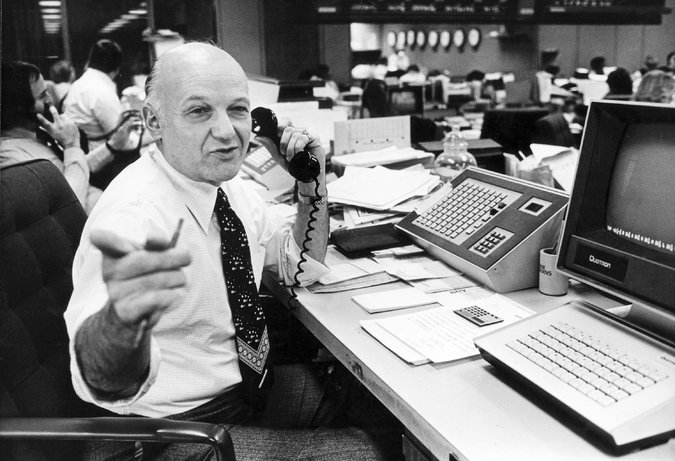

Alan C. Greenberg at his desk at Bear Stearns in 1980, two years after he became chief executive.

Photo credit: Fred R. Conrad/The New York Times

I was down on the floor of the NYSE on Friday as news broke of the passing of Alan “Ace” Greenberg, the former Chairman of Bear Stearns and one of the most illustrious Wall Street personalities of all time. The legendary trader-turned-executive got his first gig at Bear as a clerk and rose through the ranks thanks to his trading prowess (big risks, quick losses), personality (the trademark bow tie, magic tricks, memorable memos) and counter-cultural style (an emphasis on hustle over heredity when hiring).

I’ve known some people who were close to Ace over the years and will be at the big memorial service they’re having in New York on Monday. I’ve also gotten to hear lots of great Ace stories over the years. The financial media has dredged up some interesting anecdotes as they memorialized him this weekend as well. Below, I collect a few interesting ones that I think are good food for thought for investors and other finance industry professionals.

1. Ace arrived on The Street from Oklahoma City in 1949 as a former college football player from the University of Missouri. He was 21, had no experience with financial markets (his father sold clothing) but he got a job assisting a Bear Stearns partner that paid $135 a month. He spent his lunch breaks hanging around watching the traders in the arbitrage department and eventually they brought him on to their desk.

2. His first day as a clerk on the arbitrage desk was so disorienting and hectic that one partner remembered Ace getting nauseous and rushing to the bathroom. That didn’t last long. Ace’s “nerves of steel” and unwillingness to let losses run helped him steadily rise through the ranks at Bear. He eventually became the Chief Executive in 1978, but never left the trading desk. And while the bow tie was ever-present, a suit jacket was a rarity – Greenberg was there to get work done, not to preen like they did at the “white shoe” firms down the street.

3. Ace did keep a small office – tiny some said – for private phone calls and meetings. The defining feature of this little office was “a photograph of a huge African antelope stretched out dead. Above the carcass of the animal crouches Mr. Greenberg holding a bow and arrow, expressionless as always.” Ace’s penchant for an eat-what-you-kill culture became the prototype for Wall Street culture as the 1980’s bull market got underway. His primary compensation rule was that salaries should be kept extremely low but partnership profits should be huge. Ace wanted his brokers to live and die on their own commission and his traders to get paid on their profits. This kept incentives aligned toward success and weeded out laziness.

4. Speaking of partnership, Ace Greenberg told the Wall Street Journal in 1982 that this was the secret to Bear’s success. He said “I believe in partners. Employees can leave; partners can’t.” Ace took other steps to keep it so that “nobody can afford for anything to go wrong here,” including a rule that partners had to wait six years upon departing the firm before being able to withdraw their entire stake in the company. In addition, while the firm allowed its partners to make outside investments and build up stakes in other endeavors, if they grew too large relative to their ownership in Bear, Greenberg made them pony up more dough to keep the firm as important to them, financially speaking. Partnership at Bear was not for life (KKR was founded in 1976 by a few breakaway leveraged finance execs) but it may as well have been. Greenberg’s predecessor atop the firm, a 35-year Bear veteran named Cy Lewis, had famously collapsed and died at his own retirement dinner in 1978.

5. Greenberg hired the hungriest, most determined kids from all the five boroughs of New York City and beyond. This was in distinction to the white shoe firms like Morgan Stanley who would only interview WASPs from acceptable backgrounds and with strong family connections. Bear hired Jews and Italians from Brooklyn, Queens and the Bronx – an utterly unheard of faux-pas in respectable banking circles at the time. He didn’t care what their daddies did for a living or who they knew – he wanted hustlers who could think on the fly, take big risks and be street-smart enough to cut those losses quickly in order to survive. Culturally speaking, it worked. Ace called his employees the P.S.D.’s – Poor, Smart and Determined. Some amazingly talented people came out of this system over the ensuing decades, many of whom went on to build huge firms and fortunes of their own.

6. Ace saw the writing on the wall and smartly diversified the firm toward both retail brokerage and securities clearing for smaller firms ahead of the negotiated commission rule in 1975. Prior to this rule, commissions were fixed at a uniformly high level, thus ensuring fat profit margins for the brokerages who had NYSE membership. Once negotiation was permitted, margins shrank and competition got tougher. Bear’s foray into these other areas kept the firm growing and thriving: they had over 100 smaller broker-dealers using them for custody and clearing services along with eight retail brokerage branches around the world staffed by over 300 reps by the early 1980’s.

7. In September of 1985, “the secret” got out that Bear was considering a public offering. The tightly-controlled partnership would be raising badly needed capital for its continued expansion. If Bear wanted to play with the big boys, there was no other option. At that time, Bear was coming off of a fantastic year in which its profitability was head-and-shoulders above its competitor firms. But it was still considered a scrappy upstart, Bear was only the 11th largest investment house on The Street. Greenberg’s excitement at the time was tempered by his acknowledgment that the old partnership structure would be tested. ”If it weren’t for that problem of continuity and our need for capital, we probably wouldn’t be doing this…the main goal of management now is to make this work just like the partnership.” Bear was 62 years old at the time and was one of the first of the old-line investment houses to IPO. It was the beginning of the end of the risk-obsessed partnership culture and Bear was at the Vanguard of the movement toward corporate enormity on The Street.

8. The 1980’s and 1990’s were boom-times for Bear. Ace Greenberg was one of the highest-profile financiers of the era, having become the stockbroker to the stars (Donald Trump! The Sultan of Brunei!) and having spawned a trading culture like no other. Bear was the firm to go to for creative financings and for higher-risk business that the other shops turned their noses up at. This reputation would eventually get the firm in trouble as their clearing relationships with some of the most notorious penny-stock boiler rooms were laid bare by regulators and the press. Bear would be named (and disciplined) as an enabler of rip-off artists and manipulators from the lowest-rung of the industry – small, scroungy firms like DH Blair and AR Barron that used their implied Bear Stearns affiliation to rob the public.

9. One of Greenberg’s early hires, a fellow bridge-playing high-stakes trader named James Cayne, would become a lifelong friend and consigliere to him. Cayne would eventually succeed him in the early 1990’s as the CEO of Bear. This relationship would ultimately sour as Greenberg, who’d become executive chairman, never really loosened his grip on the day-to-day operations of the firm.

10. While Ace Greenberg had built Bear Stearns into one of the most powerful financial firms in history, his legacy will forever be tarnished by how it all ended – a blow-up in the credit crisis followed by the ignominious buy-out / bail-out from JPMorgan, backed by the federal government, at just ten bucks a share. As the executive chairman during both the boom and the bust, Ace went to his grave bearing the bulk of the responsibility for his firm’s failure alongside his old partner Jimmy Cayne. Although Greenberg’s post-collapse autobiography attempted to paint their relationship as strained toward the end, explaining how Cayne had attempted to keep him out of the loop, the billions of dollars and thousands of jobs lost will never be forgotten.

***

After we had made some remarks about Ace Greenberg’s passing on Friday, NYSE stalwart and legendary trader in his own right, Art Cashin, came over to the Post 9 set we do the show from. I leaned back and Art whispered that Ace’s final trade may have been the best one he had ever made – the sale of all but 15,000 shares of his Bear Stearns stake at prices above $100 before the crisis spiraled out of control. Mr. Greenberg may not have had control over the amount of risk the firm had taken under Jimmy Cayne’s stewardship, but he certainly wasn’t going to abandon the “small losses” ethos that had guided him throughout a 65-year career on one of the meanest streets in America.

Alan “Ace” Greenberg was a true giant of American capitalism and one of the most important players in the history of Wall Street and a true original. As everyone from Warren Buffett to Jamie Dimon to T. Boone Pickens mourns his passing, we are consoled by the terrific lessons his successes and failures can offer us all in our future endeavors.

Read Also:

Tough Pit Boss (Wall Street Journal)

Former Bear Stearns Executive Alan ‘Ace’ Greenberg Dies (Wall Street Journal)

Remembering Ace Greenberg, Through Good Times and Bad (DealBook)

Alan C. Greenberg, 86, Dies; Led Bear Stearns in Good Times and Bad (New York Times)

.

ñïàñèáî çà èíôó!!

.

ñýíêñ çà èíôó.

.

ñýíêñ çà èíôó!!

[…] 10 things you should know about Ace Greenberg […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Here you will find 43885 more Information to that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] There you will find 17174 additional Info to that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/07/27/10-things-you-should-know-about-ace-greenberg/ […]