Do investors have a habit of buying high and adding more to the funds in their portfolio right after they’ve run up?

Does Courtney Stodden have lower back pain in her future?

Buying high is so prevalent that it looks almost systematic when plotted on a chart. One such example comes from a blog post at the St. Louis Fed this week, you can almost hear senior economist YiLi Chien shaking his head as he types:

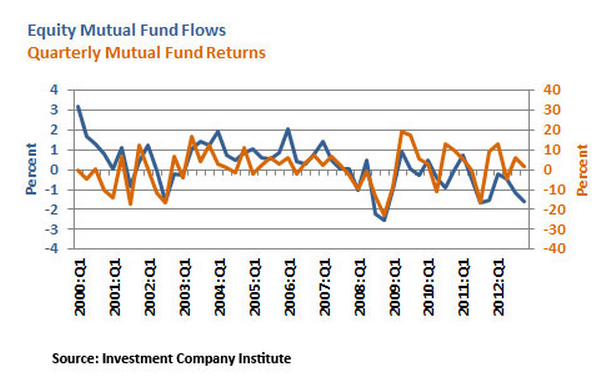

I used quarterly equity mutual fund flow and return data from the Investment Company Institute for the period 2000-2012. The figure shows two data series: equity mutual fund flows and past quarter returns. The flow data at period t is measured as a percentage of the total value of U.S. equity mutual funds. The return plotted at period t is the return over the previous quarter. Clearly, equity mutual fund flows correlated positively with past return. The correlation coefficient between the returns and flows was 0.49.

Josh here – In real life business ventures, people like to invest money where they can visibly see money being made. They bet on people who come across as successful and who are considered to be “winners”. They add investment capital to businesses or divisions where the profits are flowing. This is very reasonable, rational behavior. Unfortunately, in the stock market, this can work against us. If we only get interested in companies or sectors once they’re “performing”, often we are joining a crowded trade that enough other investors have already scoped out – thus the future opportunity is diminished. Similarly, if we only add to our portfolios once they’ve already “shown us something”, then we are, in effect, systematically adding at highs and ignoring opportunities at lows (no one wants to throw “good money after bad”).

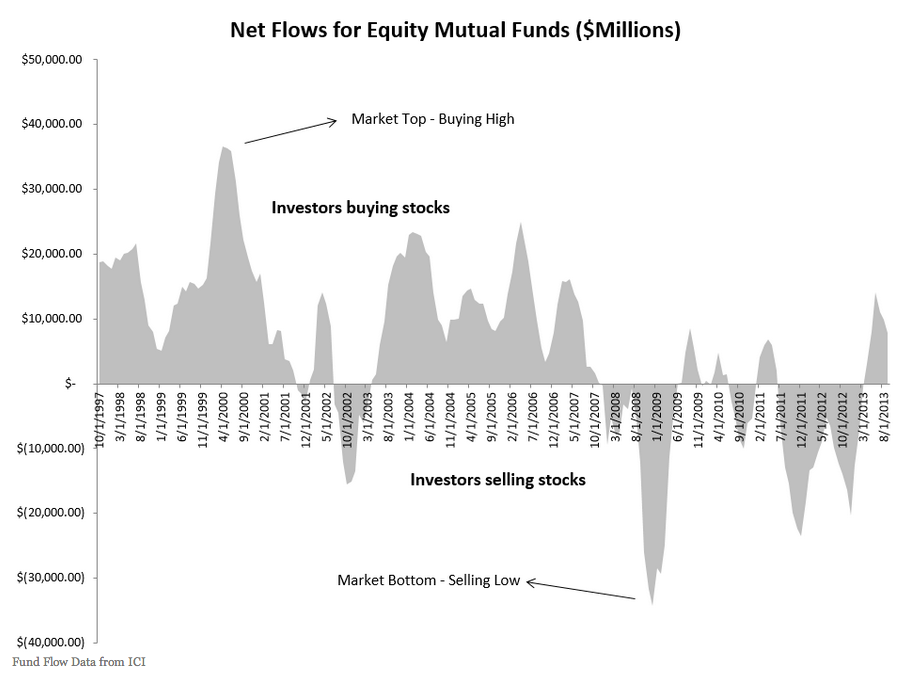

Here’s another terribly unfortunate example of this same phenomenon – an epic chart from my pal Patrick O’Shaughnessy at Millenial Invest, who looked at net flows for equity mutual funds over the last fifteen years:

In the first chart, we see investors adding money to their stock funds based on quarterly performance. In the second chart (above), we see something far worse – investors capitulating as markets bottom while opening up both barrels and blasting away with their capital as the stock market peaks out. It’s an embarrassment in both directions. It wouldn’t even matter so much that one added at tops so long as they had the fortitude to keep plugging away in tough times. But my experience working with investors over the last decade and a half tells me that the people most likely to chase tops are the least likely to be willing to add after a correction. The personality type I’m referring to is fairly common – and this mentality of “betting on winners” works in other aspects of their lives, so I totally get it.

Patrick calls investor behavior “the final frontier” in our quest to become better at this whole game. Unfortunately, we can’t all achieve this and reap the maximum benefit of other people’s bad behavior. Someone still has to be the mark, jumping in and out based on Wall Street’s opinions and the news of the hour.

In order for good behavior to be rewarded, someone’s got to be subscribing to newsletters and banging their head against a keyboard somewhere.

So let’s keep this stuff to ourselves, deal?

Source:

Chasing Returns Has a High Cost for Investors (St Louis Federal Reserve)

.

tnx for info.

.

áëàãîäàðñòâóþ!

.

tnx for info!

.

good info.

.

tnx!!

.

ñïàñèáî!

.

good!

.

áëàãîäàðåí.

.

tnx!!

.

ñïàñèáî çà èíôó!

.

ñïàñèáî çà èíôó!

.

ñýíêñ çà èíôó.

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/07/07/systematic-suckers/ […]

… [Trackback]

[…] There you will find 41680 more Information on that Topic: thereformedbroker.com/2014/07/07/systematic-suckers/ […]

… [Trackback]

[…] Here you will find 39390 additional Information on that Topic: thereformedbroker.com/2014/07/07/systematic-suckers/ […]