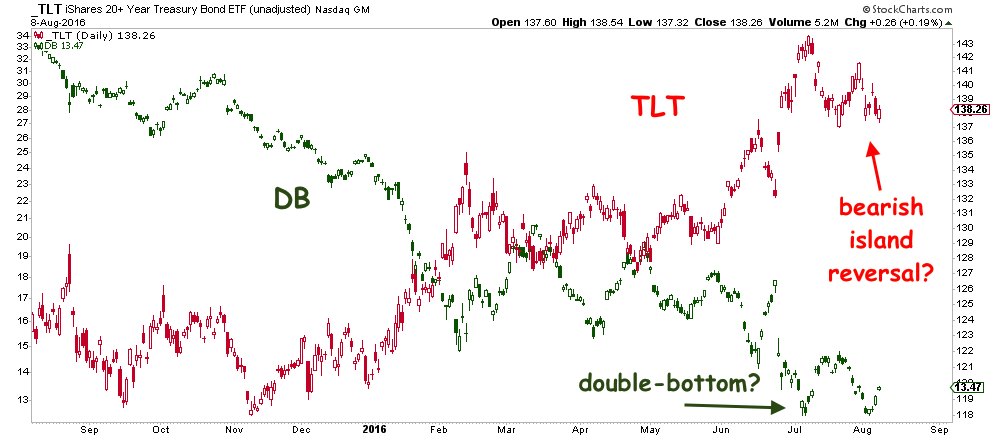

And now, the best part. If TLT strength is the ultimate indicator of risk-off behavior and capitulation on rates, then what instrument is its polar opposite? What is the one security or asset class that carries the nastiest of all negative implications for the global asset and economic picture? I submit to you that the instrument in question would be the common stock of Deutsche Bank (DB). A failure for DB, with its massive, multi-trillion dollars worth of derivatives exposure, would virtually guarantee a financial crisis and global recession.

DB common stock is the key to the entire thing, in my opinion. How and when the Deutsche situation resolves is the answer to what’s next for risk markets around the world. It’s been the subject of rumors all year – first a collapse and, more recently, a rescue package. Too soon to tell. Who knows?

Interestingly, it’s trading as a mirror image reflection of TLT, it’s evil twin. But the jaws are closing. DB’s latest bounce off a potential double bottom is coinciding with the potential for a bearish island reversal in TLT. The symmetry is breathtaking:

As you can see, TLT and DB are moving inversely with one another. The 60-day correlation between the two securities I’ve calculated is minus .93, meaning they are 93% inversely correlated. A reading of minus 1 would be perfect inverse correlation, or 100%. This is as close as you get.

But again, the jaws (jaws of life?) appear to be closing. A spike higher in DB or a gap down in TLT (or both) could seal the deal.

Now, the question is which side of this pair is everyone leaning toward? I think you know. How many players are long Deutsche Bank and short bonds? None? One? Is anyone ready for this reversal, should it happen?

Anyway, just thinking out loud…What do you think?

[…] Josh Brown: The Jaws of Life […]

[…] TLT vs DB – what are the implications of a reversal? (TRB) […]

[…] The Jaws of Life (TRB) […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]

… [Trackback]

[…] There you can find 34043 more Info on that Topic: thereformedbroker.com/2016/08/08/the-jaws-of-life/ […]