361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

July 8, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Pamplona, Spain or Wall Street, NYC?

@KetyDC: Wow, this is what I call close encounter. San Fermin Festival on Sunday (Reuters)

So the Bulls returned to Equities on a holiday shortened week with plenty of news and data to outrun. The Egyptians threw out their President and the Portuguese gave a thumbs down to their government. But dovish comments out of Draghi/ECB, strong data out of Japan, and a 3rd strong month of Non-Farm Payroll growth pushed the Russell 2000 to all-time highs as the rest of the market jumped into its slipstream. But what was good for equities ended up being a gorging for fixed income as Bonds suffered their worst day in 5 years and the 10 year yield jumped 25bps on the week. Remember, big inflection points are violent and will cause pain, screams, and broken monitors. And while equity investors feared ‘The Taper’ in May and June, so far in July, they are warming up to their new pet. Of course that all could change on Wednesday as Fed Chairman Bernanke will be grabbing the microphone so maybe a good time to put your portfolio ‘Under the Dome’ for the day to protect your gains. And don’t forget, Q2 earnings start to trickle in this week and become a fire hydrant of info next week.

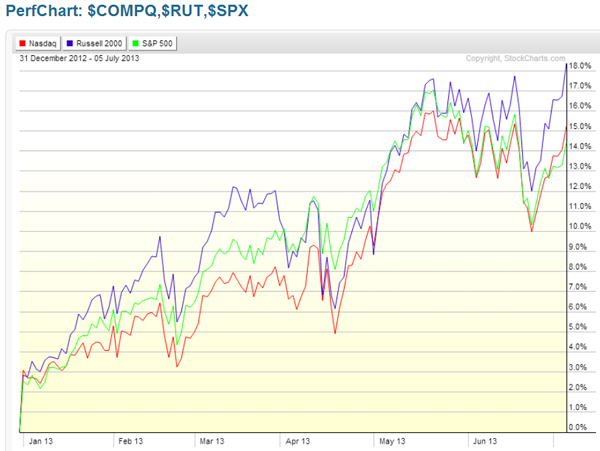

The Small Cap Russell 2000 Index has led the RISKON charge in the equities market all year…

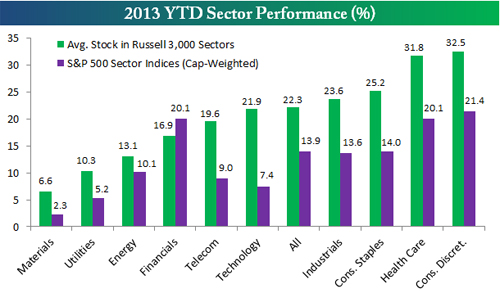

Diving deeper, the Small Cap leadership is broad based across every sector of the market but financials…

Friday’s jobs data showed the 3rd solid monthly gain in a row…

The jobs picture is improving. Friday’s report shows America’s job market is improving faster than many economists thought. The 195,000 gain in jobs beat economists’ expectations of around 160,000 and is slightly above the monthly average of 182,000 over the past year. Importantly, April’s and May’s figures were bumped up significantly, adding an additional 70,000 jobs combined. When employers are hiring in a recovery, the Labor Department tends to initially underestimate job growth. The substantial revisions to this spring’s data are therefore a positive sign in and of themselves — and suggest better months may be ahead. More broadly, today’s news on jobs dovetails with other positive economic reports in recent weeks that show strong demand among consumers for goods.

(WSJ)

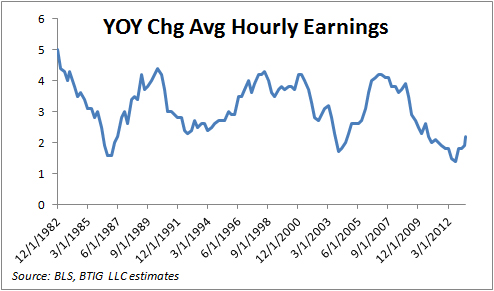

Also very encouraging is the pickup in wages…

@DanBTIG: Have to like Avg Hourly Earnings rising by 0.4%/YOY by 2.2%.

Meanwhile one of the oldest countries in the world gets a re-boot and the markets couldn’t be more excited…

You know Egypt had a bad President when on the week of the Military Coup, the market jumps +15%. This is exactly the inverse of LULU which fell -20% on the week of its Board of Director Coup. (Note to self: Watch where Christine Day lands.)

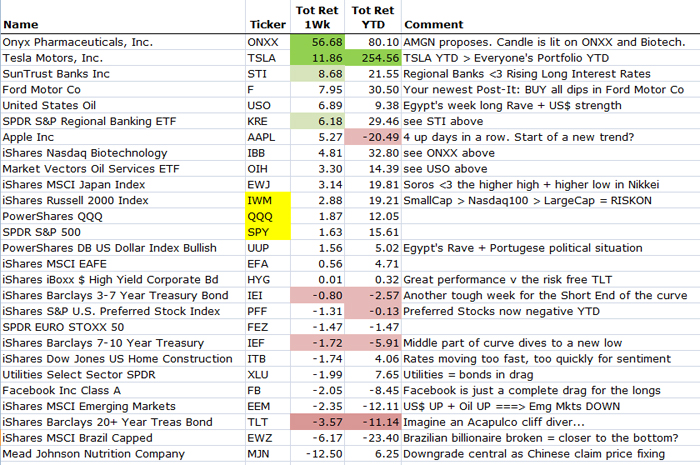

Looking at the holiday week returns, Financials, Biotech, and Small Cap remained most loved while Brazil, Bonds, and Utilities remained at the top of PM’s ‘raise cash’ list…

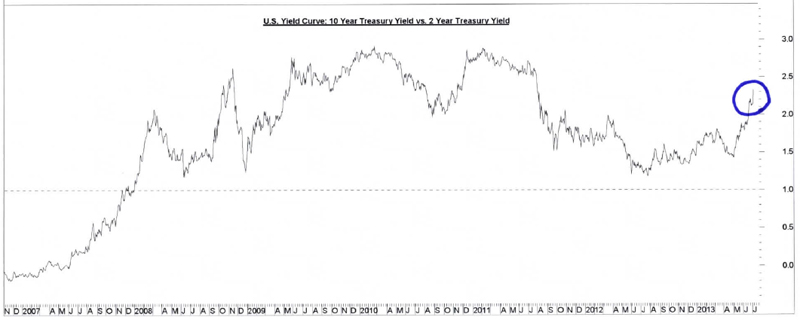

It was a big week for moves in the bond markets…

2yr Notes +4bps at 0.40%. 10yr Notes +25bps at 2.74%.

Meanwhile, the bond market gurus remain focused on making money from this sell-off…

“July will not be the same type of month” as June, Jeffrey Gundlach, chief investment officer of Los Angeles-based DoubleLine, said in a June 27 webcast for investors. “There are profits to be made in the bond market between now and the end of the year.”

(Bloomberg)

If you are a long term investor in bonds, you had better stick to reading the Sports section this year otherwise the volatility may land you in the Obituary section…

Gary Liversidge doesn’t invest for the upside. The 58-year-old Boston man has no money in the stock market. He sells the stock options he gets through his employer, a biopharmaceutical firm where he is chief technology officer, almost as soon as they vest. He plows the proceeds and all his other investments into individual bonds. The aim, he says, isn’t to see how much more money he can make, but to generate enough income to preserve his current lifestyle.

(WSJ)

Bond Market pain = Financial Stocks gain…

Remember that most banks & finance companies borrow short (deposits & wholesale funding) and lend long (mortgages, auto & commercial loans). Thus the rise in long term rates and a steepening yield curve are a big positive for lending companies which is why your bank stocks are outperforming.

(RenMac)

The CIO of JPMorgan Asset Management oversees $170b in Equities. Guess what he ISN’T buying?

Which parts of the market are you shying away from? Those sectors where the companies usually pay high dividends, such as utilities, real estate investment trusts, MLPs [master limited partnerships], some of the consumer-staple companies, and telecom companies — companies where investors really have focused just on the dividend, and have driven stock prices up to levels where they don’t make a lot of sense. Unsurprisingly, those stocks have suffered the most in the last few weeks. And those sectors still look expensive.

(Barron’s)

Byron Wien talks to the ‘Smartest Man in Europe’ who suggests European equities as the best place to spend your research time…

There is tremendous pent-up demand in Europe and I think you could see positive growth in 2014. In the meantime most investors have reduced their European exposure. Who would want to invest in a place where a recession was underway and likely to get worse? Money managers had been so preoccupied with that idea that they failed to recognize the pullback from austerity which could lead to the restoration of growth. During the last few years European companies, like their American counterparts, have become vastly more efficient. Unemployment in Europe is 12% and part of the reason it is so high is that companies are getting the work done with fewer employees, so profits should improve considerably on any increase in revenues. Stocks are priced assuming conditions will get worse and I see them getting better – not everywhere and not in every sector, but if you are a careful stock picker you can make money. The most important factor is that almost no investor likes Europe now and that enhances the opportunity.

(Blackstone)

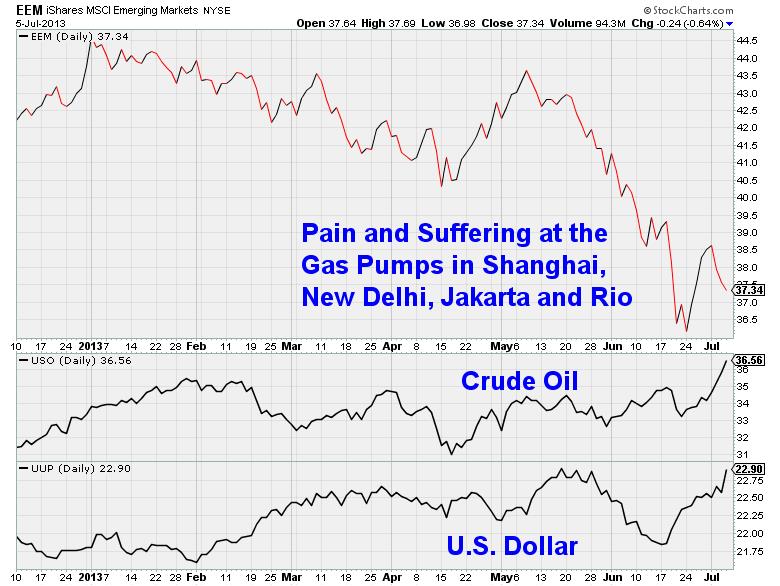

One area of Equities continuing to see selling is Emerging Markets which have nightmares of ‘The Taper’…

Oil prices surged above $100 (+19% from mid-April). The Dollar burst through 100 vs Yen (+5% from mid-April). Exciting! Unless you’re fillin’ your tank in Tokyo (Oil in Yen is +24%). Thankfully, Japan’s rich. And have 50 idled nukes, ready to reboot. But poor Indians, with plunging Rupees, pay 31% higher from mid-Apr (oil in Rupees now equals ’08 all-time highs). Brazilians +33%, South Africans +32%, Turks +29%, Mexicans +27%, Egyptians +21%, Indonesians +21%, and Chinese +18%.

(WkndNotes)

If you are looking for a pure ‘Taper’ play, the CME might just be it…

The Chicago group has just released a broad breakdown of its trading volumes in June.

Here are the highlights:

- The total number of contracts traded a day climbed by 29 percent to 16.9m.

- The volume of interest rate contracts soared 70 percent, making June the month with the most volume since January 2008.

- Volumes in three and five-year eurodollar contracts – which traders use to bet where the Federal Reserve’s key interest rate will be – had their biggest month on record.

- Trading in derivatives tied to metal prices rose 27 percent.

(@fastFT)

@EddyElfenbein: The Astros are in last place. But relative to gold, they’re in third…

I hope someone has started a blog/website to track the number of Gold Buying store closings. You could no doubt sell the data to both the Shorts and the Longs (if they are also able to remain in business)…

(@flocktard)

Attention Muni Investors… Oregon will soon be upgraded from AA+ to AAA+++…

Under a bill that has suddenly picked up steam at the Oregon Legislature, the fine for using a cell phone from behind the wheel would double to a maximum of $500 instead of the current $250 maximum. Senate President Peter Courtney, D-Salem, who is pushing the bill, said he ratcheted down his original proposal of a $1,000 fine to secure enough backing to keep the bill alive.

(OregonLive)

Oregon is also looking at innovative ways to send their kids to college…

As lawmakers in Washington remain at loggerheads over the student-debt crisis, Oregon’s legislature is moving ahead with a plan to enable students to attend state schools with no money down. In return, under one proposal, the students would agree to pay into a special fund 3% of their salaries annually for 24 years. The plan, called “Pay it Forward, Pay it Back,” would create a fund that students would draw from and eventually pay into—potentially bypassing traditional education lenders and the interest rates they charge. The state would likely borrow for the fund’s seed money, which could exceed $9 billion, but the program’s designers intend it to become self-sustaining.

(WSJ)

If the Oakland A’s don’t get their Cisco Stadium, Moneyball should increase their after tax payroll by becoming the Austin Athletics…

“Howard would pay nearly $12 million in California tax over the four years if he signs with the Lakers, but only $600,000 in state tax should he sign with Houston. This means that a four-year deal with Houston would actually yield an additional $8 million in after-tax income.” California has the highest top rate for personal income in the nation, while Texas has no state income tax. The difference is even greater if cost-of-living is taken into account: California’s is the fourth-highest in the nation, while Texas’s is the second lowest.

(WSJ)

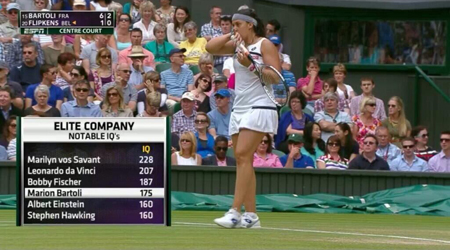

Speaking of sport geeks… Nice to see one win the top trophy at Wimbledon over the weekend…

(@runofplay)

If you want to increase your kids’ IQ, just have them read the beach ball before they start playing with it…

@jasonmendelson: The lawyers have officially won. Beach ball insanity.

And finally, a great video for your inner golf geek…Rory vs. The Machine…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

buy cialis 36 hour

American health