Full disclosure: Our client portfolios have been riding the Japanese stock trade since the second week in January. When the leadership of one of the largest economies in the world decides to explicitly set out upside targets for their stock market, I don’t argue.

Last night the Nikkei exploded yet again – another 2.8% gain added in a single session thanks to the continual thrashing of the yen.

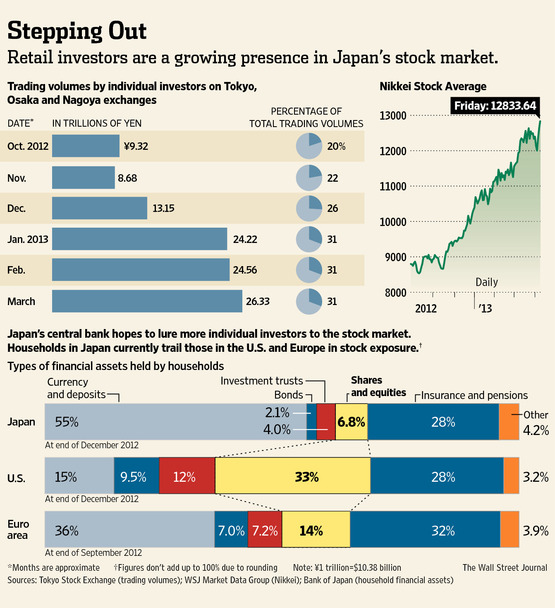

Anyway, the Wall Street Journal informs us that the locals are starting to buy in to the Nikkei rally after almost two decades of abysmal treatment at the hands of their own stock market.

So with Japanese Moms and Pops getting excited, is this the end of the rally? Or a major propellant that can really kick things into high gear?

The potential for growth in retail investing appears huge. Japanese households now are sitting on one of the largest pools of savings in the world, with about $8.9 trillion held in cash and bank deposits, compared with $7.7 trillion in the U.S., which has a population more than twice as big as Japan’s, according to data from the BOJ and the U.S. Federal Reserve. Right now, only 11% of Japanese financial assets are invested in equities and mutual funds, compared with 45% in the U.S. and 22% in Europe.

For years, Japan’s stock market has been dominated by day traders and foreign institutional investors. That is still true, but retail investors are on the rise. In the last week of March, mom-and-pop investors like Mr. Kobayashi accounted for 31% of trading value on Japan’s three main exchanges, up from just 20% in October.

“We’re entering uncharted territory,” says Hiroki Tsujimura, chief investment officer at Nikko Asset Management Co., Japan’s third-largest asset manager. “There may be people who think Japanese investor activity is so embedded in deflation that their money will not become active, but you can’t underestimate what may happen.”

So here’s the thing – if this scheme of the BoJ’s is going to work, I mean really work to produce a cycle’s worth of true growth and break the back of deflation, then they’re going to need true “buy in” from the people. There’s no wealth effect benefit of wealth doesn’t lead to the desire for more wealth, the whole thing falls back over on itself minus a touch of greed, envy, mania etc.

I have no idea whether or not Japan can tip the national psyche (and all those 80 year olds) into this state of mind after so much disappointment. We shall see.

By the way, nobody send this WSJ article to Kyle Bass, he’ll have a conniption.

Source:

… [Trackback]

[…] There you will find 4971 more Info on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] There you can find 4095 additional Information on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/04/08/the-japanese-buy-in/ […]