Michael Johnston is doing great work over at ETF Reference. It looks like he took my historic valuations rant and made it a jumping-off point to demonstrate the major difference between today vs the past. Specifically, Johnston takes the “It’s 1929 again” meme out behind the woodshed, but using facts instead of a belt buckle.

Ok that was dark.

Anyway…

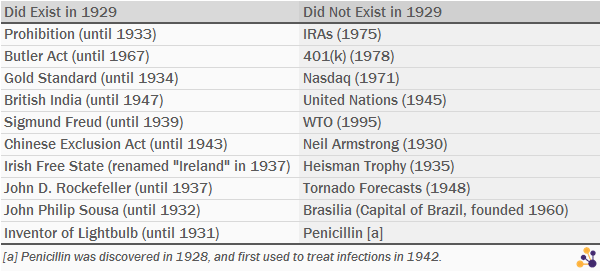

When the stock market crashed in 1929, no damage was done to any IRA or 401(k) accounts; those wouldn’t be established for another 45 years or so. There was also no United Nations or World Trade Organization; those would be founded in 1945 and 1995, respectively.

Several institutions that did exist then have since been replaced. The gold standard was in place on Black Tuesday, as was Prohibition. Virginia had recently passed a series of Racial Integrity Acts that legally defined “white” and “colored” people. In Tennessee, it was illegal to teach evolution in schools (and some teachers had been convicted). The inventor of the light bulb was still alive, and Knute Rockne was the head coach at Notre Dame.

Josh here – Definitely read the whole thing. History can repeat, but it’s never exactly the same. Always different. Johnston shows just how different things truly are. These types of posts are sometimes the only weapon we have in the war against financial commentary extremism.

Source:

The Ultimate 1929 Stock Market Comparison (ETF Reference)

Now vs 1929 http://t.co/lrMdf4Yi7V #Uncategorized @ReformedBroker

Now vs 1929 http://t.co/5ux8QLVXIu

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

Now vs 1929 by @ReformedBroker http://t.co/kLThMYoq9g

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu

RT @asibiza1: “Another 1929 market comparison? Wow, that’s original…” @ReformedBroker http://t.co/nbsF3Z3CD3

[…] Joshua Brown: Now Vs. 1929 […]

RT @asibiza1: “Another 1929 market comparison? Wow, that’s original…” @ReformedBroker http://t.co/nbsF3Z3CD3

RT @ReformedBroker: Now vs 1929 http://t.co/5ux8QLVXIu