As a general rule, it gets harder and harder to surprise people the more you do it.

So too goes the game of economic expectations – as reports come in better, economists nudge their forecasts for future reports higher and higher. Until they get ahead of themselves and the data starts to “disappoint”. It’s all enormously ridiculous but we pay attention regardless.

Jeff Kleintop (LPL Financial) cited this inability to continue to surprise as one of his potential warning signs for the next spring slide.

From his note:

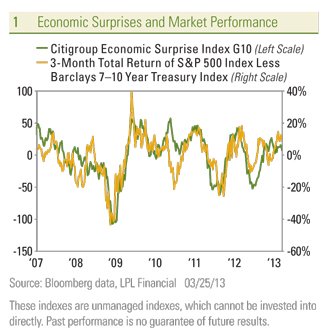

Economic surprises – The Citigroup Economic Surprise Index [Figure 1] measures how economic data fares compared with economists’ expectations and has marked the spring peaks in both economic and market momentum in recent years. While the latest readings have not surged up near the 50-level that marked the peaks of recent years, the weakening trend does suggest expectations may have become too high. Turning points typically have coincided with a falling stock market relative to the safe haven of 10-year Treasuries.

Also, here’s Bespoke’s roundup of economic data vs expectations through the month of March:

Below is a chart that shows the percentage of economic indicators that have beaten estimates during March as the month has progressed. As shown, back on March 13th, a whopping 81.5% of March indicators had come in better than expected. Since then, however, we’ve seen a pretty sharp drop-off, with a big decline this week down to just 61.3%. It looks like economists jumped on the bullish bandwagon in the middle of the month and they’re now starting to get burned.

Sources:

10 Warning Signs Of Another Spring Stock Market Slide (Business Insider)

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/03/29/no-surprises/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/03/29/no-surprises/ […]