Just when I think I can no longer be shocked by a statistic about the bad behavior of investors and its consequences, a new one comes running across my path that leaves me completely floored.

The latest stat I’ve come across concerns the hiring and firing of managers because of three-year track records, a exercise in faildom if ever there was one. The executive summary for this kind of thing goes like this: “Wow, look at those returns for the last three years! I would have made a lot more money if I was with that fund, I’m not going to miss out over the next three years!” The old manager you’re working with, who is of course a complete idiot to you now, gets fired and the new hotshot who’s been crushing it gets hired.

And then, of course, mean reversion sets in and you ended up firing the old guy at the worst moment you possibly could have, and then doubly screwing yourself by handing that money over to the new guy just as he’s statistically poised to do even worse.

Many investors do this sort of thing again and again, as though on a treadmill. It’s understandable, as people succumb to both the Recency Bias and the Hot Hand Fallacy all at once. Usually, it’s the people who pay too much attention to the day-to-day fluctuations of their investments that are most susceptible. By focusing on what’s been happening lately, an extrapolative picture forms in their mind in which they envision a continuing trend of unhappiness with one strategy and a grass-is-greener fantasy about some other approach. At a certain point, they just can’t take it anymore and they make the switch.

There’s a great George Orwell quote that I think is applicable here: “Whoever is winning at the moment will always seem to be invincible.”

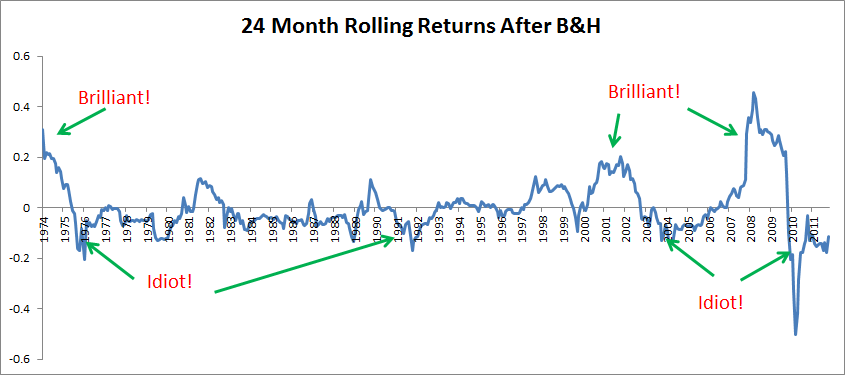

My friend Meb Faber talked about this years ago during a spate of underperformance for an old strategy of his. He totally nailed it with this graphic, which juxtaposes the strategy against a plain vanilla buy-and-hold, the thing everyone is relentlessly judged against in a bull market:

The bottom line is that everyone is “long-term oriented” and comfortable with the tradeoffs of investing up to a point. And then we break. Some have a higher tolerance and more patience for a rough patch than others, but in the end, human nature usually wins out.

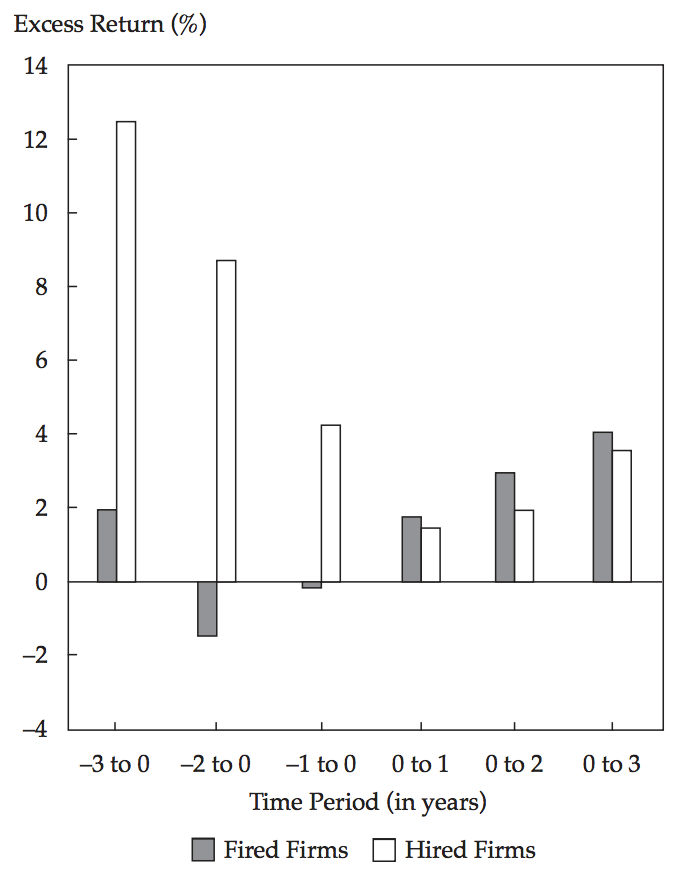

Anyway, the harm done by firing underperforming managers and hiring perceived outperformers hasn’t been extensively documented, even if the lack of persistence of performance has. Below, we’ll take a look at this phenomenon thanks to a chart posted by the team at GestaltU. In an epic post from January of 2013, the blog makes the point that three-year track records are meaningless and can even do more harm than good when investors react to them.

My favorite illustration of this is in the form of a manager switch study they cite with data from the Employee Benefit Research Institute…

Chart 5. clearly illustrates the impact of this phenomenon in the pension space. The grey bars represent the average annualized performance of terminated managers in the three years prior to, and three years subsequent to, their termination. The white bars represent the performance of replacement managers in the same years. Clearly institutions are hiring managers with exceptional historical track records over trailing 3 year periods, and firing managers with poor track records. The joke is on the institutions, however, since on average the fired managers go on to outperform the hired managers over the subsequent 1, 2, and 3 year periods!

Chart 5. Excess returns to terminated and newly hired managers in the 3 years prior to, and subsequent to, termination

Josh here – Yes, I was surprised by this. But upon reflection, it makes total sense.

It shouldn’t be surprising to see the firms that were fired for trailing three-year performance (gray) pull ahead of the new managers that were added (white) if you understand how powerful the role of luck is in investment returns and how inexorable mean reversion can be in a complex system like the stock market. The more skilled the total pool of managers is, the more quirky the results will be as a result. With so many skilled managers on The Street all trying to do the same thing, it shouldn’t come as a shock that randomness plays such a big part in the end result. Michael Mauboussin has written and spoken extensively on this paradox of skill, check it out here.

Anyway, the interesting thing is that this behavior is not limited to the individual investor. Wholesalers are constantly pitching advisors like myself on funds that have done really well recently, family offices are constantly taking meetings with the sexiest fund managers of the moment, magazines are still blaring the old “Five Hot Funds You Need To Check Out Now” right from the cover. And even the most sophisticated among us aren’t immune – as the above study concerns institutional investors who hire and fire managers for trillions of dollars held in pension funds.

GestaltU reminds us that even an institutional investment fund is run by people, after all, and the human element is tough to eradicate.

Read Also:

Why Are You Outperforming? Why Are You Underperforming? (Meb Faber Research)

Alpha and the Paradox of Skill (Credit Suisse)

کفسابی

Many thanks again for the weblog put up.Really thank you! Excellent.

strap-on dildo

[…]The details talked about within the article are a number of the very best accessible […]

suction cup dildo base

[…]we came across a cool web page that you could possibly delight in. Take a look if you want[…]

Minneapolis airport limo

[…]the time to read or take a look at the subject material or web-sites we’ve linked to below the[…]

تعمیرات دوربین مداربسته

Many thanks once again for the blog submit.Really thank you! Excellent.

waterproof power stud

[…]The details talked about in the report are a few of the most effective accessible […]

rabbit bunny vibrator

[…]Wonderful story, reckoned we could combine a handful of unrelated information, nevertheless genuinely worth taking a look, whoa did 1 discover about Mid East has got additional problerms as well […]

Ethereum (ETH)

[…]below you will find the link to some web sites that we feel it is best to visit[…]

kona coffee

Kona coffee is so good you’ll be tempted to drive to the Hawaii. Shop our high quality selections of Kona Coffee beans shipped fresh from Kona to your doorstep, no splash required.

دزدگیر اماکن

Hey! I know this is relatively off matter but I was pondering if you understood where I could get a captcha plugin for my remark form? I’m using the exact same blog platform as yours and I’m possessing difficulties locating one? Thanks a whole lot!

Limo Minneapolis

[…]we came across a cool web-site which you may possibly delight in. Take a search should you want[…]

como mantener una buena ereccion

[…]usually posts some pretty fascinating stuff like this. If you are new to this site[…]

هوشمند سازی ساختمان

Greetings from Florida! I’m bored to death at work so I made a decision to check out your internet site on my iphone throughout lunch crack. I enjoy the information you give listed here and can not wait to just take a look when I get home. I’m shocked…

تولید محتوا

I know this if off matter but I’m seeking into starting up my very own weblog and was curious what all is essential to get set up? I’m assuming having a blog like yours would value a pretty penny? I’m not very net savvy so I’m not a hundred% certain. A…

طراحی سایت

Greetings from Colorado! I’m bored to demise at work so I made the decision to search your website on my iphone for the duration of lunch crack. I truly like the info you provide here and simply cannot wait around to just take a seem when I get home. I…