Here’s the stock market’s reaction to Apple’s massive roll-out of all new products and platforms today (via MoneyBeat):

Shares surged as much as 4.8% to $103.08, pushed close to a fresh record high, and at one point, was on track for one of its best days of the year. The rally contrasted with Apple’s previous product announcements, when the stock usually fell after the unveiling of new offerings.

UPDATE: Shares reversed course and dropped late in the trading session, falling by more than 1%.

LOL @ “reversed course”. As if there’s a course to begin with. It’s monkeys rattling their cages, tormented by emotion, armed with half-truths and misinformation, wracked by the need to do something, anything, in the presence of a new burst of stimuli.

I used to be in that game – making shit up in my own head to justify why this or that stock should go up or down in the next few minutes, trading headlines with instant reactions and so forth. The further I get away from it, the harder it is not to laugh at the ridiculousness of the whole thing.

As if the people reacting at either 2pm or 4pm or at any point between even have the faintest idea of the import (or lack thereof) of what’s just been announced.

I don’t know if these new phones, the watch or the payment system will be world-changing or just an incremental win or loss for Apple. What I know for a fact is that anyone wagering big in either direction this early has absolutely no idea either. But I’m sure they’ve assured themselves that they do.

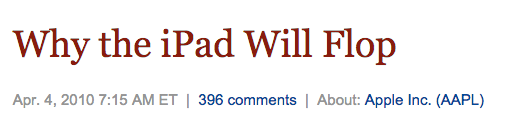

The insta-hysteria in both directions today reminded me of this now-classic Seeking Alpha post, published the day after Apple’s initial rollout of its first-gen iPad in early April 2010:

The iPad hype machine has been in full effect this week, and I still think it’s just that—hype…

As I wrote previously, nobody has ever made a commercially successful tablet computer…

They’re not as useful as a laptop, and they’re not mobile enough or cheap enough to replace a smartphone—and of course, they can’t make phone calls…

In short, tablets try to fill a niche that doesn’t exist…

I don’t buy the iPad hype. Analyst expectations for iPad revenue are way overblown. If I turn out to be wrong, I’ll gladly eat my words, but I’m pretty sure that I’m not wrong…

Amazing, especially that last pretty sure part. To be “pretty sure” of anything in the seconds and minutes after something like that comes out? Based on what? Nothing.

By the time that blogger’s post was published, Apple was tabulating sales figures. It turns out the first iPad had been completely sold out in its first day in the stores, not even counting all of the pre-orders that had flooded into Apple beginning in March of that year. iPad has gone on to sell over 200 million units cumulatively since then.

Sometimes you’re allowed to not have such a strong opinion. Sometimes you can STFU and just digest, see how things shake out. Listening to people carry on about how they’ll “never wear a smart watch” or how they “can’t imagine anyone paying $500 for a phone!” is embarrassing. Maybe they’ll be wrong, maybe they’ll be right, but definitely they cannot possibly know. No one does. Go read about Ford’s can’t-miss launch of the Edsel in the late 1950’s if you want to see just how persistently hard these kinds of things have been to call throughout history.

Snap judgments and table-pounding predictions about something totally new like iPad, ApplePay, the iWatch, the iMac, the iPod, the smartphone etc are utterly ridiculous. Make a few of these calls and then find out how little you know. I sure have.

And as to the ol’ “wisdom of crowds” nonsense…give me a break. How many more episodes like this do we need to see before we end this deification of markets business altogether?

The emperor has no clothes and the crowd has no clue.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/09/09/snap-judgments/ […]

Title

[…] Here you can find another great insight of […]