Last week the S&P dropped 2.2%, it’s worst weekly fall since June when the summer rally took off. The Nasdaq has been trashed as well.

I wouldn’t say that the technicians I follow have gotten completely bearish just yet, but signals from the last month have had them at the very least practicing their growls.

Here’s Michael Kahn at his Getting Technical column in Barron’s this weekend:

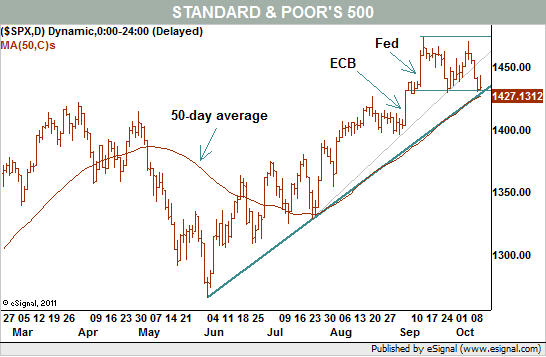

The S&P 500 chart shows several conditions that are now on the side of the bears, starting with a failure last week to set a new high.

Recall that the September high was reached one day after the Federal Reserve announced its next round of quantitative easing, dubbed QE3. The fact that the rally could not be sustained after the news immediately cast a shadow on the market because previous Fed actions resulted almost immediately in significant price increases. They lasted weeks, if not months.

Wednesday, just one month later, the S&P 500 temporarily dipped below its late September low. To technical analysts, it was the first hint that the trend was turning from positive to negative.

MKM Partners’ Katie Stockton has also begun to growl, here’s a taste from this morning’s WSJ MarketBeat morning roundup:

Katie Stockton, chief market technician at MKM Partners, noted that the number of stocks that hit 52-week highs last week dropped more significantly than in recent market declines. That’s a development that Stockton says “differentiates last week’s pullback from previous pullbacks, suggesting the market has not found its low yet.”

Prior to earnings season, MKM’s Stockton had been predicting the S&P 500 would move back above 1460, surpass recently hit multiyear highs and then start slumping. “But it appears the correction has already begun…There is the potential for a brief oversold bounce early this week…but we think it will fade quickly,” Stockton added. She expects the S&P 500 to test a support level near 1400 before making another move higher.

Until then, she’s recommending clients to remain cautious: “We think it is prudent to take down partial exposure in anticipation of a deeper pullback,” she says.

But there is a dissenting opinion that, while controversial, must be heeded. Mike Harris, the TA heretic who writes at the Price Action Lab says the bears have been pummeled by false sell signals for three years and counting – and that this current spate of weakness will probably have much the same effect:

This is not a market for technical methods of the past century. This is a market for true believers in the ability of strong hands to squeeze out weak hands and speculators. Whether this pattern will continue largely depends on fundamental developments. It is possible that bears will get crashed once again because based on the charts above there are not yet conditions in place to support a trend reversal. In the meantime, fast short-term traders and strong hands are profiting at the expense of those who use old methods to spot a trend reversal. You have more chances if you are a true believer in the market’s ability to move higher than a reader of 100 technical analysis books. At least, that has been the story until recently.

Interesting food for thought – the levels are obvious to all, but those with an inclination toward bearishness still haven’t found what they’re looking for.

Sources:

Bears Begin to Draw Blood (Barron’s)

Morning MarketBeat: Charts Flash Warning Signs (MarketBeat)

Bears May Get Fooled Once Again and Get Crashed (Price Action Lab)

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/10/15/technicians-starting-to-growl/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/10/15/technicians-starting-to-growl/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/10/15/technicians-starting-to-growl/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/10/15/technicians-starting-to-growl/ […]

… [Trackback]

[…] Here you will find 18817 additional Information to that Topic: thereformedbroker.com/2012/10/15/technicians-starting-to-growl/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/10/15/technicians-starting-to-growl/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/10/15/technicians-starting-to-growl/ […]