Combined with the wealth effect from stable-to-rising home prices this year is another crucial contributor to the economic Animal Spirits we’ll need to truly exit the Crisis Era. That contributor is the lack of indebtedness per household across the country. Just as people tend to spend more as their home makes them feel wealthier, so to do they transact more business and take more risk when they feel less indebted.

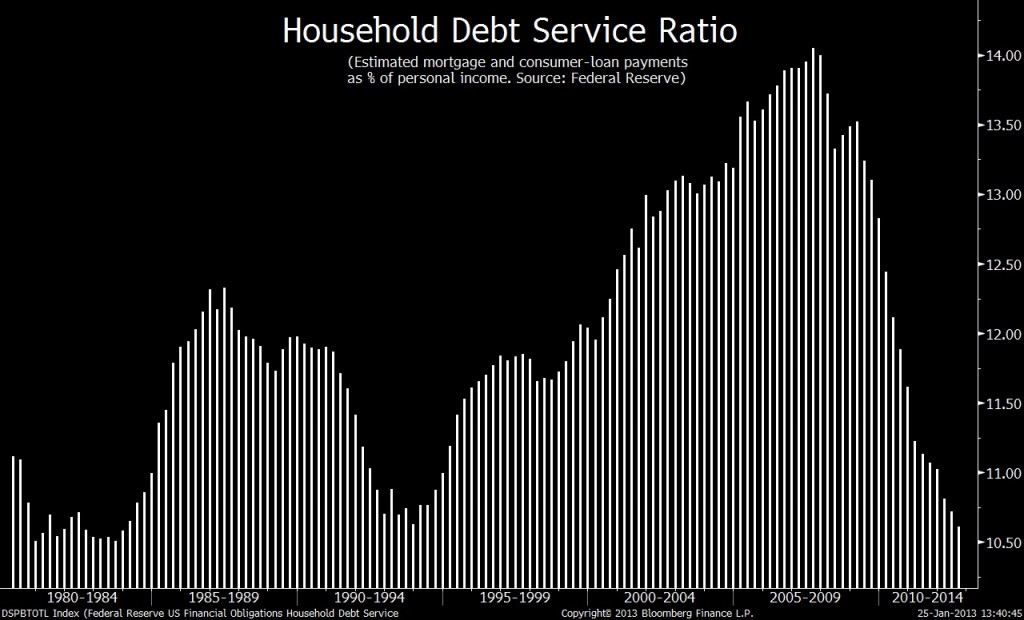

The good news in that regard is that mortgage and consumer loan payments as a percentage of personal income have dropped off a cliff since the deleveraging cycle began – back to early 1980’s levels in fact says Bloomberg’s Dave Wilson in his chart of the day from Friday…

Consumers have reduced their debt burdens enough to be able to withstand higher taxes and help sustain the U.S. economy’s expansion, according to Pavilion Global Markets Ltd. strategists.

As the CHART OF THE DAY shows, mortgage and consumer-loan payments amount to the smallest percentage of after-tax income since 1983, according to quarterly statistics compiled by the Federal Reserve.

The debt-service ratio was 10.6 percent of disposable income in last year’s third quarter. Five years earlier, the figure peaked at 14.1 percent. Pavilion highlighted the drop yesterday in a report with a similar chart. Household spending is poised to “strongly contribute to growth” this quarter and next, Pierre Lapointe, head of global strategy and research at the Montreal-based firm, and two of his colleagues wrote. Consumers account for about 70 percent of the economy, according to Commerce Department data.

Here’s what that looks like:

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Here you can find 73604 additional Information on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] There you will find 88871 more Info on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Here you will find 73682 additional Information on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/01/27/household-deleveraging-illustrated/ […]