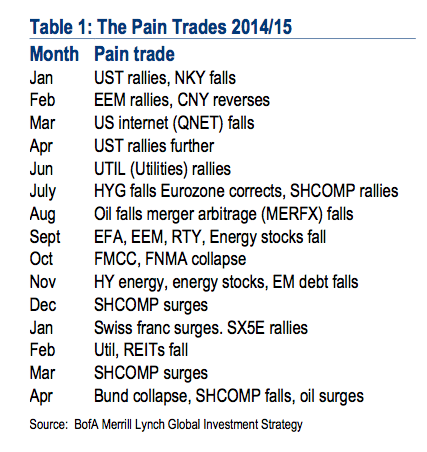

This morning’s Thundering Word note at Merrill Lynch contains an interesting passage about the litany of “pain trades” that have blown up as the end of the “max liquidity” regime has wreaked havoc in some of the most crowded areas of the market…

A “Cesspool of Rotation”

2015 asset returns have been none too shabby: stocks 7%, commodities 6%, bonds -1%, dollar 4%. But this should not be mistaken for Wall Street terra firma. Since Fed tapering was announced (Feb’14) investors have been scarred by a series of vicious “pain trades” (Table 1), crowded trades suffering harmful reversals.For example, many were positioned this Jan for US macro liftoff. Once weaker- than-expected Q1 data caused the Fed to “blink” in March, an immediate painful US$ peak, biotech selloff and trough in oil prices ensued. In the same vein, bond investors were “all-in” on ECB QE at the end of Q1. German bunds and other European bond markets were priced-to-perfection. Few acknowledged the surprise turn higher in EU inflation expectations as even Spain outperformed US growth in Q1. A sudden “buyers strike” for $6tn of negatively-yielding global government bonds (it’s now $4.5tn) caused a 16% crash in German bund futures in 13 trading days.

Josh here – this cuts to the heart of the idea that nobody knows nothin’ and that the blowup will always occur just when enough people have caught on to a theme and there’s no one left on the other side of the seesaw.

Jeff Gundlach likes to say “When you hear people in the investment business say the word ‘Never’, that’s when it’s about to happen.” In the case of many of these pain trades, the term “never” was often assigned to the other side of them – ie: Utilities will never outperform in an improving economy. Oh well.

Source:

The Twilight Zone

Bank of America Merrill Lynch – May 17th 2015

“A Cesspool of Rotations” http://t.co/6VHCmTRQUm

Conviction is being tested here-in a list from JB http://t.co/oo61APOtZ9

A short history of all the “pain trades” that have blown since tapering began

http://t.co/PBqqCCRdBZ

RT @ReformedBroker: A short history of all the “pain trades” that have blown since tapering began

http://t.co/PBqqCCRdBZ

“a cesspool of rotations” http://t.co/uyqEPndsWe

RT @Notiflux: “a cesspool of rotations” http://t.co/uyqEPndsWe

RT @ReformedBroker: A short history of all the “pain trades” that have blown since tapering began

http://t.co/PBqqCCRdBZ

RT @ReformedBroker: “A Cesspool of Rotations” http://t.co/6VHCmTRQUm

RT @asibiza1: The view from the other side of the Wall Street seesaw! @ReformedBroker http://t.co/GQLksumhem

[…] blown up at different points in the past few months as “max liquidity” has left the building. Reformed Broker’s Josh Brown says these episodes prove “nobody knows nothin’ and that the blowup will always occur just when […]

RT @asibiza1: The view from the other side of the Wall Street seesaw! @ReformedBroker http://t.co/GQLksumhem

“A Cesspool of Rotations” by @ReformedBroker http://t.co/mv1rmXpM0t

[…] been an abundance — nay, “cesspool of rotations” ever since the Fed announced the beginning of the end the tapering. “Many were positioned this […]

[…] blown up at different points in the past few months as “max liquidity” has left the building. Reformed Broker’s Josh Brown says these episodes prove “nobody knows nothin’ and that the blowup will always occur just when […]

… [Trackback]

[…] There you will find 27698 additional Information on that Topic: thereformedbroker.com/2015/05/18/a-cesspool-of-rotations/ […]