Here’s a game I stopped playing a while ago and it’s been a very good development in my investment philosophy. Sector bets, as a trader, are a good way to categorize and exploit where the momentum is. But as an investor, worrying a lot about this sort of thing is probably a mistake. Because there’s very little rhyme or reason from year to year why one sector does better than another.

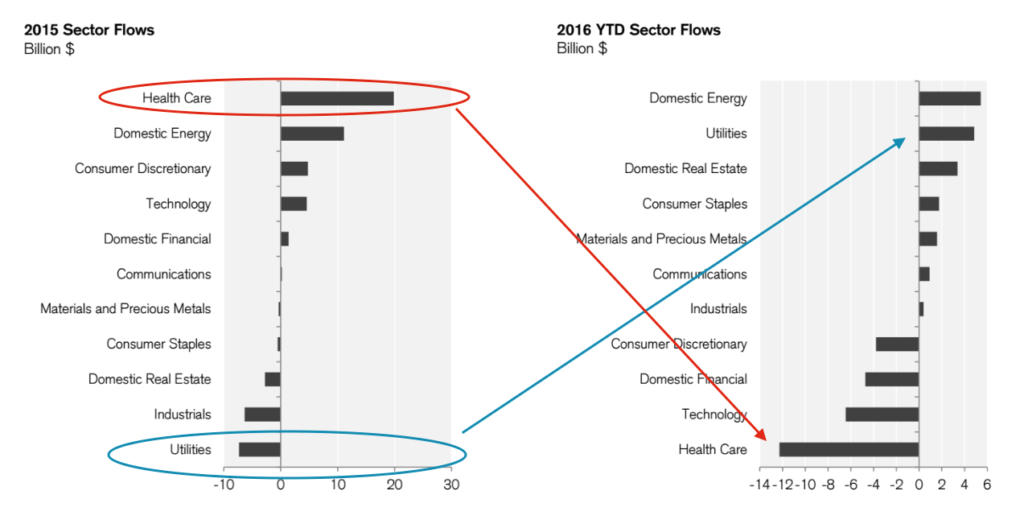

I’ll give you a for instance, based on Morningstar fund flow data via Credit Suisse. In the chart below, which I’ve annotated, you’re seeing sector fund inflows / outflows for last year and YTD 2016…

If there is any doubt in your mind about whether or not this is pure, pathetic performance chasing, let me ease your uncertainty. It is plain and simple, the most perfect form of performance chasing you’ll find. The data is unambiguous.

In 2015, the S&P 500 Healthcare Sector (XLV) was the best third best performing sector, with a total return of 6.83% for those who held from New Year’s Day through New Year’s Eve. And, like clockwork, it saw the highest inflows of the sectors. This year, Healthcare is the second worst, down -.85%. And, can you believe it, it’s the bottom of the barrel for 2016 in terms of inflows. By a mile.

Now let’s look at last year’s dog, the Utilities sector, down 4.93%, the third worst group. This year it’s the very best, up an astounding 17.44%. And guess where investors are sending their money in reaction…Utilities are the second highest destination for inflows in 2016.

Investors play this game all the time and usually lose as a result. In fact, it’s probably the same dollars chasing one “theme” and then running from it to chase the next one in the following year. They aren’t typically rewarded for it, but the behavioral impulse to “be in what’s working” is a powerful one, so it persists – from year to year and from one generation into the next.

There is one glimmer of hope here, however, that I’d like to point out. The S&P Energy Sector (XLE) was unquestionably the worst performing sector of 2015, with a -21% loss in 2015. However, many investors continued to allocate to energy funds regardless, making it the second most popular destination for sector flows. This year, their ability to go against the grain was rewarded, as energy stocks have been a market-leading sector with 12.3% YTD gains so far. This pleases me. Someone’s learning something.

They’ve continued to buy energy through May 31st as the chart above indicates, with sector fund inflows slightly leading the pack. The cycle begins anew as the energy recovery theme becomes the healthcare growth theme of 2016. Let’s not ask too much of the electorate 😉

Now of course, in hindsight, we can assign narrative reasons for all of this activity away from performance chasing. For example, last year the S&P 500’s earnings growth outlook stalled, so stocks that had high rates of earnings growth that seemed unconnected to the economic cycle (think Healthcare and FANG), were the popular place to flock to. This year, with global rates dropping through the floor, yield is hot again so Utilities and Real Estate Investment Trusts (number three on the inflows list YTD) are bought.

As for Healthcare’s recent weakness, you’ll hear sector aficionados blame it on everything from short-sellers (Valeant) to Martin Shkreli to Theranos to a tweet sent by Hillary Clinton. The stories are hilarious.

These are market memes, no different than the latest emoji or .gif to spread throughout your favorite social network. They begin to work, and the story gets told and retold to others, who then join in, which creates a trend. The trend picks up additional adherents as the media picks up on the phenomenon and begins to create articles and TV segments based on it. Then, without warning or the blowing of a whistle, the trend falls apart or fades away.

The good news is, a new trend is already beginning to form, like a wave far out at sea. The process repeats. Some will be able to switch from trend to trend effortlessly, paddling in front of it early and bobbing over and out just before it crashes into the shore. Most won’t, because this is a very difficult sport.

For most investors, the baseline assumption should be “I don’t need to attempt this.” Fund flow data, however, makes it clear that this is not how the majority of investors are operating.

ordering prescriptions from canada legally

Sector Surfing – The Reformed Broker

canadian drugstore cialis

Sector Surfing – The Reformed Broker

cialis 200mg

Sector Surfing – The Reformed Broker

cialis dapoxetine

Sector Surfing – The Reformed Broker

compra de viagra contrareembolso

Sector Surfing – The Reformed Broker

viagra for a 25 year old

Sector Surfing – The Reformed Broker

who makes viagra

Sector Surfing – The Reformed Broker

what works better viagra or cialis

Sector Surfing – The Reformed Broker

generic brand of cialis

Sector Surfing – The Reformed Broker

36 hour cialis no prescription

Sector Surfing – The Reformed Broker

can americans buy prescription drugs from canada

Sector Surfing – The Reformed Broker

cialis manufacturer coupon

Sector Surfing – The Reformed Broker

pharmacy management in canada book

Sector Surfing – The Reformed Broker

cialis what age

Sector Surfing – The Reformed Broker

certified online canadian pharmacies

Sector Surfing – The Reformed Broker