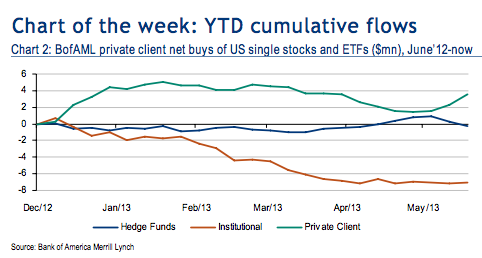

Right now there’s a bit of a tug-o-war between what private clients and what hedge funds are doing about the recent patch of volatility we’ve seen in the stock market.

Savita Subramanian’s quantitative research group at Bank of America Merrill Lynch does a really great job with their weekly equity flow reports. The firm breaks up investors into three categories: Private Client (retail), Hedge Funds and Institutions (including pension funds).

This was an interesting week as private clients and institutions bought the 1% dip in the stock market while hedge funds took profits. Not that this is exactly the opposite of what we saw throughout the spring, as hedge funds were buying the new highs in April and May while retail investors sold into strength.

It looks something like this (note the “mirror image” in hedge fund and private client activity since the beginning of May):

Some other highlights from BAML’s report:

* Last week, during which the S&P 500 was down 1.0%, BofAML clients were net buyers of $725mn of US stocks following two weeks of net sales. Inflows were led by private clients, whose purchases of US equities were the largest since January.

* Year-to-date, private clients remain the only group who have been cumulative net buyers of US equities, but this is entirely due to ETFs.

* Six of the ten GICS sectors saw net buying last week, with inflows led by Tech. Flows into Telecom and Utilities were particularly large vs. history despite continued fears of QE tapering, with net buys of Telecom their largest since February and net buys of Utilities their largest since November 2011. Cyclical sectors continue to see net buying on a four-week average basis, which has been the case since late May, while defensive sectors continue to see outflows.

* No size segment saw net buying by all three client groups last week, while small caps saw net sales by all three.

Bottom line, private investors are adding to stocks – but all of the net flows are large cap, much of it is into ETFs and a lot of it is still dividend-driven (huge dip-buying into utilities) or dividend growth-driven (technology led by sector). Hedge funds, on the other hand, are now net sellers on a four-week rolling basis and – astonishingly – are now net sellers year-to-date, just as they had been throughout 2012.

We’ll see how much longer the two segments can remain diametrically opposed and what effect this tug-o-war has on the tape.

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Here you will find 93383 additional Information to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Here you can find 80614 more Info to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Here you will find 4537 more Information to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Here you will find 68825 more Info on that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Here you can find 70000 more Info to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/06/18/private-clients-are-buying-while-hedge-funds-sell/ […]