I was on TV the other day next to a guy who goes, totally matter-of-factly: “We should get 8 percent earnings growth for the S&P 500 in 2014 and earnings drive stock market returns so I expect to see an 8ish percent return for the market this year.” My jaw dropped. I don’t even want to tell you how much actual money he manages for people in real life. It’s disturbing.

But only disturbing to me. Everyone else seemed okay with both the forecast and the basis upon which it had been formulated, no questions asked. Maybe I’m the freak. I need to learn to nod my head, I guess. By the way, 8% isn’t very far off of the average annual return for equities, so he may end up being right by accident 😉

So anyway, does earnings growth determine the returns of the stock market?

How about interest rates? Do they drive returns for stocks?

What about inflation? Or GDP growth? Or the rate of the ten-year treasury bond? Or any of the other factors used on a daily basis to predict the markets?

Well? Which one is it? Which one works?

All of them. None of them. Some of them sometimes – but then others of them other times. And usually in all different combinations. Also, they start and stop mattering randomly and with no warning. And then sometimes no combination of any of them is indicative of anything because a president is shot or a war starts or a plane hits a building or a nuclear reactor melts down during an earthquake-caused tsunami on the other side of the world.

In other words, forecasts using any combination of any of these can only ever be nonsense – even if it’s well-meaning nonsense. None of these factors can continually keep an investor on the right side of the stock market, although ignoring them altogether also won’t be able to either.

Ben Carlson is an institutional investor who writes a great new blog called A Wealth of Common Sense. He tries to distill complex topics down into key points of understanding for regular folks and pros who are interested in the truth. I love his stuff. Here he makes the same point with data that I’ve made above with my anecdote:

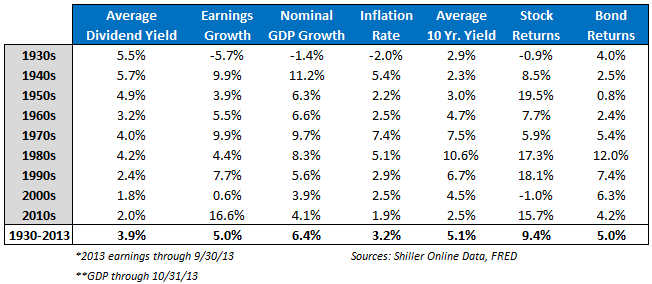

The following table shows the average dividend yield, company earnings growth and performance of the S&P 500 by decade along with economic growth, inflation, average interest rates and the 10 year treasury returns:

Some observations on this data:

- Add up the average dividend yield and the average earnings growth (8.9%) and you get pretty close to the long-term average annual stock return (9.4%) since 1930.

- Yet stock returns can be feast or famine depending on the decade.

- Dividend yields have come down in recent decades, but much of this stems from a combination of rising markets and share repurchases.

- Rising interest rates don’t necessarily have to be bad for stock returns (50s & 60s)

- There were times when bonds outperformed stocks (30s, 00s).

- There were long periods of negative real bond returns (40s to 70s).

- Bonds didn’t have a single decade of negative nominal returns proving their worth as a stabilizer for the low risk part of your portfolio.

- There were times of subdued inflation (50s-60s & 90s-present) and high inflation (40s, 70s & 80s).

- Stocks lost out to inflation over two different decades (70s & 00s)

- There were times when economic growth outpaced growth in company earnings (30s to 60s, 80s & 00s).

- There were times when company earnings growth outpaced economic growth (70s, 90s, 10s).

- Economic growth was fairly stable from the 1950s to the present time but stock returns were not.

- Stocks lost investors money during two decade long stretches (30s & 00s).

- Companies still paid decent dividends during those periods.

- The 1930s were a pretty terrible decade.

Ben goes on to show that stocks have, in fact, murdered bonds in inflation-adjusted terms going back to the 1920’s at a rate of more than 3-to-1. But it is important to note that this long-term record for the market has been accumulated through a vast array of economic environments – no two are ever exactly the same.

Moreover, even when there are similarities between environments – think of the rapid earnings growth during both the 1970’s and the 1990’s – the end results can be starkly different; the 70’s couldn’t have been worse for stocks while the 90’s couldn’t have been better.

The bottom line is that it’s great to be aware of the current trends and the ability to contextualize them in terms of historic periods is probably not harmful either. So long as you’re not betting big on the predictive power of these metrics. Because it’s not different this time, it’s different every time.

Source:

The Way Way Back of Market Cycles (A Wealth of Common Sense)

games for pc download

[…]Wonderful story, reckoned we could combine a number of unrelated information, nonetheless really worth taking a look, whoa did 1 discover about Mid East has got much more problerms as well […]

best blowjob

[…]one of our guests not long ago advised the following website[…]

free download for windows 10

[…]Every once in a even though we select blogs that we read. Listed below would be the most current websites that we select […]

free download for windows 8

[…]just beneath, are quite a few completely not connected web sites to ours, however, they are surely really worth going over[…]

free windows app download

[…]one of our visitors not long ago encouraged the following website[…]

pc games for windows 7

[…]the time to read or stop by the subject material or internet sites we’ve linked to below the[…]

مه پاش

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a remark is included I get 3 e-mail with the same comment. Is there any way you can eliminate me from that provider? Thank you!

pc games apps free download

[…]Here is an excellent Blog You may Come across Exciting that we Encourage You[…]

مه پاش

Wonderful weblog! Is your theme personalized created or did you obtain it from somewhere? A style like yours with a couple of basic adjustements would actually make my blog stand out. You should permit me know where you got your layout. Bless you

app download for windows 10

[…]Wonderful story, reckoned we could combine some unrelated data, nevertheless seriously really worth taking a appear, whoa did one particular discover about Mid East has got a lot more problerms too […]

pc games free download

[…]the time to study or stop by the material or web-sites we’ve linked to below the[…]

spreader bar bdsm

[…]check below, are some entirely unrelated websites to ours, even so, they are most trustworthy sources that we use[…]

satisfyer deluxe pro review

[…]Wonderful story, reckoned we could combine a few unrelated data, nonetheless actually worth taking a appear, whoa did a single discover about Mid East has got extra problerms as well […]

games pc download

[…]always a significant fan of linking to bloggers that I really like but do not get a great deal of link enjoy from[…]

prazdnik iyu

[…]Wonderful story, reckoned we could combine a handful of unrelated data, nonetheless genuinely really worth taking a search, whoa did one understand about Mid East has got additional problerms at the same time […]