My pal Ari Wald (Oppenheimer Asset Management) has an interesting take on the “feel” of the market versus the objective reality.

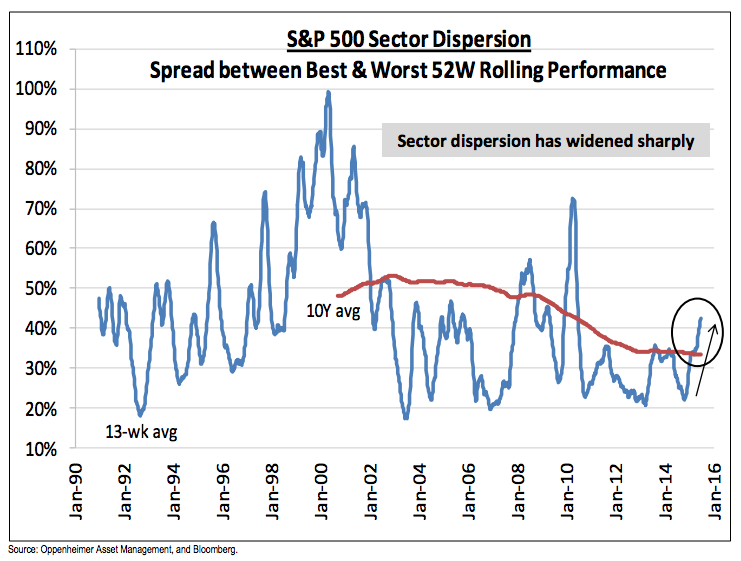

While Wald maintains an overall bullish bent, he notes that identifying winners and losers has been more important this year given the trendless nature of the S&P 500. High dispersion and flat indices make for a frustrated investor class, despite our proximity to the all-time highs:

If the alternative is a bearish view, we believe a bullish S&P 500 outlook remains warranted. However, reality is probably somewhere in the middle as stock-level trends vary considerably. At last week’s low, the S&P 500 was down 3.6% from its all-time high of 2134, but the market environment feels worse than this is because the dispersion of performance has widened sharply. For instance, the spread between the best (Health Care, +24%) and worst (Energy, -24%) performing S&P 500 sectors over the last 52 weeks is the widest since February 2010. This is a reason we continue to place greater emphasis on our sector and stock calls than our market one.

Josh here – If you’re a devoted stockpicker, now is finally your time to shine after five years. Try not to f*** it up.

Source:

Inflection Points

Oppenheimer Asset Management – July 6th 2015

Why the Market Feels Worse Than It Is

http://t.co/rRok3D38A3

Dispersion chart via @AriWald

RT @ReformedBroker: Why the Market Feels Worse Than It Is

http://t.co/rRok3D38A3

Dispersion chart via @AriWald

Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/ub5ZfoYdgS #Uncategorized @ReformedBroker

Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/YmggUU0j62 My pal Ari Wald (Oppenheimer Asset Management) has an inte…

Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/ecMe2M04pt

The market environment feels worse than this is because the dispersion of performance has widened sharply http://t.co/UZVJR3Y3v3 #investing

RT @ReformedBroker: Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/ecMe2M04pt

RT @ReformedBroker: Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/ecMe2M04pt

Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/BmATZuDTBh

RT @ReformedBroker: Why the Market Feels Worse Than It Is

http://t.co/rRok3D38A3

Dispersion chart via @AriWald

“If you’re a devoted stockpicker, now is finally your time” MT @ReformedBroker Why the Market Feels Worse Than It Is http://t.co/k4Ob2HmpiW

RT @ReformedBroker: Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/ecMe2M04pt

Chart o’ the Day: Why the Market Feels Worse Than It Is by @ReformedBroker http://t.co/YFA6VlVc0C

RT @ReformedBroker: Why the Market Feels Worse Than It Is

http://t.co/rRok3D38A3

Dispersion chart via @AriWald

RT @ReformedBroker: Chart o’ the Day: Why the Market Feels Worse Than It Is http://t.co/ecMe2M04pt