Rising wages, a tighter labor market, the wealth effect from tremendous stock and bond market gains, Millennials turning mid-30’s, pent-up home-shoppers coming out after a terrible winter – these are all the ingredients for a ballistic housing market, not unlike the one I had guessed we would see this spring (see my February story at Fortune here).

Last week, we got data on new single-family home starts that was just incredible – a 22% gain over the prior year. This week, we heard this about homes under contract as of April (via Barclays):

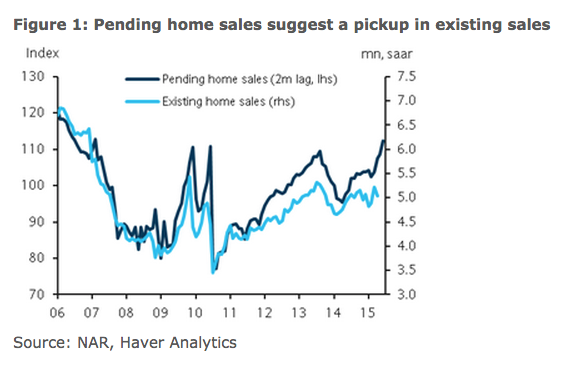

Pending home sales rose 3.4% m/m in April, coming in a bit above our forecast (3.0%) and well above consensus expectations (0.9%) for only a modest rise. The strength in April pending sales was broad-based, with gains led by the Northeast (10.1%) and Midwest (5.0%). Sales activity in these regions was hard hit by adverse weather in Q1 and the strength in April pending sales suggests a boost to regional existing home sales in the coming months. Gains in the Midwest (5.0%) and South (2.3%) were more modest, though these regions did not recently experience declining sales. The April data leave total pending sales up 13.4% y/y and, on balance, are supportive of our expectation of a solid Q2 rebound in residential investment.

As you can see, we’re back above pre-crisis levels. Residential housing has indeed gone ballistic this spring:

Source:

Update: US pending home sales post solid advance in April

Barclays – May 28th 2015

Housing Market: Shall we say…ballistic? http://t.co/x1G2V9bLZz

RT @ReformedBroker: Housing Market: Shall we say…ballistic? http://t.co/x1G2V9bLZz

RT @ReformedBroker: Housing Market: Shall we say…ballistic? http://t.co/x1G2V9bLZz

RT @ReformedBroker: Housing Market: Shall we say…ballistic? http://t.co/x1G2V9bLZz

@ReformedBroker makes persuasive case for another housing boom, a huge tailwind for US economy. http://t.co/Im53Ud2d3i

RT @markbrian: Housing Market: Shall we say…ballistic? http://t.co/w1H5LcrAnv #realestate

Housing market: shall we say…ballistic? http://t.co/sZtaMAwM5D

[…] Housing Market: Shall We Say…Ballistic? – by The Reformed Broker – As Liz and I contemplate buying real estate, articles like these make us realize that it’s probably not the right time to buy property unless we find an extreme bargain. It could happen, but we might just have to wait for another economic struggle… […]

Housing Market: Shall we say…ballistic? http://t.co/DGjlMJVfAo #money #feedly

[…] to be little doubt that the market, buoyed by low rates, scarcity and a mostly stable economy is currently hot and residential construction spending picked up in April which bodes well for both sales volumes […]

[…] Housing Market: Shall we say.ballistic? – The Reformed. – · The April data leave total pending sales up 13.4% y/y and, on balance, are supportive of our expectation of a solid Q2 rebound in residential investment. As you can see, we’re back above pre-crisis levels. residential housing has indeed gone ballistic this spring: Source: Update: US pending home sales post solid advance in April […]

[…] Housing Market: Shall we say.ballistic? – The Reformed. – · The April data leave total pending sales up 13.4% y/y and, on balance, are supportive of our expectation of a solid Q2 rebound in residential investment. As you can see, we’re back above pre-crisis levels. residential housing has indeed gone ballistic this spring: Source: Update: US pending home sales post solid advance in April […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/05/29/housing-market-shall-we-say-ballistic/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/05/29/housing-market-shall-we-say-ballistic/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2015/05/29/housing-market-shall-we-say-ballistic/ […]