Jeff Macke and I wrote a book about financial punditry and, after 200-something pages of historical context and behind the scenes commentary, we concluded with the fact that most financial content is probably not relevant enough to be actionable for your personal situation. A majority of it is well-meaning, lots of it is interesting and informational and enlightening. You can’t ignore it all, we reason, so why not become a savvier consumer of it.

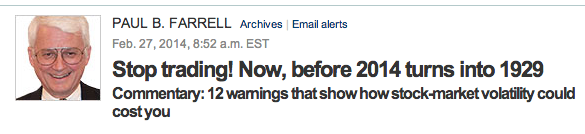

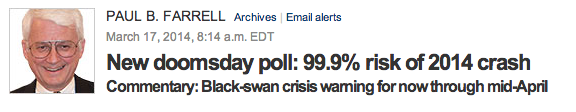

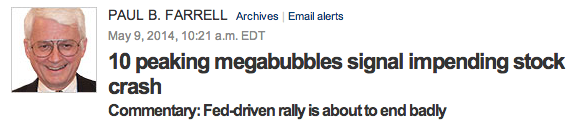

For example, anyone who reads the book would know exactly what to do when coming into contact with something like this at MarketWatch…

February:

(mental health break, re-up the prescriptions)

Why, you might ask, does MarketWatch keep publishing this?

Did you think a Dow Jones property owed you something? How much do you pay MW for your subscription? That’s right, zero dollars.

Well if you’re not the one paying, then you’re not the customer and MarketWatch owes you nothing. The real customers here are BlackRock and MarketIQ and WisdomTree and Fidelity and e*trade – and they want impressions to place their ads against. They rarely make a qualitative judgment about which content their ads appear next to. They say to themselves, “It’s Dow Jones, how bad could it be?” Besides, the clicks are coming in and the demo is on point – so who cares? MarketWatch and other sites exist to generate consumer traffic so they can capture a portion of the enormous marketing budgets at the large asset managers and brokerages. Farrell’s stuff is perfect for that function; Outrageous, financial-flavored infotainment that hooks ’em from the headline.

For every one thousand people who click over to this article, my guess is that 950 of them get it and keep on living their lives. The other 50 might either become emotionally distressed or even make a trade based on it.

Collateral damage.

I single out MarketWatch here just because of this very visible, egregious example – but almost every financial media outlet is guilty of some form of this, to greater or lesser degree, including Business Insider, CNBC, Forbes, WSJ, CNN Money and other sites at which I’ve contributed. There are no perfect angels in capitalism and the news business is still a business after all.

This kind of stuff used to make me angry as I hate seeing unsophisticated investors’ worst fears preyed upon for page views, click-through rates and other scooby snacks. Now I don’t get mad at all – I realize it’s just Mr. Market imposing his “stupid tax” and handing opportunity over to those who can control themselves and who care enough to learn the game.

Carry on, Saruman.

[…] fact it could be rather hazardous. Josh Brown here highlights a peculiar observation of a media providing market news. The agenda why they put out […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/07/05/fun-with-stock-market-hysteria/ […]