Two years ago I stopped contributing to all outside publications and chose to focus whatever time I had to write solely on The Reformed Broker. It’s worked out nicely and the site continues to build record page views, unique visitors, etc.

And then I got the chance at my dream columnist gig – with Fortune Magazine – and I jumped at it.

Fortune is, in my mind, the most prestigious financial magazine in existence. It’s delivered to executives all over the world. It’s the one outlet still doing in-depth corporate profiles that matter. Its articles connect the dots between capital markets, American business and Main Street – something that’s sorely missed in the modern era.

It’s got a legacy of both celebrating and excoriating the business world, of telling it straight, of criticizing titans and presidents alike.

It’s where Warren Buffett goes when he wants to do something long-form, thanks to his lifelong friendship with Carol Loomis. See Buffett’s now-legendary explanation of why he doesn’t invest in innovation, from November of 1999, here.

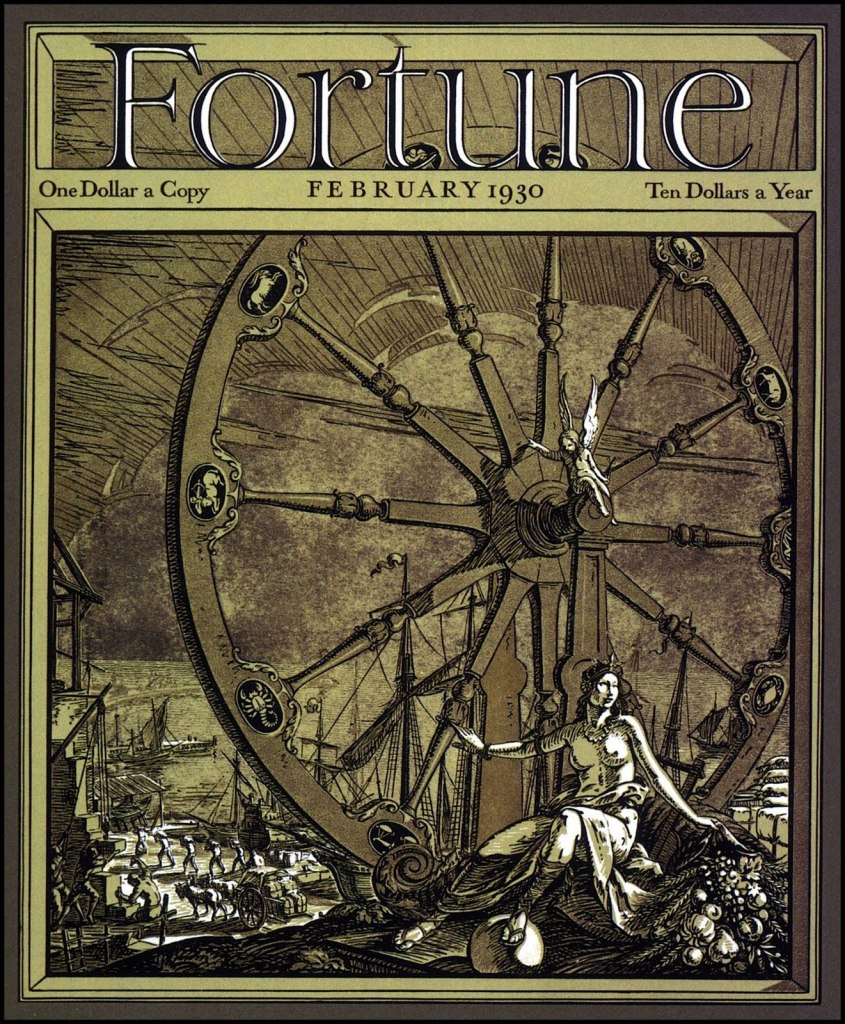

When TIME Magazine’s Henry Luce created Fortune in 1929, the stock market was roaring to new heights and it was the perfect time for a high-sheen, big-concept publication to cover the glories of capitalism and commerce. The concept he had in mind was to keep the content from devolving into stodginess by recruiting young, up and coming literary talent rather than traditional business writers. When he was asked about his hiring of poets and authors, he replied “There are men who can write poetry, and there are men who can read balance sheets. The men who can read balance sheets cannot write.”

For his visuals, he brought in the painter Diego Rivera to do splashy, provocative covers and Margaret Bourke-White, whose full-color photography of factories and farms brought the stories in each issue to life.

Just prior to the launch of Fortune, the stock market crashed and the economy began to collapse. Luce didn’t blink. He didn’t abandon the high production values he had planned nor did he cut loose any of the magnificent writers, artists, photographers and editors he’d assembled. He pushed forward, knowing that his ambition to make business news exciting and palatable to a broad audience was going to take on a whole new level of import, given the economic climate at hand.

Fortune’s first issue came out in February of 1930, just four months after the crash. It had 184 pages and approximately 30,000 subscribers. Luce thought the economic downturn would last no more than a year, but as it turns out, the rest of the decade would be marked by hard times, Depression and then the ramp up to World War II. Fortune plowed through the storm and by the 1950’s it had half a million subscribers and had become the most well-known magazine in business.

Through the years, Fortune Magazine has remained among the most important financial news and opinion publications around the world. It’s played host to a who’s who of influential reporters and columnists, past and present, such as Carol Loomis, Allan Sloan, Alvin Toffler. Alfred Kaxin, Marshall Loeb, John Kenneth Galbraith, Bethany MacLean, Nina Easton, James Agee, Justin Fox, Archibald MacLeish, Andy Serwer and Daniel Seligman – a far from complete list, of course. In its current incarnation, Fortune is home to some of my favorite contemporary writers, people like Dan Primack, Stephen Gandel and the new top editor, Alan Murray.

Fortune has been been the preeminent chronicler of the rise of US industry for more than seven decades. It’s the home of the Fortune 500 and the only physical publication I actually get delivered (nothing wrong with the app, but wanting to hold each issue in my hands is a long-lived habit of mine and one that is not easily broken).

And now, I have a chance to contribute to American Business’s magazine of record. I’m excited and inspired beyond words.

The gist of what my biweekly column will be about (I haven’t thought up a cool name yet) will be the intersection at which Wall Street and the real world collide, the nexus between high finance and the actual economy. I hope to channel some of the market observations I make regularly into stories and viewpoints about this collision. I hope to make it interesting and relatable to an audience of both professionals and civilians, and investors of all experience levels. The mission is to make you think and maybe even chuckle. But not out loud – I don’t want other people to think you’re crazy.

Without further adieu, my first column for Fortune is below. It’s about the return of retail investors to the stock market and a look at how they’re investing now. I hope you like it!

Revenge of the mom and pop investors (Fortune)

RT @ReformedBroker: Here’s why I’m so excited about my new column @FortuneMagazine

http://t.co/kJuCshzHKr

RT @ReformedBroker: Here’s why I’m so excited about my new column @FortuneMagazine

http://t.co/kJuCshzHKr

RT @ReformedBroker: Here’s why I’m so excited about my new column @FortuneMagazine

http://t.co/kJuCshzHKr

RT @retheauditors: “@ReformedBroker: Here’s why I’m so excited about my new column @FortuneMagazine

http://t.co/7F64qCrABF” Congratulatio…

RT @ReformedBroker: Here’s why I’m so excited about my new column @FortuneMagazine

http://t.co/kJuCshzHKr

RT @ReformedBroker: Here’s why I’m so excited about my new column @FortuneMagazine http://t.co/GT9Q8h44Bh

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG

Gratz Josh! Cool retrospective on Fortune Magazine, too! RT @ReformedBroker About my new column at Fortune Magazine http://t.co/6ltmIuKdS3

RT @ReformedBroker: About my new column at Fortune Magazine http://t.co/fEVXb7CYkG