Just when I think I can no longer be shocked by a statistic about the bad behavior of investors and its consequences, a new one comes running across my path that leaves me completely floored.

The latest stat I’ve come across concerns the hiring and firing of managers because of three-year track records, a exercise in faildom if ever there was one. The executive summary for this kind of thing goes like this: “Wow, look at those returns for the last three years! I would have made a lot more money if I was with that fund, I’m not going to miss out over the next three years!” The old manager you’re working with, who is of course a complete idiot to you now, gets fired and the new hotshot who’s been crushing it gets hired.

And then, of course, mean reversion sets in and you ended up firing the old guy at the worst moment you possibly could have, and then doubly screwing yourself by handing that money over to the new guy just as he’s statistically poised to do even worse.

Many investors do this sort of thing again and again, as though on a treadmill. It’s understandable, as people succumb to both the Recency Bias and the Hot Hand Fallacy all at once. Usually, it’s the people who pay too much attention to the day-to-day fluctuations of their investments that are most susceptible. By focusing on what’s been happening lately, an extrapolative picture forms in their mind in which they envision a continuing trend of unhappiness with one strategy and a grass-is-greener fantasy about some other approach. At a certain point, they just can’t take it anymore and they make the switch.

There’s a great George Orwell quote that I think is applicable here: “Whoever is winning at the moment will always seem to be invincible.”

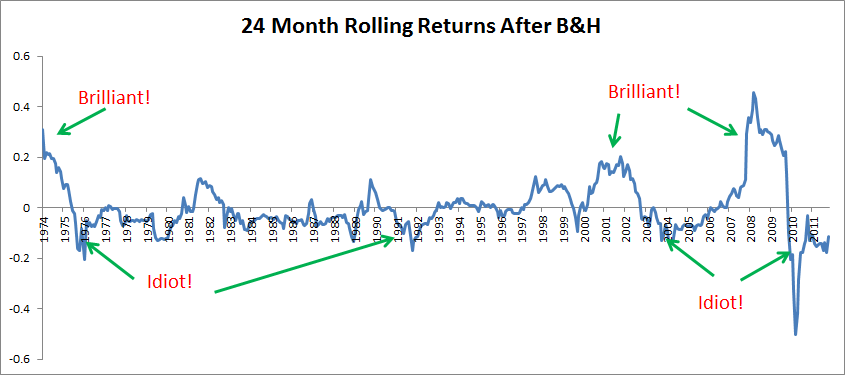

My friend Meb Faber talked about this years ago during a spate of underperformance for an old strategy of his. He totally nailed it with this graphic, which juxtaposes the strategy against a plain vanilla buy-and-hold, the thing everyone is relentlessly judged against in a bull market:

The bottom line is that everyone is “long-term oriented” and comfortable with the tradeoffs of investing up to a point. And then we break. Some have a higher tolerance and more patience for a rough patch than others, but in the end, human nature usually wins out.

Anyway, the harm done by firing underperforming managers and hiring perceived outperformers hasn’t been extensively documented, even if the lack of persistence of performance has. Below, we’ll take a look at this phenomenon thanks to a chart posted by the team at GestaltU. In an epic post from January of 2013, the blog makes the point that three-year track records are meaningless and can even do more harm than good when investors react to them.

My favorite illustration of this is in the form of a manager switch study they cite with data from the Employee Benefit Research Institute…

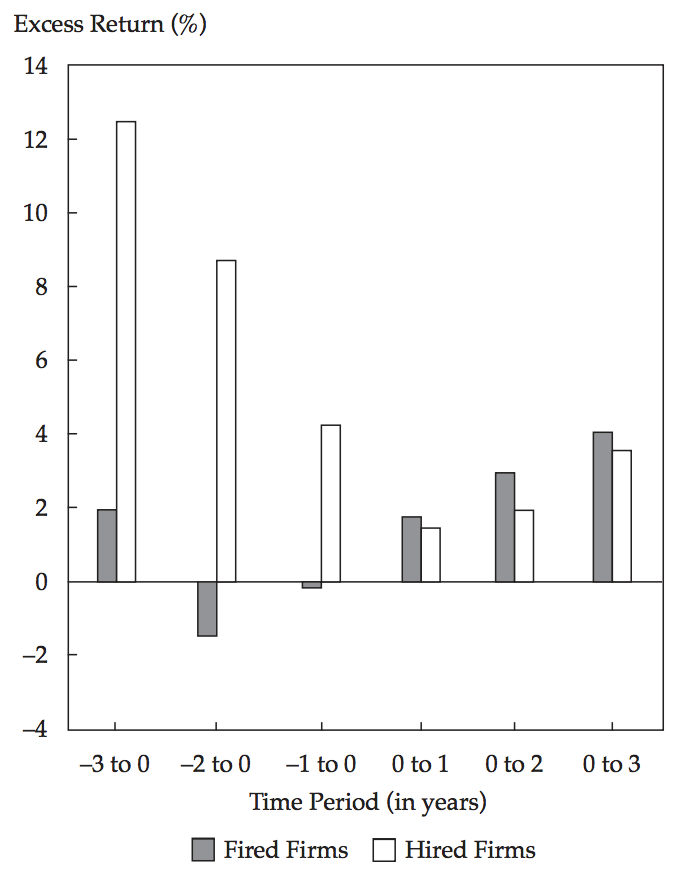

Chart 5. clearly illustrates the impact of this phenomenon in the pension space. The grey bars represent the average annualized performance of terminated managers in the three years prior to, and three years subsequent to, their termination. The white bars represent the performance of replacement managers in the same years. Clearly institutions are hiring managers with exceptional historical track records over trailing 3 year periods, and firing managers with poor track records. The joke is on the institutions, however, since on average the fired managers go on to outperform the hired managers over the subsequent 1, 2, and 3 year periods!

Chart 5. Excess returns to terminated and newly hired managers in the 3 years prior to, and subsequent to, termination

Josh here – Yes, I was surprised by this. But upon reflection, it makes total sense.

It shouldn’t be surprising to see the firms that were fired for trailing three-year performance (gray) pull ahead of the new managers that were added (white) if you understand how powerful the role of luck is in investment returns and how inexorable mean reversion can be in a complex system like the stock market. The more skilled the total pool of managers is, the more quirky the results will be as a result. With so many skilled managers on The Street all trying to do the same thing, it shouldn’t come as a shock that randomness plays such a big part in the end result. Michael Mauboussin has written and spoken extensively on this paradox of skill, check it out here.

Anyway, the interesting thing is that this behavior is not limited to the individual investor. Wholesalers are constantly pitching advisors like myself on funds that have done really well recently, family offices are constantly taking meetings with the sexiest fund managers of the moment, magazines are still blaring the old “Five Hot Funds You Need To Check Out Now” right from the cover. And even the most sophisticated among us aren’t immune – as the above study concerns institutional investors who hire and fire managers for trillions of dollars held in pension funds.

GestaltU reminds us that even an institutional investment fund is run by people, after all, and the human element is tough to eradicate.

Read Also:

Why Are You Outperforming? Why Are You Underperforming? (Meb Faber Research)

Alpha and the Paradox of Skill (Credit Suisse)

تبلیغات در گوگل

we favor to honor plenty of other internet net-web sites on the web, even when they arent connected to us, by linking to them. Beneath are some webpages really value checking out

virtual private server hosting

[…]Here are a few of the web pages we recommend for our visitors[…]

رفع ارور 1009

Hey, I consider your internet site may well be having browser compatibility troubles. When I search at your weblog in Chrome, it seems to be fine but when opening in Web Explorer, it has some overlapping. I just desired to give you a rapid heads up! Ot…

وی پی ن آیفون

I absolutely really like your blog and discover a lot of your post’s to be just I’m hunting for. Does a single provide guest writers to compose content material offered for you? I wouldn’t brain making a submit or elaborating on a couple of of the subj…

رفع ارور 1009

Hi would you head stating which site platform you’re operating with? I’m arranging to start my very own weblog quickly but I’m getting a challenging time determining among BlogEngine/Wordpress/B2evolution and Drupal. The purpose I ask is because your d…

Belize city inn

[…]although sites we backlink to beneath are considerably not associated to ours, we really feel they are truly worth a go via, so possess a look[…]

Andrew Wright Attorney Maine

[…]very handful of web sites that occur to become comprehensive beneath, from our point of view are undoubtedly effectively worth checking out[…]

Promotional Video Mauritius

[…]very handful of internet websites that transpire to become detailed beneath, from our point of view are undoubtedly effectively really worth checking out[…]

رفع ارور 1009

Fantastic blog! Is your concept custom produced or did you download it from somewhere? A design like yours with a few straightforward adjustements would really make my blog stand out. You should let me know the place you acquired your layout. Bless you

تبلیغات در صفحه اول گوگل

Hey, I feel your site may possibly be having browser compatibility problems. When I appear at your website in Chrome, it appears good but when opening in Net Explorer, it has some overlapping. I just desired to give you a swift heads up! Other then tha…

خرید کولر صنعتی

Hello there! This is kind of off topic but I want some tips from an established site. Is it extremely tough to established up your very own website? I’m not really techincal but I can figure issues out pretty rapid. I’m thinking about environment up my…

رفع ارور 1009

listed here are some backlinks to web sites that we url to considering that we think they are well worth checking out

تبلیغ در گوگل ادوردز

I was curious if you at any time thought of altering the layout of your site? Its quite well written I love what youve obtained to say. But possibly you could a minor a lot more in the way of material so people could link with it greater. Youve obtaine…

vpn ایفون

Howdy there! Do you know if they make any plugins to assist with Seo? I’m trying to get my site to rank for some qualified key phrases but I’m not seeing quite excellent gains. If you know of any please share. A lot of many thanks!

vpn ایفون

Many thanks for one more informative net web site. The place else could I get that type of details composed in this sort of an best approach?I have a undertaking that I’m just now operating on, and I have been at the look outfor this kind of info.