Savita Subramanian reminds investors that Januarys are a seasonally strong month – especially after the prior year.

January is seasonally strong, especially after a strong year

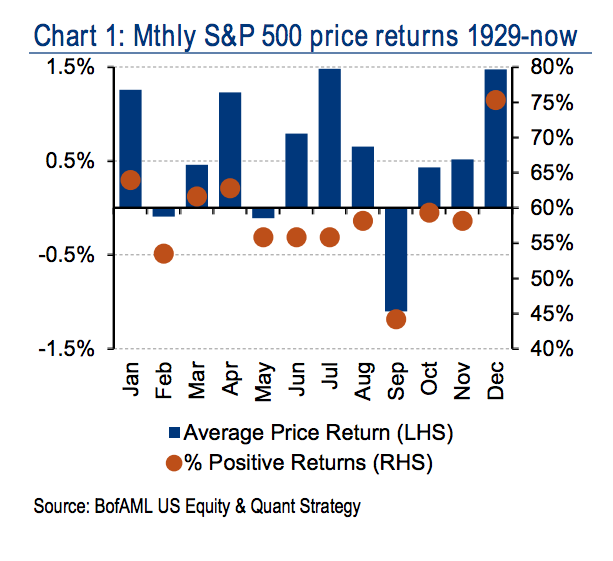

Since 1929, January has been one of the seasonally strongest months for the S&P 500, with average and median price returns of +1.3%/+1.6% vs. average/median returns of +0.6%/+0.9% for all months (Chart 1). January has also had the second highest percentage of positive returns (64%) after December (75%). Returns have tended to be even stronger following years where the S&P 500 has double-digit gains, as it has so far this year. In these years, returns have averaged +1.8%, with positive returns 68% of the time.

Josh here – while January is usually great after a positive year, higher 68% of the time by an average of 1.8%, it’s important to keep in mind that averages are helpful but not predictive. They don’t work every year. Notably, January of 2014 followed an incredibly strong year in 2013, but treated investors to a peak-to-trough 6% selloff from the moment the year began, bottoming on the first day of February.

Like most things, seasonals work often except for when they don’t. And no one tells you which time you’re in – the exception or the norm – in advance.

Source:

January in full effect

Bank of America Merrill Lynch – December 23rd 2014

RT @ReformedBroker: January seasonals after a good year http://t.co/NzDfUETf7Y

Ocak ayı Aralık ayından sonra en fazla getiri potansiyeli olan ay (ABD piyasaları için) http://t.co/2RcjYtwzpk

January seasonals after a good year http://t.co/5YRgyNimaR

[…] Quant study: S&P 500’s monthly price returns (1929-2014) | Bank of America Merrill Lynch (… Both January & December are the best performing months in the market, especially after a FY with double-digit returns like 2014; September & February are the worst. Best: – December: +1.8% mean; 75% winners – January: +1.3% mean; 64% winners (+1.8% w 68% winners after a big year) Worst: – September: -1.1% mean; 44% winners – February: -0.1% mean; 53% winners Charts SPX’s average monthly returns & success rate. [Previously: Charting the average year in the stock market (daily) & SPX’s historical 6-month rolling returns] #Bullish #Seasonality […]

January seasonals after a good year by @ReformedBroker http://t.co/gX7eCDUoen

RT @ReformedBroker: January seasonals after a good year http://t.co/FuqBYyygP2

RT @ReformedBroker: January seasonals after a good year http://t.co/ndBeYY7tBt

[…] is seasonally strong, especially after a good year. Josh Brown reports Merrill Lynch research going back to […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2014/12/26/january-seasonals-after-a-good-year/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/12/26/january-seasonals-after-a-good-year/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/12/26/january-seasonals-after-a-good-year/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/12/26/january-seasonals-after-a-good-year/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/12/26/january-seasonals-after-a-good-year/ […]

… [Trackback]

[…] Here you can find 16124 additional Info on that Topic: thereformedbroker.com/2014/12/26/january-seasonals-after-a-good-year/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/12/26/january-seasonals-after-a-good-year/ […]