LOL, just kidding. But if that catches on, I own it.

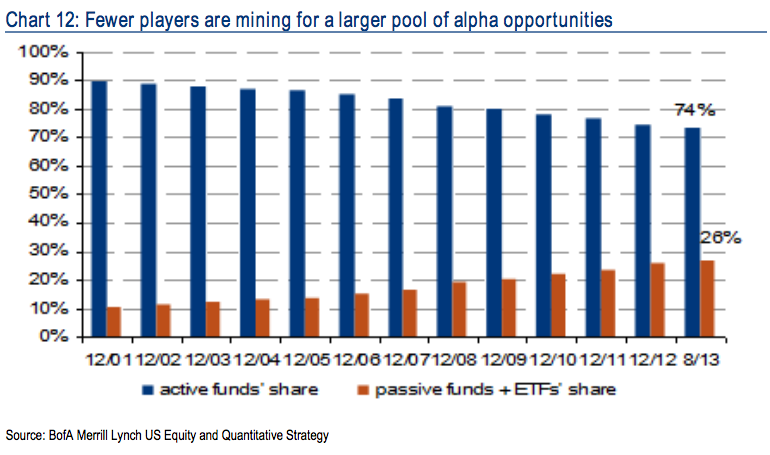

But seriously, the new market meme for 2014 is that active management is the new hot thing now that the crowd has all shifted mostly passive ($3 trillion now in index products or almost 30% of the total).

There are seven major arguments being put forth for why this should be the case now (as summarized by Bank of America Merrill Lynch):

After years of failing to generate enough alpha to cover their fees, the

environment may finally be ripe for active managers to outperform:1. Falling stock correlations

2. Increasing breadth

3. Bigger pie, fewer players

4. Widening performance spreads

5. Fundamentals are increasingly important

6. Volatility could increase

7. More modest returns suggest greater alpha

from “Expect more global alpha in 2014” ( January 21st)

The general argument goes something like this: There are more market inefficiencies with less investors seeking to take advantage of them, in the meantime a flat market means frustration for indexers who need markets to generally rise. On top of this, valuation dispersion is low (many stocks trading at an equal, market multiple) and correlations are disintegrating – so the fundamentals of individual companies matter again.

Here’s this meme perpetuated by the permanently optimistic strategist Brian Belski in USA Today of all places:

A flat market doesn’t mean that investors can’t generate positive returns, argues Brian Belski, chief investment strategist at BMO Capital Markets. The key is picking the right stocks.

“Even in range-bound market periods, a significant number of stocks deliver attractive returns,” Belski told clients in a report titled, “Sideways Works.”

Belski identified 12 periods in the past 20 years when S&P 500 performance was flat for six months or more. What he found was that “roughly one-third of the companies” in the index “still delivered double-digit price gains.” The average annualized return was about 20%.

These arguments are all reasonable and can all be backed by data. They can also be compartmentalized into various strata – in small cap, inefficiencies are greater, in certain sectors there is more separation between winners and losers, etc.

And if in fact we do find ourselves in a flattish market, there will undoubtedly be big winners in the stockpicking arena who have skillfully selected the best stocks from the overall market and triumphed notably on an after-fees basis. This kind of environment will surely shake the faith of newly-born indexers and active funds will win back some of the flock.

A reporter asked me last year why there weren’t any famous rock star stock market managers anymore like there were in the 90’s. I explained that the new rock stars were the Bond Kings and the macro guys – Gundlach, Dalio et al. Alpha was irrelevant in a year during which all ten S&P sectors were up over 10% each and the overall market had grown by a third. “Why does anyone need to make 35% if the benchmark paid you 30%?” It is in this environment that Vanguard’s AUM breaches the $2 trillion mark while active stock funds see the money sucked out as though by vacuum – outflows from active funds totaled more than $150 billion over the last two years.

The pendulum always swings too far in both directions. And now it’s probably about to swing back.

New heroes of stockpicking may arise, new empires of fund management may be built. And in a flattish market, if that is to be, we’ll see how sticky all this new passive money really is when the next generation of stockpicking rock stars rolls into town.

Read Also:

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] There you will find 63047 additional Information on that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] There you can find 37275 more Information on that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/01/22/active-is-the-new-passive/ […]