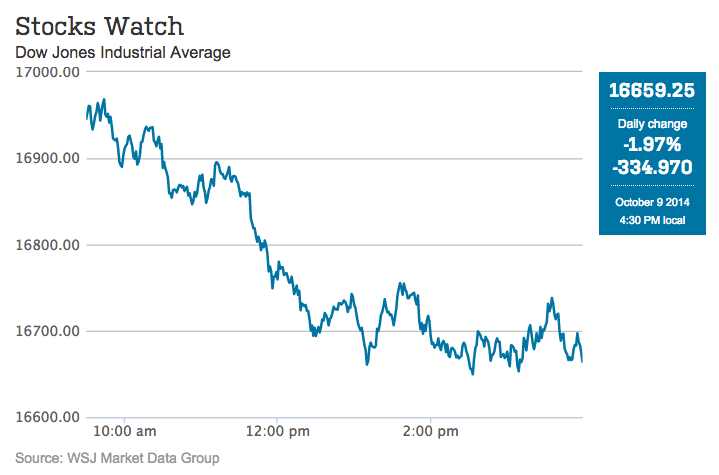

Why did the stock market plummet more than 330 points today?

I could give you any one of several answers but they won’t actually help you. Because this is the wrong question.

The right question is to ask why it went up an almost equivalent amount yesterday. And the answer to that is people are out of their f***ing minds.

They’re nostalgic for the sentiment-driven, Fed-fueled, multiple expansion market of 2013 and they haven’t yet accepted the fact it was a once (maybe twice) in a lifetime thing. The conditions that were in place to set up what happened in 2013 were the following:

1. Everyone was underinvested in stocks, overly invested in cash, gold and bonds.

2. The Fed was furiously pumping dollars directly into the investment markets, fueling all manner of buybacks, IPOs and raised dividends.

3. Sentiment was absurdly pessimistic, with Wall Street, institutional investment managers and retail players negative on equities.

4. US companies were consistently smashing expectations and raising guidance for the future.

5. The rest of the world began reporting improving economic fundamentals.

That was then. I documented the shit out of this phenomenon that entire year, until my fingers bled from blogging.

This year, many of those factors are non-existent or on the wane.

Consider:

1. Investors are no longer underinvested in stocks. According to the Federal Reserve’s Flow of Funds report, we’re back at all-time peaks (last seen in 2000, 2007) for household corporate equity (stocks, mutual funds, corporate bonds) participation.

2. The Fed is walking away. Later this month, the taper of stimulus will have been concluded. After shoveling a trillion dollars a year at the investment markets, they are retiring from the QE business and merely pledging a low Fed Funds rate in lieu of stimulus. Investor demand must now stand on its own and you better believe things are going to adjust. Buybacks are expected to slow markedly from their torrid pace. It already began in the most recent quarter. IPO volume (in transactions, not dollars) has already dropped.

3. Sentiment from week to week has been volatile but the big picture is that people are back in again. All you need to do is to look at the inflows to Vanguard’s passive stock index products and the record levels of 401(k) buying to know that. Never listen to a survey, watch what their hands are doing, not what their lips are saying.

4. US companies are not smashing anything. Their beats have become more modest. Their warnings have become more grave. There are many high profile blue chip companies that have already thrown in the towel on 2014, most notably Target and Ford. There’s plenty of good news on the earnings front (mostly in tech, select consumer discretionary), but there is less surprisingly good news overall. Expectations are everything. We’re already expecting a lot.

5. The rest of the world is not only not improving, it’s becoming a disaster. Europe is looking at a continent-wide triple-dip recession. An absolute absurdity, and yet here it is. Japan is going nowhere, China’s slow-mo unwind continues apace and the commodity collapse / dollar rally is killing off any hope of strength around the rest of the emerging world.

And so with the five factors that had driven the rally since 2012 no longer in our favor, we consolidate and thrash around a bit awaiting the next set of catalysts. Maybe a great holiday shopping season thanks to plunging energy costs. Perhaps – at long last – a meaningful uptick in wages for our now tighter labor market. Maybe European QE resets the board game there and sparks les esprits animaux. All of these things are possible – they’re just not happening yet.

And so volatility ticks up and the crowd second-guesses everything in their portfolios.

Welcome to the next phase. The old phase has been over for awhile, I’m sorry that nobody rang a bell or hung a sign.

Read Also:

Stocks Explode Higher on Fears of Renewed Economic Weakness (TRB)

cctv

Each and every right after in a even even though we decide for weblogs that we study. Outlined underneath are the most recent world wide web internet sites that we decide for

persian tar

[…]usually posts some really fascinating stuff like this. If youre new to this site[…]

دوربین

I’m really loving the concept/design and style of your internet internet site. Do you at any time run into any web browser compatibility troubles? A small number of my website audience have complained about my weblog not working correctly in Explorer b…

vpn ایفون

Good way of explaining, and fastidious report to get details regarding my presentation matter matter, which i am heading to express in faculty.

resume sample

[…]that could be the finish of this post. Right here youll obtain some internet sites that we assume you will appreciate, just click the links over[…]

سیستم حفاظتی

Hello just needed to give you a brief heads up and permit you know a few of the photographs aren’t loading properly. I’m not certain why but I feel its a linking concern. I’ve tried it in two diverse internet browsers and the two display the very same…

تبلیغ در گوگل ادوردز

My developer is making an attempt to persuade me to shift to .web from PHP. I have usually disliked the idea because of the costs. But he’s tryiong none the considerably less. I’ve been using Movable-sort on a quantity of internet sites for about a cal…

دوربین

Verify under, are some totally unrelated internet-internet sites to ours, however, they’re most trustworthy resources that we use.

buy n sell domains

[…]Wonderful story, reckoned we could combine a couple of unrelated information, nevertheless truly worth taking a search, whoa did one particular master about Mid East has got more problerms at the same time […]

خرید کولر صنعتی

When I to begin with commented I clicked the “Notify me when new remarks are added” checkbox and now every time a remark is added I get three e-mails with the identical remark. Is there any way you can get rid of me from that provider? Thank you!

سیستم حفاظتی

Good submit! We will be linking to this excellent publish on our website. Keep up the excellent producing.

دوربین

Howdy would you head allowing me know which webhost you’re making use of? I have loaded your website in 3 entirely distinct browsers and I have to say this site hundreds a lot a lot quicker then most. Can you advocate a very good hosting provider at a…

سیستم حفاظتی

With respect to ergonomics and the innovative technilogy Heuer reproduction watches have been the amazing samples of sports watches.

خرید کولر صنعتی

Admiring the commitment you set into your site and in depth info you offer. It’s amazing to occur throughout a blog each and every as soon as in a while that isn’t the identical previous rehashed information. Fantastic read through! I have bookmarked y…

سیستم حفاظتی

Thank you for some other excellent write-up. Where else might just any person get that variety of information in this sort of an perfect implies of creating? I have a presentation following 7 days, and I am on the search for this kind of data.