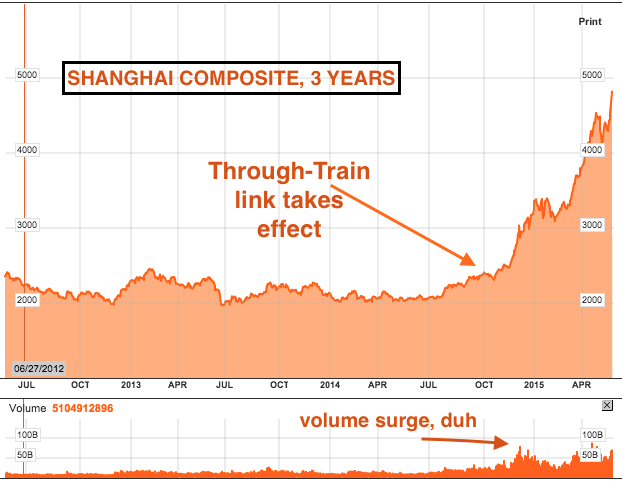

Last summer, the biggest catalyst I could see on the horizon for investors was the then-upcoming Shanghai-Shenzhen link to Hong Kong’s stock market. This link, colloquially referred to as the “through-train” was meant to drive liquidity from developed markets around the world into the mainland Chinese shares market, where valuations were substantially discounted owing to the closed-off nature of local stock exchanges.

Here’s what I told Jeff Macke in a Yahoo Finance interview last August…

One massive catalyst that Brown sees boosting Chinese stocks is something called the “through train.” The through train setup would all allow investors on China’s mainland and Hong Kong to trade shares in each other’s markets, which have been limited thus far with trading quotas on both sides. The big factor here is the exposure to China, which would mean “greater access to the mainland’s equities for overseas investors as they could invest much easily in the A-share market through Hong Kong,” reports China Daily.

In Brown’s mind the influx of foreign money into China’s stock market could boost share prices from anywhere from 15 to 30%.

Did it work?

Well, yes – beyond even my wildest imagination. Chinese stocks are up 111% over the last year, with most of that appreciation thanks specifically to the through-train link. Economic in growth in China has actually declined since the link went live so the major catalyst for this doubling in the value of Chinese stocks was undoubtedly a PE expansion cycle driven by the surge in inbound liquidity that was easy to foresee.

The gains, however, were not easy to foresee. Buying into Chinese stocks (or even the Hong Kong-listed stocks like those of the FXI ETF) was far from a no-brainer at the time. Concerns about the banking sector, the shadow-banking complex and the state of the slowing economy offered plenty of reasons to stay away.

In fact, those with the most intimate knowledge of the local stock market – the Chinese equity analysts themselves – barely saw the move coming. According to Bloomberg, Chinese analysts who cover the 50 largest companies in the country had an average target return of just 28% on their market one year ago. So directionally they were right, but estimating the degree to which these stocks would rally was pretty difficult.

Here’s one who spoke candidly about it:

“This market has been driven up by capital that’s flooded in, while you need to touch upon company fundamentals in your research notes,” Li Xiaolu, a Shanghai-based equity analyst at Capital Securities Corp., said by phone on May 13. “We can’t write baseless reports, so the current market makes it more difficult for us, and makes me hesitate. If a stock’s gain is beyond reasonable, it may continue to climb even if I cut its rating.”

“There’s so much money in the market,” Li said. “It’s a bit embarrassing to re-rate companies at this point.”

By maintaining a globally diverse portfolio, investors can avoid the guessing games inherent in trying to tie economic data to the potential returns of the investment markets. This means taking the bad with the good, of course, when things don’t go particularly well. Your other alternative would be to make things up as you go along, and then scramble to find the economic or fundamental data that backs you up, ex post facto.

To each their own, I guess.

Sources:

When Predicting China Stocks There’s Only Wrong and Very Wrong (Bloomberg)

RT @ReformedBroker: How did the Through-Train Work Out? http://t.co/Vid9IwFEpd

RT @ReformedBroker: HOW DID THE THROUGH-TRAIN WORK OUT?

http://t.co/QByV6UNN5v http://t.co/yhL1TO91Vz

RT @ReformedBroker: HOW DID THE THROUGH-TRAIN WORK OUT?

http://t.co/QByV6UNN5v http://t.co/yhL1TO91Vz

[…] A Chinese stock market rally was not all that difficult to see. (thereformedbroker) […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Here you will find 75640 additional Info on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2015/05/26/how-did-the-through-train-work-out/ […]