“The large cap space is too competitive so active managers do a much better job in small caps, where their skills add value.”

You’ve heard that before. A lot. Except it isn’t true. At least not over any length of time that actually matters.

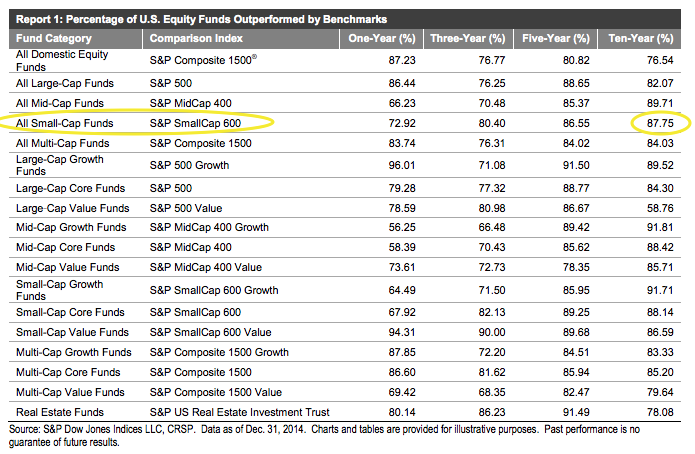

S&P Dow Jones Indices is out with their latest SPIVA Scorecard, with complete findings for end-of-year 2014. It turns out that small-cap stockpicking didn’t do investors any favors relative to the benchmark index, once again.

Here’s SPDJI (emphasis mine)

The S&P 500® had its third straight year of double-digit gains in 2014, returning 13.69% (returns were 32.39% in 2013 and 16% in 2012). Based on data as of Dec. 31, 2014, 86.44% of large-cap fund managers underperformed the benchmark over a one-year period. This figure is equally unfavorable when viewed over longer-term investment horizons. Over 5- and 10-year periods, respectively, 88.65% and 82.07% of large-cap managers failed to deliver incremental returns over the benchmark.

The returns of 66.23% of mid-cap managers and 72.92% of small-cap managers lagged those of the S&P MidCap 400® and the S&P SmallCap 600® , respectively, on a one-year basis. Similar to the results in the large-cap space, the overwhelming majority of mid- and small-cap fund managers underperformed their benchmarks over the longer-term horizons as well.

It is commonly believed that active management works best in inefficient environments, such as small-cap or emerging markets. This argument is disputed by the findings of this SPIVA Scorecard. The majority of small-cap active managers have been consistently underperforming the benchmark over the full 10-year period as well as each rolling 5-year period, with data starting in 2002.

Josh here, as you can see in the scorecard below, 87.75% of all small cap funds did not beat their benchmark over the 10-year period ending December 31st 2014. That’s actually worse than the overall domestic funds universe, where close to 24% were able to outperform.

Yes, the good news is that 12% of small cap funds were able to beat the SmallCap 600 index over the last decade, but these funds probably had two things in common:

1. low fees

2. you could not have identified them in advance

Why does this matter? Because, according to Morningstar, the average expense ratio for a small-cap fund is 1.61%. That’s a huge internal cost that investors being sold these funds do not see – but that take a giant chunk out of their returns over years and decades. And for what? The 12% chance they picked the right one?

I wish it weren’t so, but it is what it is.

Source:

RT @Jamesmlevy01: Money Managers don’t add value in the small cap space EITHER. Marketplace lending is a far better option. https://t.co/t…

MYTHBUSTERS Another Bulls*** Myth Debunked by @ReformedBroker http://t.co/ySoByph6yp

Another Bulls*** Myth Debunked http://t.co/t0zkbeK6gF

Active management works in the small cap space, right? Wrong! http://t.co/uDa24XIUD5 via @ReformedBroker #investing #management

RT @gssmith77: Active management works in the small cap space, right? Wrong! http://t.co/uDa24XIUD5 via @ReformedBroker #investing #manage…

RT @gssmith77: Active management works in the small cap space, right? Wrong! http://t.co/uDa24XIUD5 via @ReformedBroker #investing #manage…

RT @InvestSensibly: We hear it all the time – that active managers do best in the small-cap sector. Bulls***, says @ReformedBroker http://t…

RT @gssmith77: Active management works in the small cap space, right? Wrong! http://t.co/uDa24XIUD5 via @ReformedBroker #investing #manage…

… [Trackback]

[…] Here you can find 11358 more Information on that Topic: thereformedbroker.com/2015/03/12/another-bulls-myth-debunked/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/03/12/another-bulls-myth-debunked/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2015/03/12/another-bulls-myth-debunked/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/03/12/another-bulls-myth-debunked/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/03/12/another-bulls-myth-debunked/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2015/03/12/another-bulls-myth-debunked/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/03/12/another-bulls-myth-debunked/ […]