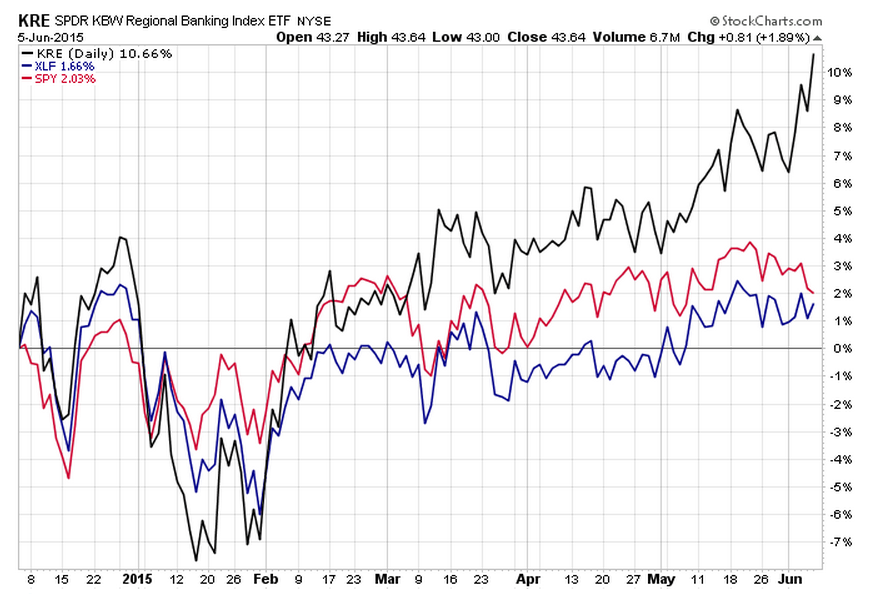

I’ve been talking about both the relative and absolute breakout for the regional bank stocks all week. Below, a chart of the regional bank index ETF (KRE) versus the S&P Financial Sector SPDR (XLF) and the S&P 500 (SPY):

The KRE ETF is based on the SPDR S&P Regional Bank index. It contains 89 holdings, and the the top ten names only comprise 13% of the fund, which means it’s highly diversified within the sector. It’s got just over $2 billion in AUM, so the KRE is not responsible for driving the stocks it is comprised of – the stocks themselves are being bought.

The trailing-12 month yield is just 1.6% on KRE, meaning this is not going higher as part of a chase for yield. Investors presumably seek capital gain when they buy KRE, as the annual dividend here is not greater than that being offered by the S&P 500.

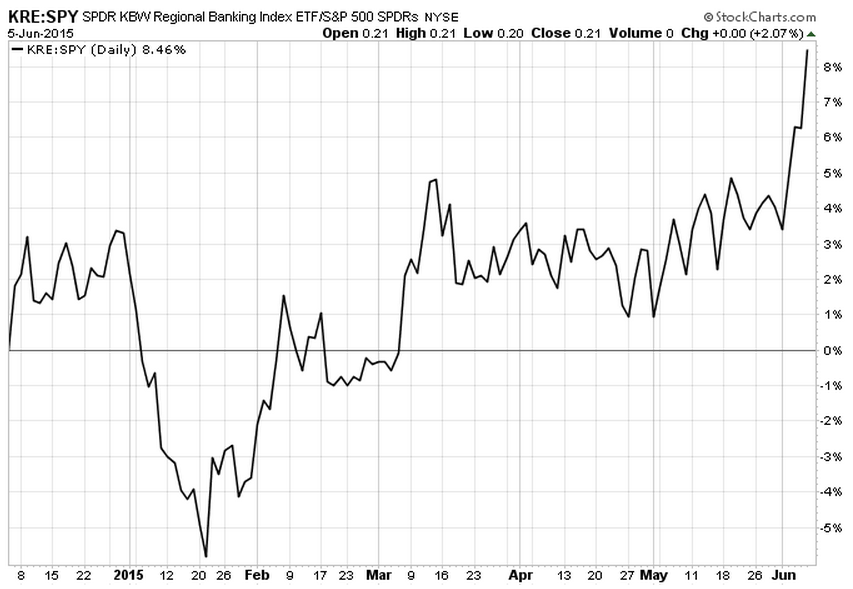

And here’s a ratio chart of KRE vs SPY on a six-month look:

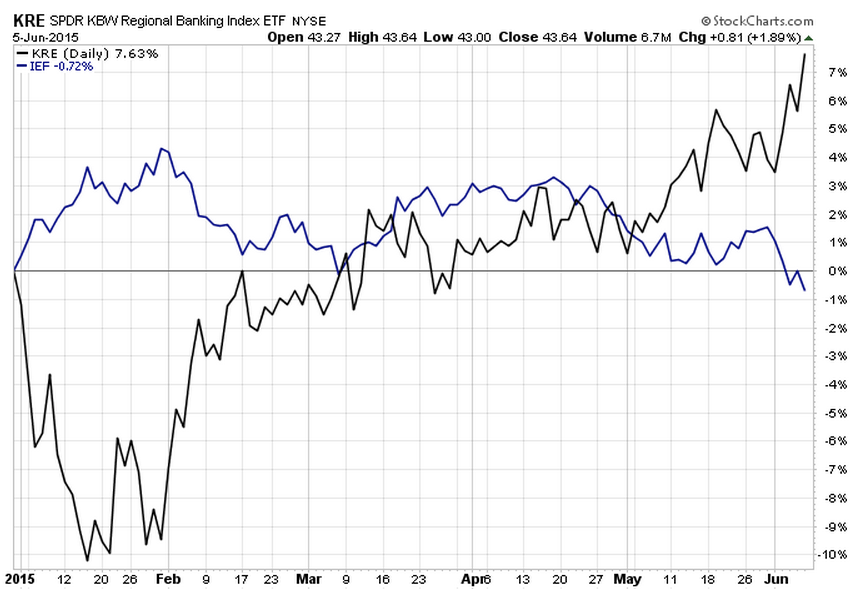

Finally, here’s the regional banks (in black) versus the IEF – an iShares ETF that tracks the 7-10 year treasury bond market. You’ll see that when IEF is strong or gaining, the KRE consolidates or sells off. But when IEF is falling (intermediate-term treasury yields are rising), the regionals get rockin’ to the upside:

As of Friday, according to CME Group data, Fed Funds futures are now pricing in a greater than 50% chance of a 25 basis point rate hike in September. It occurs to me that a long position in the regional banks is one of the primary ways in which investors might be “playing” this increased possibility. The inverse correlation between the 10-year and the regional banks is fairly solid over the last year and there’s a logical reason for it – something like 2/3rds of regional bank lending occurs at the short-end of the curve. Which means, theoretically, that a rising short-term rate move would lead to positive earnings revisions for these banks.

Additionally, the regionals do not share the same amount of capital markets risk that the major money centers (C, BAC, JPM) or the investment banks (MS, GS) have. Thus, a weakening stock or bond market would not have the same negative impact on the constituents of KRE as it would on the larger companies that constitute XLF.

What do you think? Are market participants finally voting for higher rates with their portfolios? Or is this yet another fakeout, a case of investors getting ahead of themselves as rates merely spike in the short-term within a longer-term downtrend?

Chart o’ the Day: What are the regional banks ($KRE) telling us?

http://t.co/7Q3gFCwsQI http://t.co/IeSPtT8tL5

RT @ReformedBroker: Chart o’ the Day: What are the regional banks ($KRE) telling us?

http://t.co/7Q3gFCwsQI http://t.co/IeSPtT8tL5

THIS. “@ReformedBroker: Chart o’ the Day: What are the regional banks ($KRE) telling us?

http://t.co/AsY0MAv8r2… http://t.co/uItfs5Rr7O“

RT @ReformedBroker: Chart o’ the Day: What are the regional banks ($KRE) telling us?

http://t.co/7Q3gFCwsQI http://t.co/IeSPtT8tL5

RT @ReformedBroker: Chart o’ the Day: What are the regional banks ($KRE) telling us?

http://t.co/7Q3gFCwsQI http://t.co/IeSPtT8tL5

RT @ReformedBroker: Chart o’ the Day: What are the regional banks ($KRE) telling us?

http://t.co/7Q3gFCwsQI http://t.co/IeSPtT8tL5

Chart o’ the Day: What are the regional banks telling us? http://t.co/cAGv1SJohe

RT @ReformedBroker: Chart o’ the Day: What are the regional banks telling us? http://t.co/cAGv1SJohe

RT @ReformedBroker: Chart o’ the Day: What are the regional banks telling us? http://t.co/cAGv1SJohe

Great post by Josh — “Chart o’ the Day: What are the regional banks telling us?” http://t.co/IA7Ehz2jRy #feedly via @ReformedBroker

RT @ReformedBroker: Chart o’ the Day: What are the regional banks telling us? http://t.co/cAGv1SJohe

RT @ReformedBroker: Chart o’ the Day: What are the regional banks telling us? http://t.co/cAGv1SJohe

@ReformedBroker http://t.co/c490OuXVCQ is spot on, but @timmelvin has been talking up the regional banks for some time.

Chart o’ the Day: What are the regional banks telling us? by @ReformedBroker http://t.co/Gn4TwkackB

RT @ReformedBroker: Chart o’ the Day: What are the regional banks telling us? http://t.co/cAGv1SJohe