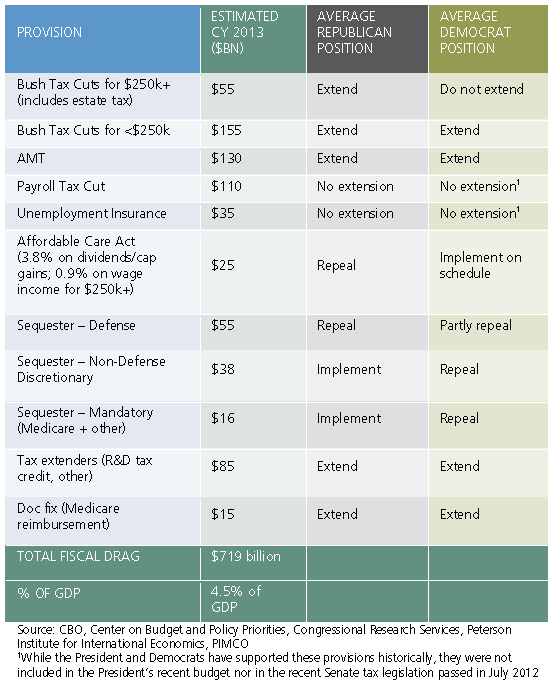

PIMCO lays out their base case for what we can expect on the fiscal cliff issue this coming winter. Accompanying their scenarios is this excellent “scoreboard” of where everyone stands politically on each of the fiscal cliff elements…

What is the fiscal cliff?

The “fiscal cliff” has been defined as many things, but most commonly refers to the following:

- the expiring Bush tax cuts that were put into place in 2001 and 2003 and extended in 2010;

- the expiration of the alternative minimum tax (AMT) patch, a technical necessity since the AMT is not indexed for inflation;

- the lapse of the payroll tax cut, the 2% reduction in employee payroll taxes in place for the past two years;

- the expiration of unemployment benefits;

- the imposition of new taxes from the Affordable Care Act , namely a 0.9% increase in the payroll tax and 3.8% tax on investment income for those making more than $200K/$250K;

- the expiration of a series of business friendly tax provisions, called “tax extenders;”

- the “sequester” or the required spending cuts in defense and non-defense spending;

- and the “doc fix,” another technical budget issue that will reduce physicians’ reimbursements for Medicare patients.

The net impact of all of these provisions? The Congressional Budget Office (CBO) estimates the budgetary impact would be 5.1% of GDP in calendar year (CY) 2013 should the fiscal cliff be fully realized.

Is there hope for compromise?

While recent Congressional inaction and the partisan rhetoric might suggest a compromise on the fiscal cliff before year-end is improbable, a compromise, especially one that is hammered-out after the election, looks less elusive if each element of the fiscal cliff is considered independently. In fact, Republicans and Democrats agree on the vast majority the fiscal cliff elements.

Click over for a discussion of how they think it plays out.

Source:

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/09/28/political-elements-of-the-fiscal-cliff-chart/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/09/28/political-elements-of-the-fiscal-cliff-chart/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/09/28/political-elements-of-the-fiscal-cliff-chart/ […]

generic cialis canadian

USA delivery

can i buy cialis online

Health