The prophecy! It has been fulfilled!

(you kind of have to picture me shrieking that line from a mountaintop as a full moon goes blood-red and a man next to me undergoes some sort of animal transformation)

Anyway, in a recent post we examined the causes for the mass-failure of active mutual fund managers to beat their benchmarks over the last few years. It turns out that active managers are not any less skillful than they used to be, it’s just that 2014 was a motherf***er of an environment for them. In order for there to be a surfeit of US domestic equity fund outperformance, at least one (and preferably two) of these three preconditions must be present:

1. Cash is not a drag

2. International stocks doing well

3. Small caps competitive with large caps

This is because the true source of alpha for US large cap managers can actually be boiled down to exposure to a combination of those factors. The data is fairly strong, according to GMO’s analysis:

…in the 12 months ending September 30, 2014 the S&P 500 beat both international and U.S. small cap stocks by around 10% while outperforming cash by 20%. If a manager were to have had 5% of his portfolio in non-U.S. stocks, 5% in small/mid cap U.S. stocks, and carried 1% in cash, then he will have effectively started with a deficit of 120 bps versus the benchmark. That is a lot of ground to make up from stock picking within the S&P 500 alone.

When the S&P 500 tramples the returns on cash, small caps and international stocks, these exposures act as speed bumps for those racing against it.

Here’s the good news for long-suffering active funds, which have seen nothing but scorn and outflows as a category for half a decade now – this year all three preconditions for active management outperformance are present!

Year-to-date, according to Morningstar, US large cap stocks are only up .72% – call it flat. In contrast, small caps are up 4.5%, an outperformance of almost 400 basis points. Small cap growth stocks are up almost 7%! A large cap manager who dips down into mid or small names for alpha vs the S&P 500 can find plenty of it.

International stocks are also doing better than the large cap US benchmarks. MSCI EAFE, the most recognized benchmark for international developed-market stocks is up some 6.25% this year with the US-focused Dow Jones Industrial Average up just .25%. That’s a huge margin of outperformance available for managers whose charters allow them some liberty with respect to foreign holdings. Japan’s Nikkei 225 is up 11% and European individual country markets are showing comparable gains. The MSCI World Index ex-USA is up 5% and, in local currency terms (subtracting the impact of the dollar) it’s actually up double, with a 10.19% gain in 2015.

Speaking of the dollar, cash is also not as big of a drag this year as it was last year. As of Thursday, there were no shortage of S&P 500 names registering year-to-date losses. Having cash in a portfolio hasn’t been a constant drag against fund manager performance at all.

To put a cherry on top, there are several other factors that are contributing to a more constructive environment for active managers so far in 2015.

One is the fact that dispersion has shot up – dispersion representing the degree of standard deviation between stocks from one another. This measure is distinct from correlation in that dispersion actually gauges intra-index stock performance separation, not just how differently stocks are moving from the overall market average.

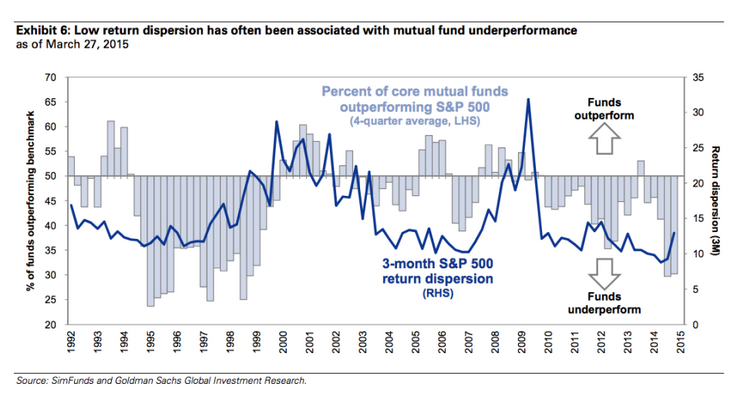

According to Goldman Sachs, increased dispersion almost always leads to a higher percentage of stockpickers outperforming, as their skills in deciding winners from losers become more useful:

As you can see, absent dispersion it’s been very difficult for skilled managers to distinguish themselves historically and beat their benchmarks en masse. Well, they should cheer up because dispersion is returning. According to our own internal research, as of last week there 16 S&P 500 stocks with double-digit losses year-to-date and 87 S&P 500 stocks with double-digit gains year-to-date. That’s a lot of daylight between big winners and big losers. We’ll leave aside the fact that the big winners have probably been heavily concentrated among health care and biotech high-fliers. Let’s not look a gift horse in the mouth.

Anyway, if you’re a stock-picking active manager whose been beaten up these last few years, your time is now. Make the most of it.

Barron’s magazine, I should note, is wasting no time in celebrating the potential for a return to active management. Their cover this weekend celebrates the comeback for the Fidelity Magellan flagship mutual fund:

The question is, will these conditions remain present long enough for the active funds to post a (sorely needed) banner year for the industry? It would make things a lot more interesting and could cause quite a stir here in the Index Utopia.

Read Also:

Why Active Management Fell Off a Cliff – Perhaps Permanently (TRB)

Chart o’ the Day: How Dispersion Stole the Alpha (TRB)

If you’re an active asset manager whose been beaten up these last few years, your time is now: http://t.co/VtIs74dh9B via @ReformedBroker

[…] to 28% from 33%, according to the fed-funds futures market.” Meanwhile, Josh Brown says “the preconditions for active management outperformance are present!” He argues that the current outperformance of small caps over large, as well as international […]

[…] All 3 Preconditions for Active Outperformance are Present (TRB) […]

All 3 Preconditions for Active Outperformance are Present #alpha#now http://t.co/KWNlLHCCqI

All 3 Preconditions for Active Outperformance are Present by @ReformedBroker http://t.co/c9fAEqGOI6

Three preconditions for active outperformance are currently present. #investing @tradingfloorcom http://t.co/2muYGg9Jyp

[…] All 3 Preconditions for Active Outperformance are Present (TRB) […]

[…] As I mentioned a few weeks back, the three critical conditions to see a large number of actively managed stock mutual funds outperform are all present: […]

[…] That’s a big jump over the 2014 disaster, thanks to the fact that all three preconditions for active management outperformance are back in place this year. […]

[…] stocks versus large-caps, as well as the good relative performance of international stocks, are paving the way for outperformance by active fund […]

[…] stocks versus large-caps, as well as the good relative performance of international stocks, are paving the way for outperformance by active fund […]

[…] stocks versus large-caps, as well as the good relative performance of international stocks, are paving the way for outperformance by active fund […]

[…] stocks versus large-caps, as well as the good relative performance of international stocks, are paving the way for outperformance by active fund […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/04/04/all-three-preconditions-for-active-manager-outperformance-are-present/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2015/04/04/all-three-preconditions-for-active-manager-outperformance-are-present/ […]