When people ask “where’s the volume” in the public markets, I try to explain that there are several factors responsible for the dearth. One factor that I never hear mentioned is that the public’s predilection is to own index ETFs or mutual funds instead of buying individual stocks and bonds. They’ve learned that it rarely pays for them to try to outsmart the indices and do all the work involved research and management-wise to have individual holdings. This tendency has meant a lot less trading in individual issues and so less overall volume.

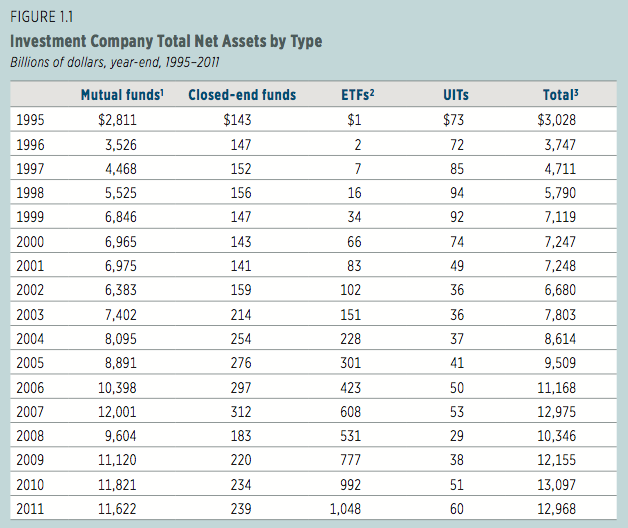

Some interesting stats from the Investment Company Institute (ICI) on the investment management industry and where people have their money held circa now:

Americans’ Continued Reliance on Investment Companies

Households are the largest group of investors in funds, and registered investment companies managed 23 percent of households’ financial assets at year-end 2011, essentially unchanged from 2010 (Figure 1.2). As households have increased their reliance on funds over time, their demand for directly held stocks has been decreasing for the past decade (Figure 1.3). Household demand for directly held bonds, which tended to be relatively strong prior to the financial crisis but has been weak ever since, plummeted in 2011. In contrast, over the past decade, households’ net investment in registered investment companies has been consistently positive and substantially stronger than their net purchases of directly held bonds and stocks. Households invested an average of $409 billion each year, on net, in registered investment companies versus average annual sales, on net, of $377 billion in directly held stocks and bonds over the past 11 years.

… [Trackback]

[…] There you will find 29166 additional Information to that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] There you can find 30063 more Information to that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] There you can find 17110 additional Info on that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/05/05/investors-are-net-sellers-of-377-billion-in-stocks-and-bonds-each-year/ […]