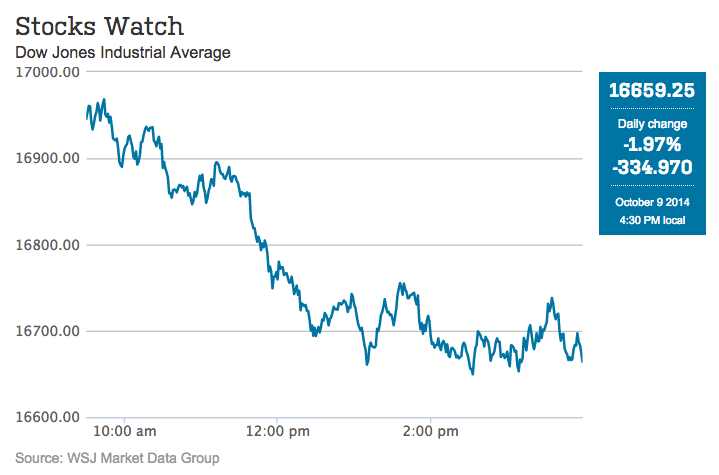

Why did the stock market plummet more than 330 points today?

I could give you any one of several answers but they won’t actually help you. Because this is the wrong question.

The right question is to ask why it went up an almost equivalent amount yesterday. And the answer to that is people are out of their f***ing minds.

They’re nostalgic for the sentiment-driven, Fed-fueled, multiple expansion market of 2013 and they haven’t yet accepted the fact it was a once (maybe twice) in a lifetime thing. The conditions that were in place to set up what happened in 2013 were the following:

1. Everyone was underinvested in stocks, overly invested in cash, gold and bonds.

2. The Fed was furiously pumping dollars directly into the investment markets, fueling all manner of buybacks, IPOs and raised dividends.

3. Sentiment was absurdly pessimistic, with Wall Street, institutional investment managers and retail players negative on equities.

4. US companies were consistently smashing expectations and raising guidance for the future.

5. The rest of the world began reporting improving economic fundamentals.

That was then. I documented the shit out of this phenomenon that entire year, until my fingers bled from blogging.

This year, many of those factors are non-existent or on the wane.

Consider:

1. Investors are no longer underinvested in stocks. According to the Federal Reserve’s Flow of Funds report, we’re back at all-time peaks (last seen in 2000, 2007) for household corporate equity (stocks, mutual funds, corporate bonds) participation.

2. The Fed is walking away. Later this month, the taper of stimulus will have been concluded. After shoveling a trillion dollars a year at the investment markets, they are retiring from the QE business and merely pledging a low Fed Funds rate in lieu of stimulus. Investor demand must now stand on its own and you better believe things are going to adjust. Buybacks are expected to slow markedly from their torrid pace. It already began in the most recent quarter. IPO volume (in transactions, not dollars) has already dropped.

3. Sentiment from week to week has been volatile but the big picture is that people are back in again. All you need to do is to look at the inflows to Vanguard’s passive stock index products and the record levels of 401(k) buying to know that. Never listen to a survey, watch what their hands are doing, not what their lips are saying.

4. US companies are not smashing anything. Their beats have become more modest. Their warnings have become more grave. There are many high profile blue chip companies that have already thrown in the towel on 2014, most notably Target and Ford. There’s plenty of good news on the earnings front (mostly in tech, select consumer discretionary), but there is less surprisingly good news overall. Expectations are everything. We’re already expecting a lot.

5. The rest of the world is not only not improving, it’s becoming a disaster. Europe is looking at a continent-wide triple-dip recession. An absolute absurdity, and yet here it is. Japan is going nowhere, China’s slow-mo unwind continues apace and the commodity collapse / dollar rally is killing off any hope of strength around the rest of the emerging world.

And so with the five factors that had driven the rally since 2012 no longer in our favor, we consolidate and thrash around a bit awaiting the next set of catalysts. Maybe a great holiday shopping season thanks to plunging energy costs. Perhaps – at long last – a meaningful uptick in wages for our now tighter labor market. Maybe European QE resets the board game there and sparks les esprits animaux. All of these things are possible – they’re just not happening yet.

And so volatility ticks up and the crowd second-guesses everything in their portfolios.

Welcome to the next phase. The old phase has been over for awhile, I’m sorry that nobody rang a bell or hung a sign.

Read Also:

Stocks Explode Higher on Fears of Renewed Economic Weakness (TRB)

penis sleeve

[…]we like to honor several other world-wide-web web sites on the web, even if they arent linked to us, by linking to them. Underneath are some webpages worth checking out[…]

menage a trois sex toy

[…]we prefer to honor quite a few other world-wide-web sites around the web, even though they arent linked to us, by linking to them. Under are some webpages really worth checking out[…]

apps download for windows 10

[…]please check out the sites we adhere to, such as this a single, as it represents our picks in the web[…]

free download for pc

[…]we came across a cool web site that you simply may love. Take a appear for those who want[…]

Sex Toy Rabbit

[…]usually posts some incredibly fascinating stuff like this. If you are new to this site[…]

free real work at home jobs

[…]below youll obtain the link to some web-sites that we assume you should visit[…]

Chaga Pilz

[…]Every after inside a although we pick blogs that we read. Listed beneath are the most up-to-date internet sites that we choose […]

Vibrator Sex Toys

[…]here are some hyperlinks to web sites that we link to for the reason that we believe they are worth visiting[…]

Sell From Your Online Store

[…]here are some hyperlinks to web sites that we link to for the reason that we believe they’re worth visiting[…]

heat pump

[…]Here are several of the web sites we advise for our visitors[…]

Google

Check below, are some totally unrelated internet websites to ours, having said that, they are most trustworthy sources that we use.

bragi

[…]check below, are some totally unrelated websites to ours, even so, they are most trustworthy sources that we use[…]

mulvadi 100% kona

[…]The info mentioned inside the article are a number of the most effective accessible […]

파파야

[…]usually posts some pretty exciting stuff like this. If you are new to this site[…]

1Z0-410 Certification Dumps

[…]we like to honor lots of other internet web pages on the web, even though they arent linked to us, by linking to them. Underneath are some webpages really worth checking out[…]