Berkshire Hathaway’s BNSF Railroad currently carts 500,000 barrels of crude oil a day out of the Northern shales. Many of the rail cars doing this sort of work need to be upgraded or replaced in the near future because Bakken Shale crude is too gaseous for the old ones. I’ve publicly mentioned Trinity ($TRN) and Greenbrier ($GBX) as interesting stocks to research as plays on potential contracts in this area. The Canadian government has just put out its new mandate on rail car standards, the US is expected to do the same within a few weeks. There’s been talk that BNSF may need to spend as much as much as $750 million right away to comply.

Of course, the biggest threat to continued rail car dominance of this area’s crude transport needs is the Keystone XL Pipeline plan – which the current administration is against. The biggest beneficiary of Keystone’s blockage is probably Buffett and his train set. In the absence of a pipeline coming anytime soon, the BNSF trains remain the only cost-effective way to move crude from the shale boom to the rest of the country.

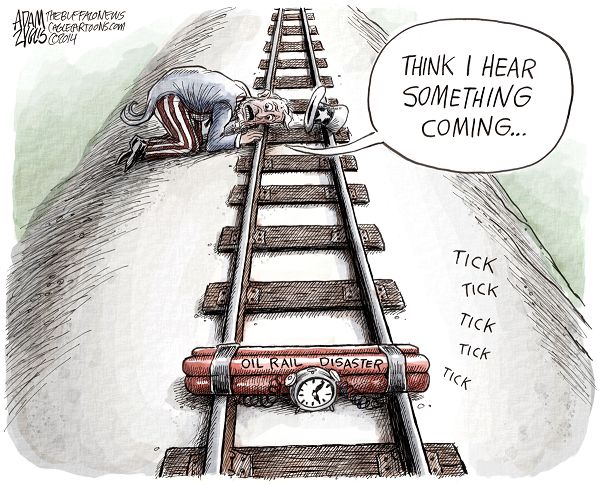

Environmentalists have successfully kept the pipeline off the table thus far but the fight isn’t anywhere near over. I wonder if these environmentalists have given much thought to the safety of the current alternative – rolling bomb trains.

Cartoon by Adam Zyglis, Buffalo News

cialis original for sale

SPA