The Reformed Broker turns seven years old today.

In blog years, this site is now eating dinner at 4pm and voting down the school budget. In human years, however, both the blog and its chief blogger have a long ways to go. I’ve written over 10,200 posts here on this site (a few of them were pretty good) and probably two hundred posts and articles elsewhere since November 2008. That’s a lot, but in my mind, I’m just getting warmed up 🙂

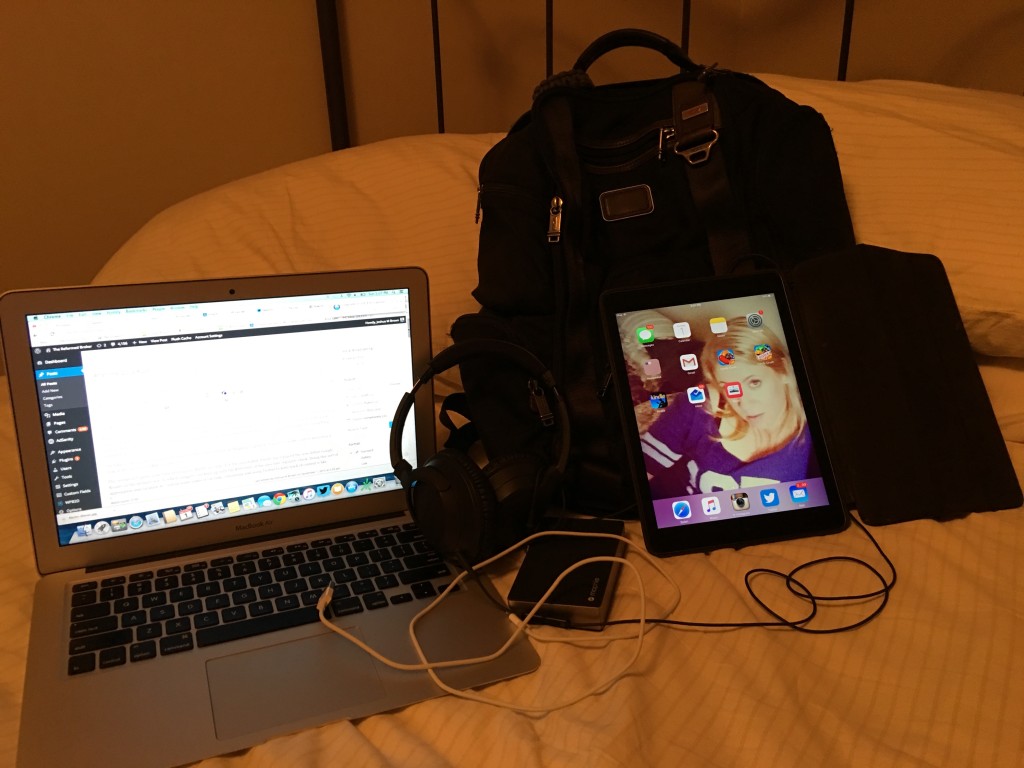

(tools of the trade – this is what I’ve carried with me every single day, everywhere I’ve gone, over all these years.)

On today’s anniversary, I wanted to touch on the state of financial blogging in general, to give you some context about how I look at the success of TRB over the years.

This weekend I spent some time pruning my Feedly account. For the uninitiated, Feedly has replaced the now defunt Google Reader as the primary way in which bloggers can keep up with the RSS feeds of the sites they regularly check. Doing this sort of aggregation and curation by visiting home pages is too time consuming and using Twitter to keep track of content is like sipping from a firehose.

Anyway, I haven’t cleaned things up in my RSS garden in at least four years. By the time I finished, it was a massacre, an absolute bloodbath of unsubscribed-to sites that I used to read every day. There were literally hundreds of blogs to unfollow.

A quick catalog of the now-unfollowed sites from my list:

- Blogs where the owner simply stopped publishing sometime in 2013 or 2014 (a fairly common timeframe among those who had given up)

- Blogs where the writing moved away from finance and toward some sort of bizarre political hinterland

- Blogs where the author was so incredibly wrong about how the recovery period would play out that there was no chance of me being able to read their stuff with a straight face

- Blogs that had converted into a paid newsletter product or shoved a tip jar or donation link toward the top of the page

- Blogs that had been abandoned, and then restarted, and then abandoned again (this was very common – no one said this was easy)

- Blogs where the writer was now employed elsewhere (remember Rortybomb? Weisenthal’s feed at Business Insider? CNBC Net Net with John Carney? Felix Salmon’s Reuters column?)

- Blogs that had become a parody of themselves and had failed to change with the times (perma-doom content, poorly plotted charts, endless links back to the writer’s previous posts, etc)

For these reasons and others, I took an axe to the thicket of .blogspots and .wordpresses and .tumblrs and got my follow list down to a much more manageable and focused slate. It was long overdue.

But one question lingered on – why did so many interesting and promising financial blogs die?

There are many cases where, for personal or business reasons, the writer had to devote more of their time elsewhere because there just wasn’t a lot of synergy between what they were saying and what they were doing in real life. This is especially the case among the subculture of anonymously penned blogs – we’re talking about an asymmetric equation in which career risk is never quite balanced out by the accolades from strangers on the web.

Additionally, the ad model probably didn’t work for a majority of DIY bloggers. Firms like Business Insider began producing so much content that CPM click rates dropped through the floor and then kept on dropping. I know the biggest and most widely-read bloggers in the industry – believe me when I tell you that none of them can earn a living from banner ads anymore.

But there are other reasons for the rapidly shrinking population of independent financial bloggers.

Here are a few:

*Mainstream media figured out how to get their journalists blogging and they’re better at it (see the WSJ’s MoneyBeat for the example par excellence). It’s hard to compete with professional journalists and trained writers backed by superior resources.

*They ran out of stuff to say or lost their edge. One of the most common things I’ve seen is that a new blogger begins as though they were shot out of a cannon, with weeks worth of incredible material. And then, when they’ve written the 10 or 20 posts that had been bursting to come out for years, they’re spent. Like a bumble bee that dies minutes after stinging something with all its might. These expended bloggers typically end up dispensing the rest of their wisdom on Twitter once they’ve run dry of original material.

*”Writing for exposure” used to be a thing people did, even when they couldn’t put their finger on exactly what all that exposure would mean for them once they had it. Forbes turned their website into a platform based on the concept and the Huffington Post built a sell-able business model from it. But for most writers, the exposure never materialized or, if it did, it never amounted to much in the way of actual success. My thoughts on writing for exposure can be summed up best by the below classic cartoon from The Oatmeal:

*A job change – especially within finance – almost always means a rethinking of one’s public commentary. Especially if the writer goes from a small firm to a larger one. The large financial industry firms already have people doing PR, thought leadership or research for public consumption. The last thing they’re interested in is a freelance opinion-haver from within the ranks proffering an “off-message” take on a given subject.

*Mainstream media writers stopped linking to outside blogs as much as they used to. Instead, they compose linkfests that are almost entirely self-referential and geared toward sending clicks to “house product” rather than to outside sites (see MarketWatch, Bloomberg, WSJ). Without this source of traffic, a lot of bloggers that used to enjoy visits from outbound links at big media sites found themselves shouting into an abyss with no one listening.

*In the early days of the recovery period, when markets remained volatile and everyone was convinced that buy-and-hold was a dead strategy (good call), the financial web was inundated with “trading teachers”. You didn’t really need any credentials to set yourself up as a trading tutor, just an online chat room and a URL. Many of those blogs went away when the phenomenon ran its course and the good ones mostly became paid services instead. It’s hard to teach people to trade in real life because the typical student isn’t born with the right temperament to begin with. It’s expensive to learn this about ourselves.

*A lot of the blogs that sprouted up during the crisis found themselves rudderless when the the chain reaction of economic explosions finally stopped. In the absence of a major disaster unfolding, the authors realized that they didn’t have much to say about the status quo, especially as volatility dropped to a below-trend level and stayed there for years on end. After Lehman, AIG and TARP, covering Greece for another 48 months probably seemed more than a little pointless to this group, so they walked away.

*Lastly, there were lots of one-trick ponies or blogs based on a narrow premise that didn’t really have the leeway to evolve. Remember LOLFed, a site based on memes using pictures of FOMC members? It was really fun.

Does anyone remember Ultimi Barbarorum? It was a markets and investing blog ostensibly written by a latter-day Baruch Spinoza, how’s this for an About page:

“Hi, thanks for looking at our blog. There are 2 of us running it, but we both prefer to stay anonymous. This is the only live Spinozist blog on the internet we know of. We love Spinoza, and wish more people did too.

The name of our website comes from an important event in Spinoza’s life. Johan and Cornelius de Witt were the political leaders who oversaw the great Golden Age of the Holland of Rembrandt, of Vermeer, of the great scientific and commercial achievements of the Dutch Republic. They were lynched by a mob in The Hague in 1672, and literally torn to bits.”

If you’re asking yourself “WTF?” I’d just say that you had to be there.

I think it’s cool that these blogs came along, tore it up for awhile, and then went away before running too thin. Not that there’s anything wrong with sticking around; I’ll gladly accept the two posts a year from Long or Short Capital if that’s all they’re able to get around to. Better than nothing.

And then there’s a much smaller list of financial blogs that have kept the fire burning. There’s Eddy and Tadas and Barry and Epicurean Dealmaker and Howard Lindzon and Yves Smith and Bess Levin, people whose sites predate the financial crisis and are still delivering each day.

There are the sites that were born in the crisis, like mine and Zero Hedge – both of which started the same month (just a coincidence).

There are also the 2.0 financial blogs – the ones that were born recently and have had the opportunity to build on everything that had come before. Sure, lots of times they’re saying things that have already been said, but most readers don’t care. As long as they’re seeing the information presented in a fresh, interesting way, the readers will click and share. There’s no shame in revisiting these well-worn paths. The award-winning and highly regarded investing writer Jason Zweig describes his gig at the Wall Street Journal like this:

My job is to write the exact same thing between 50 and 100 times a year in such a way that neither my editors nor my readers will ever think I am repeating myself.

That’s because good advice rarely changes, while markets change constantly. The temptation to pander is almost irresistible. And while people need good advice, what they want is advice that sounds good.

That’s about right, and that’s why there’s still room for more blog posts on things like diversification, the impact of investment costs, the benefits of discipline, the difference between tactics and strategy, etc. An up and coming blogger can still do canonical stuff with a topic that’s already been covered because brand new investors are arriving every year.

Which brings me to today.

Five years ago, people used to ask me “How do you have so much time to blog?” Nobody asks me that anymore. They get it.

My partners and I built a financial advisory practice around our blogs, based on the premise that smart people wanted to understand the process by which an advisor was investing their capital. We put it all out in the open and did so in real-time, seven days a week. Then that small practice became a firm and that firm grew to include several advisors, two CFAs doing research, two CFPs working directly with clients, four of the top ten investment blogs in the country, etc.

The writing and thinking we do is not a sideshow. It’s the main event. We say what we mean, we do what we say and we eat our own cooking. We’re out there managing money for real people in live markets. Writing frankly about the ideas we have and the challenges we encounter has been hugely beneficial for us. It’s forced us to become better at our jobs.

All of the money managers we respect, from Jeremy Grantham to Howard Marks to Warren Buffett to Rob Arnott to Cliff Asness to Meb Faber, have done much the same thing. They’ve been incredibly open about their philosophy and process in print – whether through white papers or books or investor letters or widely circulated memos.

We like to think we’re following the same path, only our primary medium is blogging and tweeting – apropos of the times we live in.

Writing this blog every day for seven years and having an amazing reader base to share my thoughts with has quite literally changed my life. I never could have dreamed that my free wordpress account would open up so many doors. This blog has directly led to thousands of events, connections, relationships and friendships that would have been unimaginable without it. If you’ve been with me since the beginning and have stuck around through it all, then you’ve been a big part of that and I can never truly repay you or thank you enough.

But I can try.

And so I’ll end here with a commitment to you, all of you, that I will always do my best to keep you informed about the markets and the economy as I see them. I’ll continue to link out to the most crucial and entertaining articles and posts, as they come spilling in over the transom each day. I’ll attempt to be fair about the subjects I cover, even when fairness isn’t deserved. I’ll keep my opinions informed at all times and I’ll always consider the other side of an argument before I dismiss it.

Most importantly, I will remain open-minded and willing to change when the facts no longer support a long-held belief. Even if it means I’ll have to admit to being wrong – especially then. I like to think you come here because I keep it real, not because I think I’m always right (believe me, I’m not).

The intent of this blog was always about discovery and learning, for both readers and myself. Continuing on that mission is the least I can do to say thank you for an amazing seven year run.

Cheers and thanks!

– Josh

quick hit slots facebook https://slot-machine-sale.com/

konami slots https://beat-slot-machines.com/

charles town races

free bonus slots for fun https://411slotmachine.com/

free slots casino https://www-slotmachines.com/

vagas slots https://slotmachinegameinfo.com/

dissertation fellowships https://buydissertationhelp.com/

master dissertation help https://dissertationwriting-service.com/

dissertation proposal writing help https://help-with-dissertations.com/

help dissertation https://mydissertationwritinghelp.com/

writing dissertation https://dissertations-writing.org/

medical dissertation writing help https://helpon-doctoral-dissertations.net/