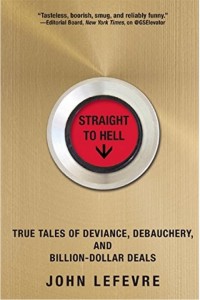

I’ve read a lot of books this summer, some informative and some highly entertaining. Not many of them were able to be both at the same time. The book Straight to Hell, by John LeFevre of @GSElevator fame, managed to pull this particular dual mandate off.

I’ve read a lot of books this summer, some informative and some highly entertaining. Not many of them were able to be both at the same time. The book Straight to Hell, by John LeFevre of @GSElevator fame, managed to pull this particular dual mandate off.

My review of the book appears in Barron’s this weekend, you can read it here. Below, I give you some background on why I chose to review it and why I think you should add it to your own reading list.

John LeFevre is an absolute sociopath. I’d like to say that his whistleblowing on the dearth of morality in global finance makes him a sort of “Reformed Banker” except for the fact that the author doesn’t grasp for any such redemption through the telling of his story. This isn’t a varnished version of his experiences meant to act as a résumé builder. Instead, it’s a pitch-black account of last decade’s Asian credit boom and the maniacs who enabled it while enjoying the perks of being rich and connected in post-millennial Hong Kong.

The Wall Street tell-all has been done before; these books usually wrap up with some sort of emotional payoff where our protagonists learn the error of their ways and atone for the sins they’ve committed while in thrall to the higher powers governing their actions – the firm, the environment, the system, man. In The Wolf of Wall Street, Jordan Belfort blames the drugs. In Why I Left Goldman Sachs, Greg Smith blames the company’s culture. In Backstage Wall Street, which was my own parting shot at the brokerage industry, I blamed the business model I had found myself trapped in for ten years.

What sets Straight to Hell apart from these stories is that, in the end, there is no redemption whatsoever. No one learns anything or becomes a better person. Nothing is resolved through good deeds or a change of heart. Finally, it takes a flood of biblical proportions, in the form of the global credit crisis, to wash away the excess and the ugliness of the era. And in the tale’s conclusion, after all the wheeling and dealing, the drinking and snorting, the cheating and fucking, there is only John LeFevre, gleefully riding to hell and taking as many other sinners down with him as he can.

There’s lots of controversy surrounding his book and some questions have come up about the validity of some of the stories. Was there some embellishment, as detractors say, or has just about every anecdote and incident been confirmed by eyewitnesses, as LeFevre claims?

I don’t think it matters either way.

It’s funny, well-written and educational. Besides, would anyone suggest, with a straight face, that Upton Sinclair’s The Jungle could have made it through a 21st century fact-check, given the content of that book? Could Ida Tarbell have slipped her groundbreaking work on John D. Rockefeller of a hundred years ago past the modern goalie, given the cuts and wounds she would have endured in today’s blog-enabled takedown culture? No chance.

The book manages to teach a lot about the mechanics of bond issuance while simultaneously entertaining the reader as massive deals are massaged, managed and mangled around the world. LeFevre’s contributed a classic to the genre. Anyone interested in global finance, credit markets or cocaine-fueled debauchery should give it a read.

My Barron’s Review:

Book Reviews: Climate Shock, Straight to Hell (Barron’s)

Buy the book here:

“Anyone interested in global finance, credit markets or cocaine-fueled debauchery should give it a read.” http://t.co/zxhSSlS94P

My Review of the Goldman Sachs Elevator Book http://t.co/TVwAXZRTFI

RT @GSElevator: “Pitch black… unvarnished… sociopathic… highly entertaining..” – @ReformedBroker reviews STRAIGHT TO HELL

http://t.co…

RT @GSElevator: “Pitch black… unvarnished… sociopathic… highly entertaining..” – @ReformedBroker reviews STRAIGHT TO HELL

http://t.co…

RT @ReformedBroker: Why I chose to review @JohnLeFevre’s book, Straight to Hell

http://t.co/dFvAIsyUEz http://t.co/m7Nz995rL2

RT @ReformedBroker: My Review of the Goldman Sachs Elevator Book http://t.co/BzgDwX0O6Y

RT @ReformedBroker: My Review of the Goldman Sachs Elevator Book http://t.co/BzgDwX0O6Y

RT @ReformedBroker: Why I chose to review @JohnLeFevre’s book, Straight to Hell

http://t.co/dFvAIsyUEz http://t.co/m7Nz995rL2

Alrighty then, adding to my Kindle! #StraightToHell RT @ReformedBroker My Review of the Goldman Sachs Elevator Book http://t.co/VfVD1636oU

Wait. By “blog-enabled takedown culture” you mean people highlighting when people makes shit up? That’s a bad thing? http://t.co/qhhpueJNfN

Must read this book. http://t.co/W4N677AVf5

My review of the goldman sachs elevator book http://t.co/o1Ep3XAkom

RT @Notiflux: My review of the goldman sachs elevator book http://t.co/o1Ep3XAkom

RT @ReformedBroker: Why I chose to review @JohnLeFevre’s book, Straight to Hell

http://t.co/dFvAIsyUEz http://t.co/m7Nz995rL2

RT @ReformedBroker: My Review of the Goldman Sachs Elevator Book http://t.co/BzgDwX0O6Y