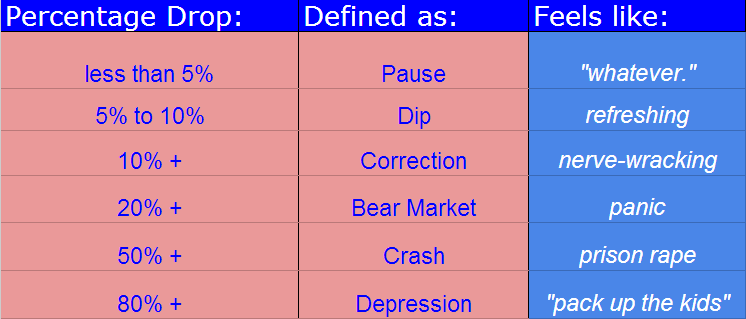

The S&P 500 is now down just about 7% from its mid-January all-time high. We’re currently somewhere between what market-watchers would call a “dip” and a “correction”.

I’d like to walk you through what these terms actually mean and give you some context before you encounter the almost-guaranteed hysterics of the financial commentariat this evening. If you’ve been reading this blog for awhile, then you already know that I don’t play for any particular team – bulls or bears – I simply deal in the facts themselves and leave readers to formulate their own opinions.

– Josh

***

For argument’s sake, let’s say we’re headed for a real correction…what should we expect? Today I’ll limit my remarks to price action and not get started into a whole discussion about news, valuations, or anything else.

A handy field guide to stock market corrections below (data via Dow Jones, Morningstar, Bloomberg):

* Since the end of World War II (1945), there have been 27 corrections of 10% or more, versus only 12 full-blown bear markets (with losses of 20% +).

* This equates to one correction roughly every 20 months, according to Dow Jones index maven John Prestbo, who points out that this average does not mean they’re evenly spaced out. 25% of these corrections over the last 66 years occurred during the 1970’s (the Golden Age of Market Timers), another 20% occurred during the secular bear market of 2000-2010.

* The average decline during these 27 episodes has been 13.3% and they’ve taken an average of 71 days to play out (just over three months).

* From the beginning of the last secular bull market in 1982 through the 1987 crash, there was just one correction of 10% or more. Between the Crash of 1987 and the secular bull market’s peak in March 2000, there were just two corrections, according to Ed Yardeni. This means that secular bull markets can run for a long time without a lot of drama.

* Since the stock market’s bottom in March of 2009, there have been only 3 corrections: In the spring of 2010 the S&P 500 began a 69-day drop of roughly 16%. The widely referenced summer correction of 2011 lasted for about 154 days and almost became a bear market. The correction during the spring of 2012 set up one of the greatest rallies of all time, although it was barely a real correction, sporting a peak-to-trough drop of just 9.9% in just under 60 days.

* The most recent correction took place in 2011, between the end of April into the end of September. The Dow dropped roughly 16%. The S&P 500 actually dropped a hair over 20% before snapping back, leading some to believe that this was a bear market – the implication being that the current bull market is just 2 years old and not five years old (dating from March of 2009). I have no strong opinion on that debate.

* Bull market rallies in between corrections – and there have been 58 in the post-war period – tend to run for an average of 221 trading days before being interrupted and gaining an average of 32%. By this standard, we are way overdue for a correction (but in fairness, we have been for awhile).

* As to what we should do during corrections, I’d recommend maintaining a list of high-quality stocks you’ve been kicking yourself for missing out on and clearing the decks of any longs you don’t truly love. For those with time horizons longer than five years (most), the best thing to do is grit one’s teeth and do very little. If a correction of between 10 and 20% is unbearable to you mentally or financially, that means you’ve either got more money than you should invested in stocks or you’re kind of a fairy. Make the adjustment you can live with and remember this feeling the next time you find yourself chasing the market.

* As to the question of whether a correction could become a bear market (or worse even, a crash), the answer is that this is always possible. But most corrections do not become crashes, and every single one of them turned out to have been great buying opportunities in the fullness of time.

* Lastly, remember your ABC’s: Always Be Cool.

***

The above appeared here originally on August 20th 2013 and has been updated.

[…] Stuff happens. – According to Josh Brown there have been 27 corrections of 10% or more since the end of World War II. The average decline has […]

[…] A Field Guide to Stock Market Corrections (TRB) […]

[…] I’ll let you know up front, I had to do an internet search to find this information. The best information I found on this subject was from Joshua M. Brown (aka Downtown Josh Brown) at this website: http://thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

[…] I’ll let you know up front, I had to do an internet search to find this information. The best information I found on this subject was from Joshua M. Brown (aka Downtown Josh Brown) at this website: http://thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] There you will find 5323 more Information on that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] There you will find 90441 more Info to that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] There you can find 32201 additional Info to that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2014/02/03/a-field-guide-to-stock-market-corrections-2/ […]